Shadow inflation refers to the hidden rise in costs not captured by official inflation statistics, often driven by quality reductions or increased fees. Reflation involves government and central bank policies aimed at stimulating economic growth and pushing inflation toward target levels following a downturn. Explore how these contrasting concepts impact financial markets and economic recovery strategies.

Why it is important

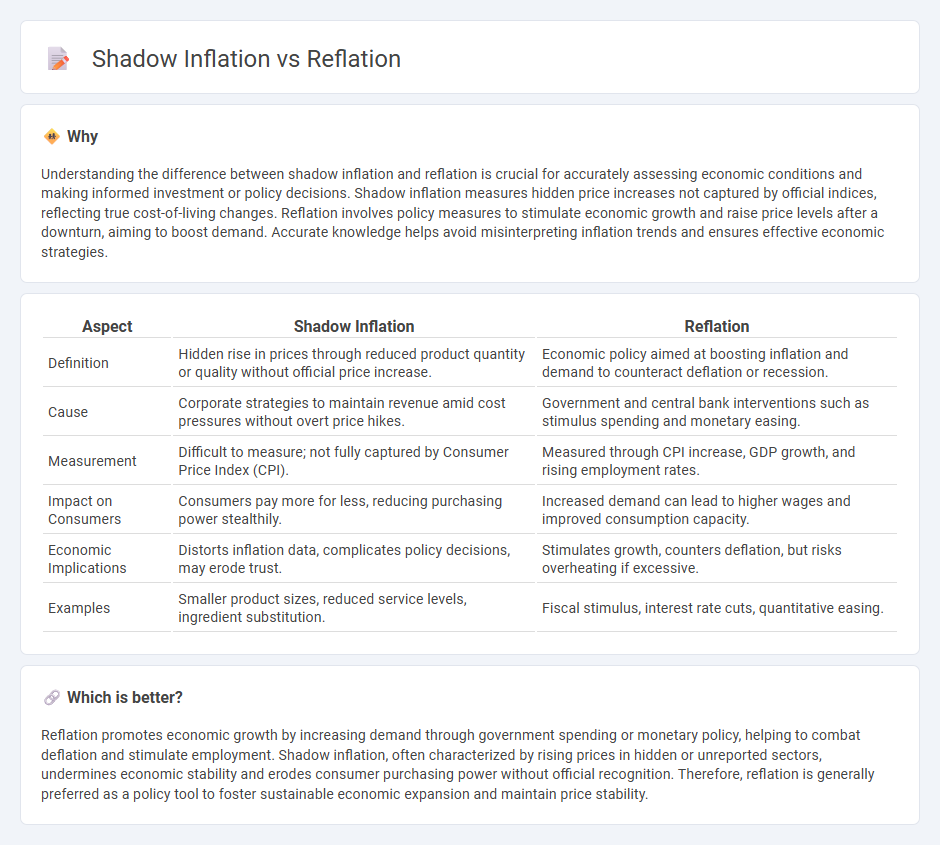

Understanding the difference between shadow inflation and reflation is crucial for accurately assessing economic conditions and making informed investment or policy decisions. Shadow inflation measures hidden price increases not captured by official indices, reflecting true cost-of-living changes. Reflation involves policy measures to stimulate economic growth and raise price levels after a downturn, aiming to boost demand. Accurate knowledge helps avoid misinterpreting inflation trends and ensures effective economic strategies.

Comparison Table

| Aspect | Shadow Inflation | Reflation |

|---|---|---|

| Definition | Hidden rise in prices through reduced product quantity or quality without official price increase. | Economic policy aimed at boosting inflation and demand to counteract deflation or recession. |

| Cause | Corporate strategies to maintain revenue amid cost pressures without overt price hikes. | Government and central bank interventions such as stimulus spending and monetary easing. |

| Measurement | Difficult to measure; not fully captured by Consumer Price Index (CPI). | Measured through CPI increase, GDP growth, and rising employment rates. |

| Impact on Consumers | Consumers pay more for less, reducing purchasing power stealthily. | Increased demand can lead to higher wages and improved consumption capacity. |

| Economic Implications | Distorts inflation data, complicates policy decisions, may erode trust. | Stimulates growth, counters deflation, but risks overheating if excessive. |

| Examples | Smaller product sizes, reduced service levels, ingredient substitution. | Fiscal stimulus, interest rate cuts, quantitative easing. |

Which is better?

Reflation promotes economic growth by increasing demand through government spending or monetary policy, helping to combat deflation and stimulate employment. Shadow inflation, often characterized by rising prices in hidden or unreported sectors, undermines economic stability and erodes consumer purchasing power without official recognition. Therefore, reflation is generally preferred as a policy tool to foster sustainable economic expansion and maintain price stability.

Connection

Shadow inflation refers to the hidden rise in prices through reduced product sizes or lower quality, which erodes consumer purchasing power without official inflation metrics fully capturing it. Reflation involves policy measures aimed at increasing economic activity and raising inflation to a target level after a period of deflation or economic stagnation. The connection lies in reflation efforts potentially amplifying shadow inflation effects, as increased demand and monetary stimulus can lead producers to subtly increase costs, impacting real consumer expenses beyond headline inflation figures.

Key Terms

Price Levels

Reflation refers to the deliberate policy measures aimed at increasing price levels and economic activity after a period of deflation or economic stagnation, typically through fiscal stimulus or monetary easing. Shadow inflation, on the other hand, encompasses hidden price increases not captured by official inflation metrics, such as lower product quality, reduced package sizes, or increased fees, which also erode consumer purchasing power. Explore further to understand how these concepts impact real-world price levels and economic analysis.

Monetary Policy

Reflation targets economic recovery by increasing demand through expansionary monetary policy, often involving lower interest rates and increased money supply to boost spending and investment. Shadow inflation refers to the hidden rise in prices not fully captured by official inflation metrics, often influenced by monetary policy effects on asset prices and housing markets. Explore how central banks navigate these dynamics to maintain economic stability and control inflationary pressures.

Hidden Costs

Reflation refers to policies aimed at increasing economic activity and raising price levels after a period of deflation or economic downturn, while shadow inflation captures the hidden costs of rising prices through quality reductions, smaller product sizes, or delayed purchases not reflected in official inflation rates. These hidden costs erode consumer purchasing power and distort the true impact of inflation on households and businesses. Explore further to understand how shadow inflation influences economic decisions beyond headline inflation figures.

Source and External Links

Reflation - Wikipedia - Reflation describes the economic policy aimed at returning prices to a previous rate of inflation, typically through increasing the money supply or reducing taxes, often after a period of deflation or economic downturn.

What is Reflation and How Do You Trade it? | IG International - Reflation involves stimulating an economy with measures like monetary easing and fiscal stimulus to counteract deflation and bring prices back up to their long-term trend.

What's the Reflation Trade? - SoFi - The reflation trade is an investment strategy focused on betting that certain sectors--such as energy, financials, and materials--will perform well during a post-recession recovery when prices and employment are rising.

dowidth.com

dowidth.com