Analyzing the polycrisis framework reveals interconnected economic challenges such as inflation, supply chain disruptions, and geopolitical tensions impacting global markets. Capital flight exacerbates economic instability by triggering rapid outflows of financial assets from vulnerable economies, undermining investment and growth prospects. Explore in-depth insights to understand how these phenomena shape economic resilience and policy responses.

Why it is important

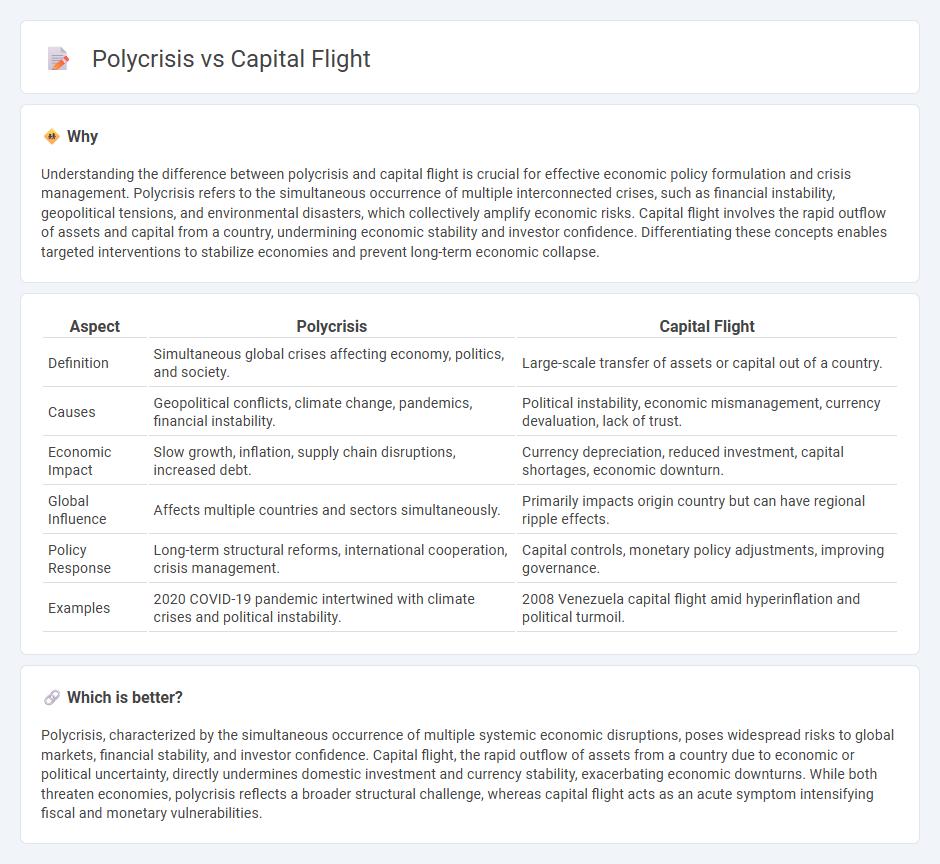

Understanding the difference between polycrisis and capital flight is crucial for effective economic policy formulation and crisis management. Polycrisis refers to the simultaneous occurrence of multiple interconnected crises, such as financial instability, geopolitical tensions, and environmental disasters, which collectively amplify economic risks. Capital flight involves the rapid outflow of assets and capital from a country, undermining economic stability and investor confidence. Differentiating these concepts enables targeted interventions to stabilize economies and prevent long-term economic collapse.

Comparison Table

| Aspect | Polycrisis | Capital Flight |

|---|---|---|

| Definition | Simultaneous global crises affecting economy, politics, and society. | Large-scale transfer of assets or capital out of a country. |

| Causes | Geopolitical conflicts, climate change, pandemics, financial instability. | Political instability, economic mismanagement, currency devaluation, lack of trust. |

| Economic Impact | Slow growth, inflation, supply chain disruptions, increased debt. | Currency depreciation, reduced investment, capital shortages, economic downturn. |

| Global Influence | Affects multiple countries and sectors simultaneously. | Primarily impacts origin country but can have regional ripple effects. |

| Policy Response | Long-term structural reforms, international cooperation, crisis management. | Capital controls, monetary policy adjustments, improving governance. |

| Examples | 2020 COVID-19 pandemic intertwined with climate crises and political instability. | 2008 Venezuela capital flight amid hyperinflation and political turmoil. |

Which is better?

Polycrisis, characterized by the simultaneous occurrence of multiple systemic economic disruptions, poses widespread risks to global markets, financial stability, and investor confidence. Capital flight, the rapid outflow of assets from a country due to economic or political uncertainty, directly undermines domestic investment and currency stability, exacerbating economic downturns. While both threaten economies, polycrisis reflects a broader structural challenge, whereas capital flight acts as an acute symptom intensifying fiscal and monetary vulnerabilities.

Connection

Polycrisis, characterized by the simultaneous occurrence of multiple interlinked crises, exacerbates economic instability and undermines investor confidence, leading to increased capital flight as investors seek safer assets abroad. Capital flight intensifies the strain on domestic economies by depleting foreign reserves and weakening currency values, which further complicates efforts to stabilize financial systems amid polycrisis conditions. Understanding the interconnected dynamics between polycrisis and capital flight is crucial for policymakers aiming to implement effective economic resilience and stabilization measures.

Key Terms

Capital controls

Capital flight often triggers the implementation of capital controls as governments seek to stabilize currencies and prevent economic turmoil during a polycrisis, which is characterized by simultaneous social, political, and economic disruptions. Capital controls restrict the flow of money across borders, aiming to curb large-scale asset withdrawals that exacerbate financial instability. Explore how capital controls serve as a strategic tool to mitigate the cascading effects of capital flight amidst multifaceted crises.

Financial instability

Capital flight intensifies financial instability by depleting a country's foreign reserves and undermining investor confidence, escalating currency depreciation and raising borrowing costs. Polycrisis, characterized by interconnected economic, political, and social crises, amplifies systemic financial risks, creating feedback loops that exacerbate capital outflows and market volatility. Explore how capital flight and polycrisis interact to challenge global economic resilience and policy responses.

Systemic risk

Capital flight exacerbates systemic risk by rapidly draining financial resources and destabilizing national economies, intensifying vulnerabilities across global markets. Polycrisis represents a convergence of interconnected systemic risks, including economic, environmental, and geopolitical factors, which collectively undermine resilience and complicate policy responses. Explore how managing capital flight and addressing polycrisis dynamics are crucial for mitigating systemic risks to global financial stability.

Source and External Links

Capital Flight - Definitions, Impact, Causes, Prevention - Capital flight refers to the rapid and large-scale outflow of assets or capital from a country, often triggered by economic or political events, leading to negative economic consequences such as reduced tax revenue, devalued assets, and weaker purchasing power for citizens.

Capital Flight - Econlib - The most common cause of capital flight is the anticipation of a home currency devaluation, prompting investors to move funds abroad to protect their assets, with the phenomenon often measured by unaccounted-for foreign exchange outflows.

Capital flight - Wikipedia - Capital flight is the sudden movement of money or assets out of a country due to economic instability, political events, or loss of investor confidence, typically causing currency depreciation and a sharp decline in the country's economic strength.

dowidth.com

dowidth.com