Revenge spending occurs when consumers rapidly increase purchases to compensate for previous periods of restraint, often seen after economic lockdowns or crises, driving sudden spikes in retail and service sectors. Pent-up demand refers to the accumulation of consumer buying power and deferred consumption during times of limited access or economic uncertainty, which can unleash significant market activity once restrictions ease. Explore the nuanced differences and impacts of these phenomena on economic recovery and market trends.

Why it is important

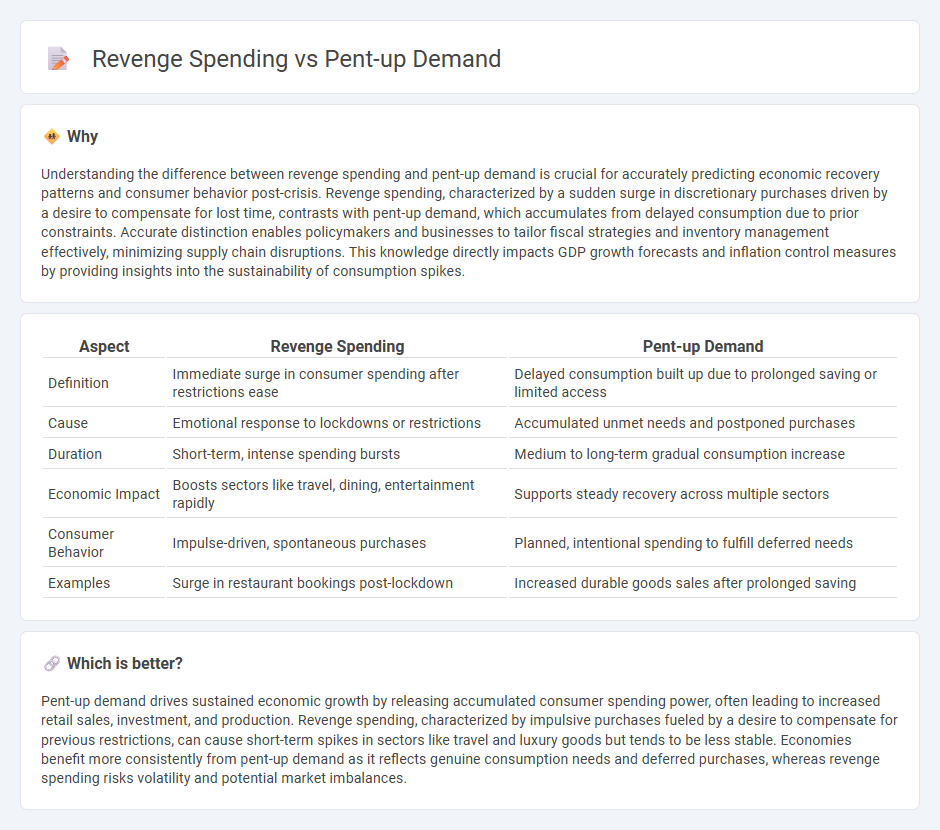

Understanding the difference between revenge spending and pent-up demand is crucial for accurately predicting economic recovery patterns and consumer behavior post-crisis. Revenge spending, characterized by a sudden surge in discretionary purchases driven by a desire to compensate for lost time, contrasts with pent-up demand, which accumulates from delayed consumption due to prior constraints. Accurate distinction enables policymakers and businesses to tailor fiscal strategies and inventory management effectively, minimizing supply chain disruptions. This knowledge directly impacts GDP growth forecasts and inflation control measures by providing insights into the sustainability of consumption spikes.

Comparison Table

| Aspect | Revenge Spending | Pent-up Demand |

|---|---|---|

| Definition | Immediate surge in consumer spending after restrictions ease | Delayed consumption built up due to prolonged saving or limited access |

| Cause | Emotional response to lockdowns or restrictions | Accumulated unmet needs and postponed purchases |

| Duration | Short-term, intense spending bursts | Medium to long-term gradual consumption increase |

| Economic Impact | Boosts sectors like travel, dining, entertainment rapidly | Supports steady recovery across multiple sectors |

| Consumer Behavior | Impulse-driven, spontaneous purchases | Planned, intentional spending to fulfill deferred needs |

| Examples | Surge in restaurant bookings post-lockdown | Increased durable goods sales after prolonged saving |

Which is better?

Pent-up demand drives sustained economic growth by releasing accumulated consumer spending power, often leading to increased retail sales, investment, and production. Revenge spending, characterized by impulsive purchases fueled by a desire to compensate for previous restrictions, can cause short-term spikes in sectors like travel and luxury goods but tends to be less stable. Economies benefit more consistently from pent-up demand as it reflects genuine consumption needs and deferred purchases, whereas revenge spending risks volatility and potential market imbalances.

Connection

Revenge spending is driven by pent-up demand resulting from prolonged periods of restricted consumer activity, such as lockdowns or economic uncertainty, leading to a surge in purchases once conditions improve. This phenomenon significantly boosts sectors like retail, travel, and entertainment, contributing to rapid economic rebounds and increased GDP growth. Understanding the link between pent-up demand and revenge spending helps businesses and policymakers anticipate consumption patterns and adjust strategies accordingly.

Key Terms

Consumer Behavior

Pent-up demand reflects consumers delaying purchases due to economic uncertainty or restrictions, creating a backlog of needs that leads to a surge in spending once conditions improve. Revenge spending, driven by emotional factors and a desire to reclaim lost experiences, often results in elevated expenditures on luxury goods, travel, and dining. Explore deeper insights into how these distinct behaviors shape market trends and influence economic recovery.

Deferred Consumption

Pent-up demand refers to consumer spending delayed due to external constraints, such as lockdowns, while revenge spending describes a surge in purchases driven by emotional relief and a desire to regain lost experiences. Deferred consumption captures the core idea of pent-up demand, highlighting purchases postponed until conditions allow, often resulting in abrupt spikes in sales across sectors like travel, dining, and retail. Explore more about how deferred consumption shapes economic recovery and consumer behavior trends.

Economic Recovery

Pent-up demand reflects consumers' deferred purchasing from earlier economic downturns, causing a surge in spending as restrictions ease and confidence returns. Revenge spending, a behavior observed during economic recovery phases, involves consumers splurging on luxury goods and experiences as a psychological response to prior constraints. Explore how these phenomena drive economic recovery and influence market strategies in post-pandemic economies.

Source and External Links

Pent Up Demand - Meaning, Explained, Causes, Examples - Pent-up demand is the sudden strong increase in consumer demand for products and services, especially luxury items, following a prolonged recession or economic slowdown when consumers resume spending after a period of saving and reduced discretionary expenditure.

Understanding Pent-Up Demand in the Real Estate Market - Pent-up demand refers to the backlog of potential buyers delaying purchases, often due to high home prices or interest rates, leading to a surge in market activity once conditions improve.

What does the author mean by 'pent-up demand'? - Pent-up demand means the suppressed desire to spend money that is unleashed once obstacles like pandemics or economic uncertainty are controlled, enabling consumers to confidently resume purchases.

dowidth.com

dowidth.com