De-risking involves strategically reducing exposure to financial or operational risks through diversification, hedging, or restructuring investments. Insuring protects against potential losses by transferring risk to an insurance provider in exchange for premium payments. Explore the distinct advantages and applications of de-risking and insuring in economic strategies.

Why it is important

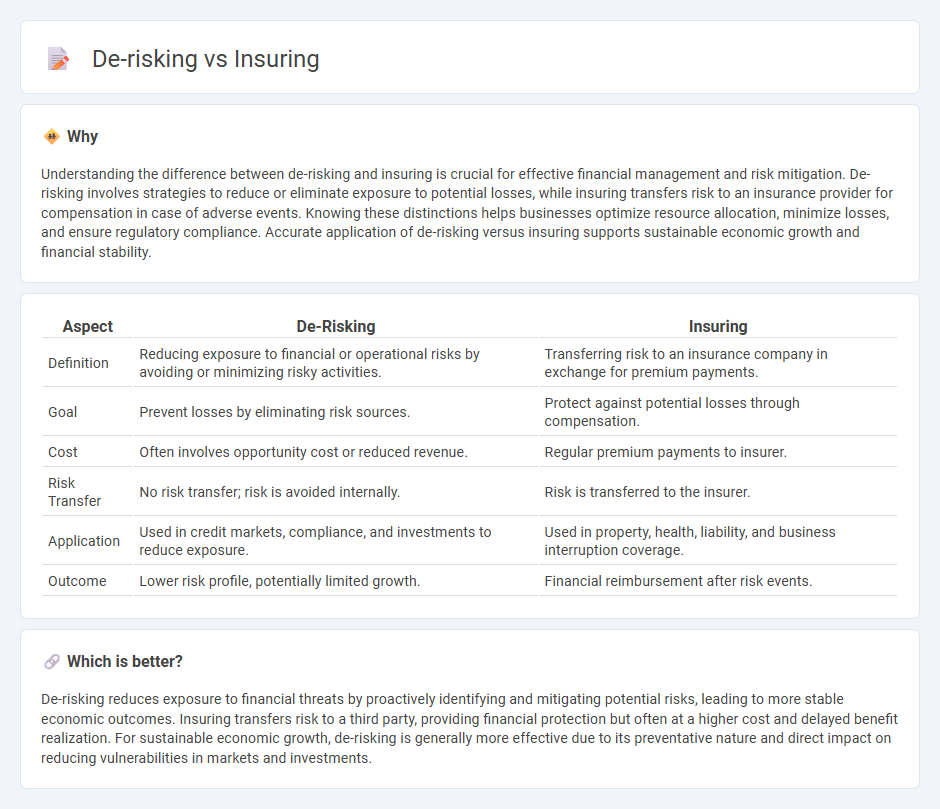

Understanding the difference between de-risking and insuring is crucial for effective financial management and risk mitigation. De-risking involves strategies to reduce or eliminate exposure to potential losses, while insuring transfers risk to an insurance provider for compensation in case of adverse events. Knowing these distinctions helps businesses optimize resource allocation, minimize losses, and ensure regulatory compliance. Accurate application of de-risking versus insuring supports sustainable economic growth and financial stability.

Comparison Table

| Aspect | De-Risking | Insuring |

|---|---|---|

| Definition | Reducing exposure to financial or operational risks by avoiding or minimizing risky activities. | Transferring risk to an insurance company in exchange for premium payments. |

| Goal | Prevent losses by eliminating risk sources. | Protect against potential losses through compensation. |

| Cost | Often involves opportunity cost or reduced revenue. | Regular premium payments to insurer. |

| Risk Transfer | No risk transfer; risk is avoided internally. | Risk is transferred to the insurer. |

| Application | Used in credit markets, compliance, and investments to reduce exposure. | Used in property, health, liability, and business interruption coverage. |

| Outcome | Lower risk profile, potentially limited growth. | Financial reimbursement after risk events. |

Which is better?

De-risking reduces exposure to financial threats by proactively identifying and mitigating potential risks, leading to more stable economic outcomes. Insuring transfers risk to a third party, providing financial protection but often at a higher cost and delayed benefit realization. For sustainable economic growth, de-risking is generally more effective due to its preventative nature and direct impact on reducing vulnerabilities in markets and investments.

Connection

De-risking involves identifying and minimizing potential financial hazards to stabilize economic activities, while insuring transfers specific risks to insurance providers, offering financial protection against losses. Both processes are pivotal in enhancing economic resilience by safeguarding businesses and investments from unforeseen disruptions. Effective integration of de-risking strategies with insurance coverage reduces vulnerability, promoting sustainable economic growth and stability.

Key Terms

Risk Transfer

Insuring involves transferring specific financial risks to an insurance company in exchange for premium payments, providing protection against potential losses from defined events such as property damage or liability claims. De-risking focuses on reducing or eliminating exposure to risk through strategic actions like diversification, hedging, or operational adjustments before risks materialize. Explore how these approaches complement each other in comprehensive risk management strategies.

Risk Mitigation

Insuring transfers financial risk to an insurance company by paying premiums in exchange for coverage against potential losses, providing a safety net for unforeseen events. De-risking involves proactive measures to reduce or eliminate risk exposure, such as diversifying investments, improving operational processes, or implementing stricter compliance controls. Explore deeper insights into effective risk mitigation strategies and their impact on business resilience.

Premium

Insurance premium is the regular payment made to transfer risk from the insured to the insurer, providing financial protection against potential losses. De-risking strategies focus on reducing exposure to risk before insurance, which can lower premium costs by minimizing the likelihood and severity of claims. Explore how optimizing premium costs through effective de-risking can enhance your overall risk management approach.

Source and External Links

insuring agreement - The insuring agreement is the part of an insurance policy where the insurer promises to pay the insured in the event of covered losses.

Insure - Definition, Meaning & Synonyms - To insure means to protect against financial loss by purchasing insurance coverage for items like homes, cars, or valuables.

15 Synonyms & Antonyms for INSURING - Common synonyms for insuring include guarantee, cover, safeguard, protect, indemnify, and underwrite.

dowidth.com

dowidth.com