Micro-dosing spending targets specific economic sectors by injecting small, strategic amounts of capital to stimulate growth and consumer confidence. Quantitative easing involves large-scale asset purchases by central banks to increase money supply and encourage lending across the broader economy. Explore deeper insights into how these fiscal tools shape economic recovery and inflation dynamics.

Why it is important

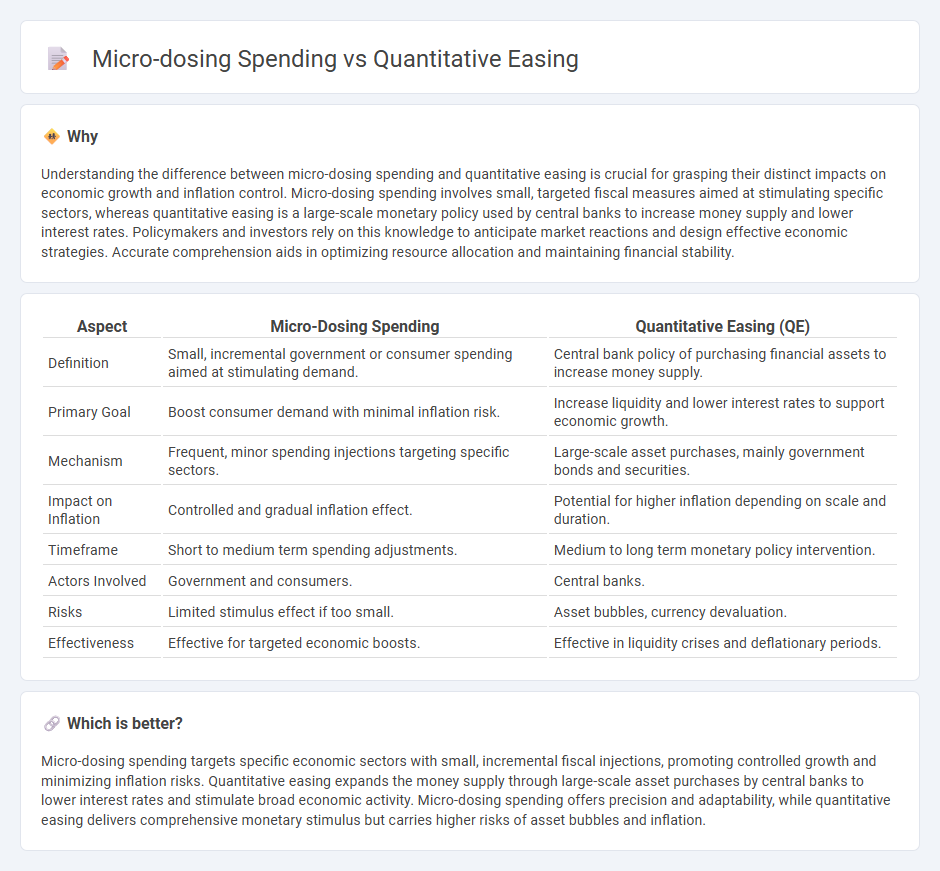

Understanding the difference between micro-dosing spending and quantitative easing is crucial for grasping their distinct impacts on economic growth and inflation control. Micro-dosing spending involves small, targeted fiscal measures aimed at stimulating specific sectors, whereas quantitative easing is a large-scale monetary policy used by central banks to increase money supply and lower interest rates. Policymakers and investors rely on this knowledge to anticipate market reactions and design effective economic strategies. Accurate comprehension aids in optimizing resource allocation and maintaining financial stability.

Comparison Table

| Aspect | Micro-Dosing Spending | Quantitative Easing (QE) |

|---|---|---|

| Definition | Small, incremental government or consumer spending aimed at stimulating demand. | Central bank policy of purchasing financial assets to increase money supply. |

| Primary Goal | Boost consumer demand with minimal inflation risk. | Increase liquidity and lower interest rates to support economic growth. |

| Mechanism | Frequent, minor spending injections targeting specific sectors. | Large-scale asset purchases, mainly government bonds and securities. |

| Impact on Inflation | Controlled and gradual inflation effect. | Potential for higher inflation depending on scale and duration. |

| Timeframe | Short to medium term spending adjustments. | Medium to long term monetary policy intervention. |

| Actors Involved | Government and consumers. | Central banks. |

| Risks | Limited stimulus effect if too small. | Asset bubbles, currency devaluation. |

| Effectiveness | Effective for targeted economic boosts. | Effective in liquidity crises and deflationary periods. |

Which is better?

Micro-dosing spending targets specific economic sectors with small, incremental fiscal injections, promoting controlled growth and minimizing inflation risks. Quantitative easing expands the money supply through large-scale asset purchases by central banks to lower interest rates and stimulate broad economic activity. Micro-dosing spending offers precision and adaptability, while quantitative easing delivers comprehensive monetary stimulus but carries higher risks of asset bubbles and inflation.

Connection

Micro-dosing spending involves incremental fiscal injections to stimulate economic activity without triggering inflation, complementing quantitative easing (QE), which expands the money supply through asset purchases by central banks. Both strategies aim to increase liquidity and encourage lending and investment, supporting economic growth during periods of slow demand or recession. By combining targeted micro-dosing spending with QE, policymakers can more precisely manage economic stimulus and mitigate the risks of overheating or asset bubbles.

Key Terms

Monetary Policy

Quantitative easing (QE) involves central banks purchasing large-scale assets to inject liquidity into the economy, targeting lower interest rates and increased lending. Micro-dosing spending refers to small, incremental fiscal interventions aimed at stimulating specific sectors or managing inflation more precisely. Explore how these contrasting monetary strategies influence economic stability and growth in greater detail.

Aggregate Demand

Quantitative easing (QE) increases Aggregate Demand by injecting large-scale liquidity into the financial system, stimulating borrowing and investment. Micro-dosing spending, involving smaller, targeted fiscal injections, aims to boost demand incrementally, minimizing inflation risks. Explore further to understand the nuanced impacts of both strategies on overall economic growth.

Consumer Behavior

Quantitative easing increases overall money supply by central banks buying government securities, usually boosting consumer confidence and spending by lowering interest rates. Micro-dosing spending involves small, frequent purchases by consumers, reflecting a shift toward mindful, incremental expenditure rather than large-scale financial interventions. Explore how these contrasting approaches uniquely influence consumer behavior patterns and economic outcomes.

Source and External Links

Quantitative Easing - This monetary policy involves a central bank purchasing government bonds or other financial assets to stimulate economic activity when interest rates are near zero.

How Quantitative Easing Actually Works - Quantitative easing is an unconventional policy that involves buying large quantities of financial assets to lower yields and boost financial markets and the real economy.

Understanding Quantitative Easing - Quantitative easing encourages spending and investment by lowering borrowing costs, particularly when interest rates are already very low, and its effects are reversed by quantitative tightening.

dowidth.com

dowidth.com