Greenflation, the rising costs linked to the transition toward cleaner energy, challenges economies by increasing production expenses and consumer prices. Carbon pricing, through mechanisms like carbon taxes or cap-and-trade systems, aims to internalize environmental costs and incentivize reduction in greenhouse gas emissions. Explore how these economic tools intersect and impact sustainable growth strategies.

Why it is important

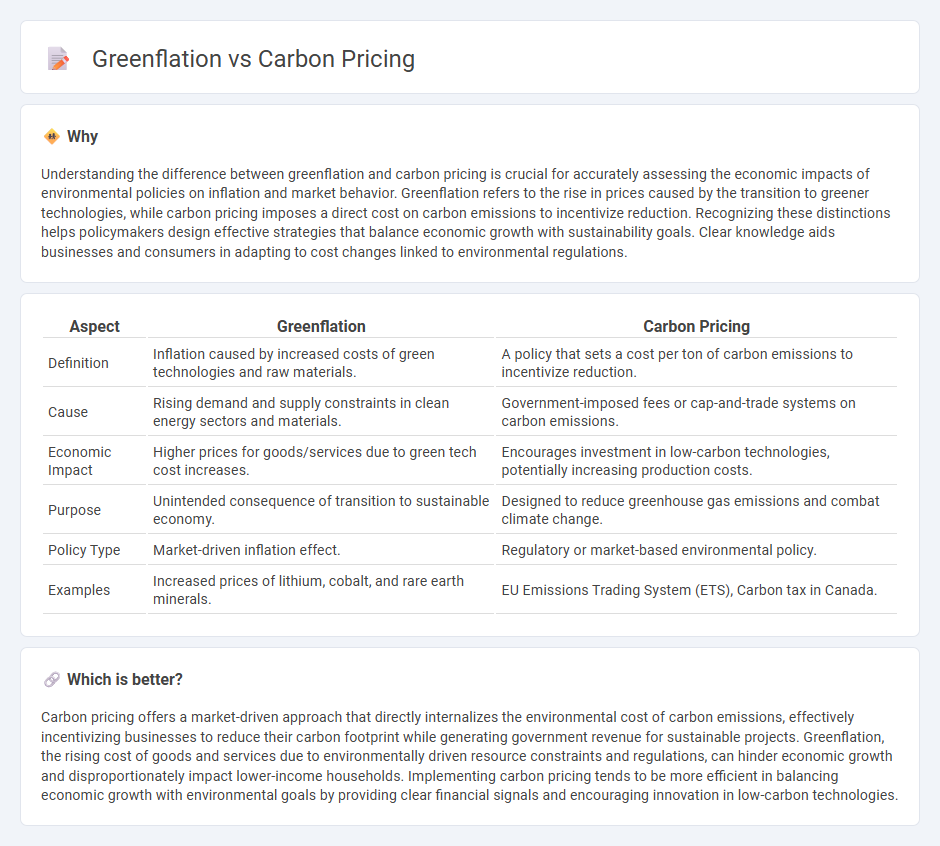

Understanding the difference between greenflation and carbon pricing is crucial for accurately assessing the economic impacts of environmental policies on inflation and market behavior. Greenflation refers to the rise in prices caused by the transition to greener technologies, while carbon pricing imposes a direct cost on carbon emissions to incentivize reduction. Recognizing these distinctions helps policymakers design effective strategies that balance economic growth with sustainability goals. Clear knowledge aids businesses and consumers in adapting to cost changes linked to environmental regulations.

Comparison Table

| Aspect | Greenflation | Carbon Pricing |

|---|---|---|

| Definition | Inflation caused by increased costs of green technologies and raw materials. | A policy that sets a cost per ton of carbon emissions to incentivize reduction. |

| Cause | Rising demand and supply constraints in clean energy sectors and materials. | Government-imposed fees or cap-and-trade systems on carbon emissions. |

| Economic Impact | Higher prices for goods/services due to green tech cost increases. | Encourages investment in low-carbon technologies, potentially increasing production costs. |

| Purpose | Unintended consequence of transition to sustainable economy. | Designed to reduce greenhouse gas emissions and combat climate change. |

| Policy Type | Market-driven inflation effect. | Regulatory or market-based environmental policy. |

| Examples | Increased prices of lithium, cobalt, and rare earth minerals. | EU Emissions Trading System (ETS), Carbon tax in Canada. |

Which is better?

Carbon pricing offers a market-driven approach that directly internalizes the environmental cost of carbon emissions, effectively incentivizing businesses to reduce their carbon footprint while generating government revenue for sustainable projects. Greenflation, the rising cost of goods and services due to environmentally driven resource constraints and regulations, can hinder economic growth and disproportionately impact lower-income households. Implementing carbon pricing tends to be more efficient in balancing economic growth with environmental goals by providing clear financial signals and encouraging innovation in low-carbon technologies.

Connection

Greenflation refers to the inflationary pressure caused by increased costs of green technologies and sustainable materials, while carbon pricing imposes fees or taxes on carbon emissions to incentivize reduction. The implementation of carbon pricing mechanisms drives demand for low-carbon alternatives, raising production costs initially and contributing to greenflation. This interconnected dynamic influences market prices, shaping investment decisions and economic policies focused on transitioning to a low-carbon economy.

Key Terms

Emissions Trading System (ETS)

The Emissions Trading System (ETS) plays a critical role in carbon pricing by setting a market-driven cap on greenhouse gas emissions, enabling companies to buy and sell allowances to meet regulatory limits efficiently. Greenflation refers to the upward pressure on prices of raw materials and energy driven by increased demand for sustainable technologies and policies like carbon pricing under ETS. Explore the impact of ETS on both reducing emissions and influencing greenflation dynamics to understand its dual economic and environmental effects.

Carbon Tax

Carbon tax directly assigns a monetary cost to each ton of carbon dioxide emitted, aiming to reduce greenhouse gas emissions by encouraging businesses and consumers to shift towards cleaner alternatives. Greenflation refers to the inflationary pressures caused by increased demand and investment in green technologies and renewable energy sources. Explore how carbon tax policies influence both emission reductions and the economic impact of greenflation for a comprehensive understanding.

Supply Chain Costs

Carbon pricing directly influences supply chain costs by increasing expenses related to emissions-intensive processes and raw materials, compelling companies to adopt cleaner technologies or pay higher fees. Greenflation intensifies these costs through elevated prices of sustainable goods and renewable energy infrastructure, driven by high demand and limited supply in green materials like lithium and rare earth metals. Explore in-depth how these factors reshape global supply chains and affect pricing strategies across industries.

Source and External Links

Carbon Pricing | MIT Climate Portal - Carbon pricing is a policy tool that puts a price (such as a tax or permit cost) on carbon dioxide and other greenhouse gas emissions to incentivize their reduction, using either a carbon tax or a cap-and-trade system.

Five Things to Know about Carbon Pricing - Carbon pricing creates broad incentives to lower energy use, switch to cleaner fuels, and direct investment toward clean technologies by making it more expensive to emit greenhouse gases.

U.S. State Carbon Pricing Policies - C2ES - Over a dozen U.S. states have implemented carbon pricing programs--including cap-and-trade and carbon taxes--covering significant portions of the population and GDP, with notable examples being California's multi-sector cap-and-trade and the Regional Greenhouse Gas Initiative in the Northeast.

dowidth.com

dowidth.com