Locavesting focuses on investing capital directly into local businesses and community projects to stimulate regional economic growth and job creation. Social lending, also known as peer-to-peer lending, enables individuals to lend money to peers or small enterprises through online platforms, offering higher returns than traditional banking. Discover how these alternative investment models reshape economic landscapes and empower communities.

Why it is important

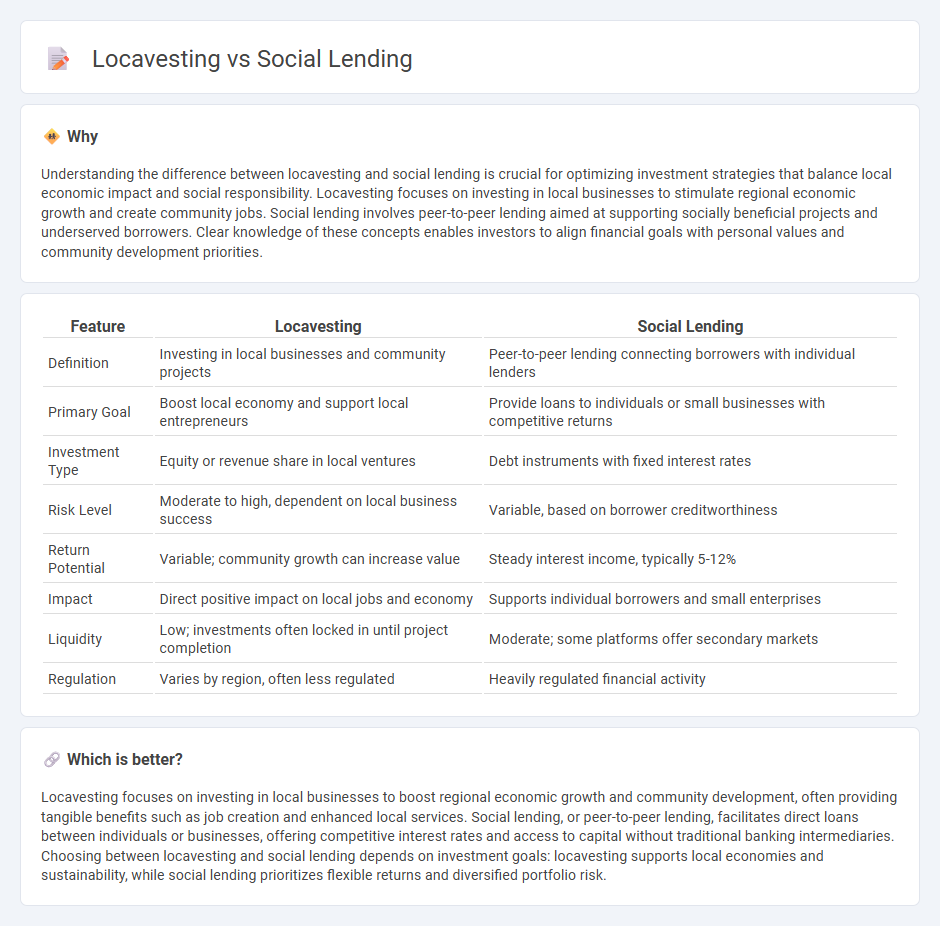

Understanding the difference between locavesting and social lending is crucial for optimizing investment strategies that balance local economic impact and social responsibility. Locavesting focuses on investing in local businesses to stimulate regional economic growth and create community jobs. Social lending involves peer-to-peer lending aimed at supporting socially beneficial projects and underserved borrowers. Clear knowledge of these concepts enables investors to align financial goals with personal values and community development priorities.

Comparison Table

| Feature | Locavesting | Social Lending |

|---|---|---|

| Definition | Investing in local businesses and community projects | Peer-to-peer lending connecting borrowers with individual lenders |

| Primary Goal | Boost local economy and support local entrepreneurs | Provide loans to individuals or small businesses with competitive returns |

| Investment Type | Equity or revenue share in local ventures | Debt instruments with fixed interest rates |

| Risk Level | Moderate to high, dependent on local business success | Variable, based on borrower creditworthiness |

| Return Potential | Variable; community growth can increase value | Steady interest income, typically 5-12% |

| Impact | Direct positive impact on local jobs and economy | Supports individual borrowers and small enterprises |

| Liquidity | Low; investments often locked in until project completion | Moderate; some platforms offer secondary markets |

| Regulation | Varies by region, often less regulated | Heavily regulated financial activity |

Which is better?

Locavesting focuses on investing in local businesses to boost regional economic growth and community development, often providing tangible benefits such as job creation and enhanced local services. Social lending, or peer-to-peer lending, facilitates direct loans between individuals or businesses, offering competitive interest rates and access to capital without traditional banking intermediaries. Choosing between locavesting and social lending depends on investment goals: locavesting supports local economies and sustainability, while social lending prioritizes flexible returns and diversified portfolio risk.

Connection

Locavesting connects local investors with community-based businesses, fostering economic growth within specific regions by keeping capital circulating locally. Social lending platforms facilitate peer-to-peer financial transactions, enabling individuals to fund projects and enterprises that align with their social priorities. Both practices enhance localized financial ecosystems, promoting sustainable development through community engagement and alternative funding channels.

Key Terms

Peer-to-peer lending

Peer-to-peer lending platforms connect individual borrowers directly with investors, bypassing traditional financial institutions, and often offer competitive interest rates compared to locavesting, which focuses on local community investments. Social lending emphasizes accessibility and diversification, allowing lenders to fund multiple borrowers across various credit profiles, while locavesting tends to prioritize local economic impact and community engagement. Explore more about how peer-to-peer lending transforms personal finance and investment opportunities.

Community investment

Social lending connects individual borrowers and lenders through online platforms, facilitating personal loans based on community trust and shared financial goals. Locavesting emphasizes investing in local businesses and projects, driving economic growth within a specific geographic area and fostering community development. Explore how these investment models strengthen local economies and empower communities by learning more about their unique benefits.

Local enterprises

Social lending enables individuals to directly fund local enterprises through peer-to-peer platforms, fostering community growth and transparent loan processes. Locavesting combines local investment opportunities with community engagement, allowing investors to support regional businesses via equity or debt while promoting economic development. Explore more to understand how these innovative financial models empower local enterprises and strengthen regional economies.

Source and External Links

Social Lending - Social lending involves providing financial support to enterprises and charities, helping them access affordable finance through methods like small loans and charity bonds.

Peer-to-Peer Lending - Peer-to-peer lending, also known as social lending, allows individuals or businesses to borrow from multiple lenders, often with more favorable interest rates than traditional banks.

Peer to Peer Lending: What You Need to Know - Peer-to-peer lending platforms act as marketplaces where lenders can provide loans to borrowers, offering returns through interest but with higher risk compared to savings accounts.

dowidth.com

dowidth.com