Shrinking middle class and growing wealth inequality disrupt economic stability, highlighting a stark divide in income distribution across developed nations. Concentration of wealth among the top 1% escalates social tension and limits economic mobility by diminishing access to quality education and healthcare for the majority. Explore the profound effects of this widening gap to understand its implications on future economic policy and growth.

Why it is important

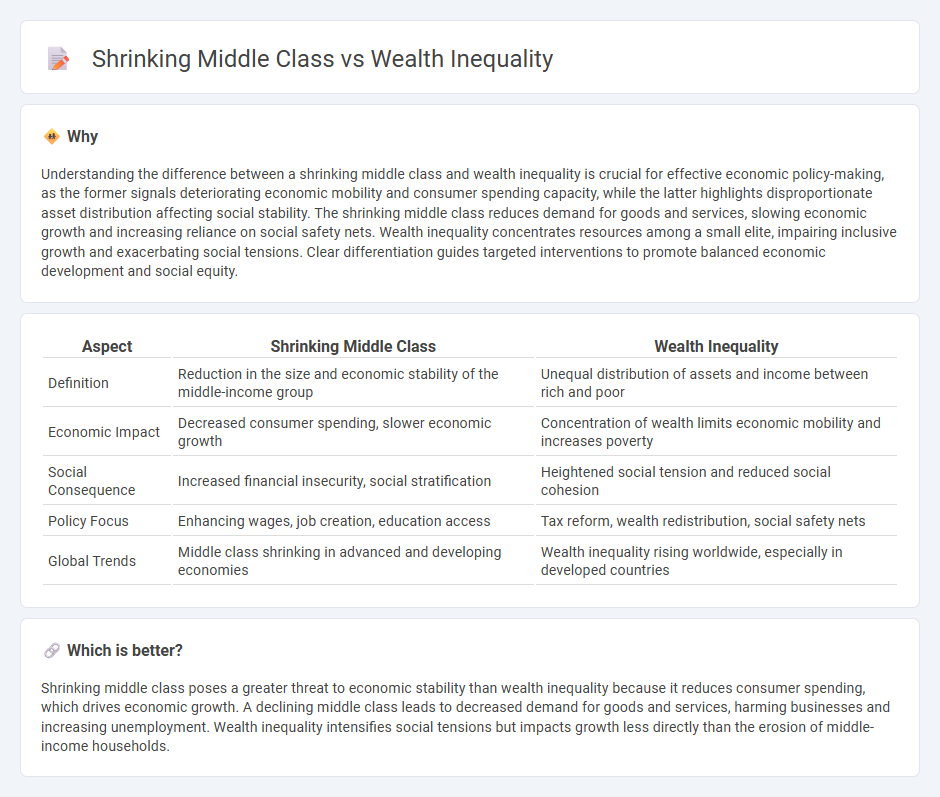

Understanding the difference between a shrinking middle class and wealth inequality is crucial for effective economic policy-making, as the former signals deteriorating economic mobility and consumer spending capacity, while the latter highlights disproportionate asset distribution affecting social stability. The shrinking middle class reduces demand for goods and services, slowing economic growth and increasing reliance on social safety nets. Wealth inequality concentrates resources among a small elite, impairing inclusive growth and exacerbating social tensions. Clear differentiation guides targeted interventions to promote balanced economic development and social equity.

Comparison Table

| Aspect | Shrinking Middle Class | Wealth Inequality |

|---|---|---|

| Definition | Reduction in the size and economic stability of the middle-income group | Unequal distribution of assets and income between rich and poor |

| Economic Impact | Decreased consumer spending, slower economic growth | Concentration of wealth limits economic mobility and increases poverty |

| Social Consequence | Increased financial insecurity, social stratification | Heightened social tension and reduced social cohesion |

| Policy Focus | Enhancing wages, job creation, education access | Tax reform, wealth redistribution, social safety nets |

| Global Trends | Middle class shrinking in advanced and developing economies | Wealth inequality rising worldwide, especially in developed countries |

Which is better?

Shrinking middle class poses a greater threat to economic stability than wealth inequality because it reduces consumer spending, which drives economic growth. A declining middle class leads to decreased demand for goods and services, harming businesses and increasing unemployment. Wealth inequality intensifies social tensions but impacts growth less directly than the erosion of middle-income households.

Connection

The shrinking middle class correlates directly with rising wealth inequality as income gains disproportionately favor the top earners, diminishing economic mobility for the majority. Research from the Pew Research Center highlights that median household income has stagnated while wealth concentration among the top 1% escalates, leading to reduced consumer spending and slower economic growth. This polarization exacerbates social disparities and reduces access to education and healthcare, perpetuating a cycle of economic inequality.

Key Terms

Income Distribution

Wealth inequality significantly exacerbates income distribution disparities, driving a concentration of wealth among the top 1% while the middle class experiences stagnating wages and rising living costs. Shrinking middle class erodes economic stability and consumer spending power, leading to a cycle of reduced social mobility and increased poverty rates. Explore more insights on how income distribution shapes economic policy and social outcomes.

Social Mobility

Wealth inequality exacerbates the shrinking middle class by limiting access to quality education, healthcare, and job opportunities, thereby hindering social mobility across generations. The concentration of wealth among the top percentile creates economic barriers that prevent lower-income families from improving their financial status, reinforcing systemic disparities. Explore in-depth analyses and policy solutions to understand how enhancing social mobility can address wealth inequality and revitalize the middle class.

Purchasing Power

Wealth inequality has intensified as the richest households accumulate a disproportionate share of assets, while the shrinking middle class faces declining purchasing power due to wage stagnation and rising living costs. This erosion of buying capacity limits consumer demand, undermining economic growth and increasing financial insecurity across broad demographics. Explore detailed analyses on how these trends impact economic stability and social mobility.

Source and External Links

Wealth inequality in the United States - Wikipedia - As of Q4 2021, the top 1% of U.S. households held 30.9% of the country's wealth while the bottom 50% held just 2.6%, with white families nearly tripling their wealth advantage over Black families from 1984 to 2009.

Wealth Inequality - The United States has the highest wealth inequality among major developed nations, with the top 1% owning more than half of all stocks and mutual funds, while most wealth for the bottom 90% comes from homeownership, an asset hit hard during the Great Recession.

Nine Charts about Wealth Inequality in America - Urban Institute - By 2022, white families' average wealth ($1.4 million) was over $1 million higher than that of Black families ($211,596), and the wealthiest families now have 71 times the wealth of families in the middle, reflecting decades of widening inequality and persistent racial wealth divides.

dowidth.com

dowidth.com