Shrinkflation describes the practice where product sizes or quantities reduce while prices remain constant, effectively increasing the cost per unit and affecting consumer purchasing power. Disinflation refers to a slowdown in the rate of inflation, indicating that prices are rising but at a decreasing pace, signaling potential stabilization in the economy. Explore in-depth how shrinkflation and disinflation uniquely impact market dynamics and consumer behavior.

Why it is important

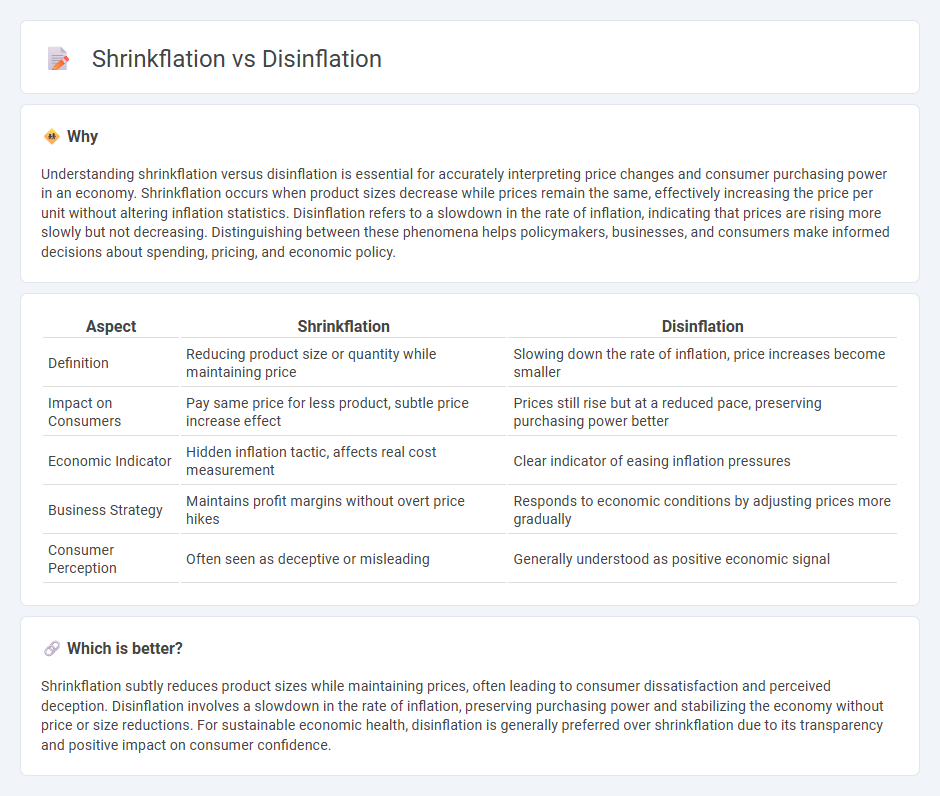

Understanding shrinkflation versus disinflation is essential for accurately interpreting price changes and consumer purchasing power in an economy. Shrinkflation occurs when product sizes decrease while prices remain the same, effectively increasing the price per unit without altering inflation statistics. Disinflation refers to a slowdown in the rate of inflation, indicating that prices are rising more slowly but not decreasing. Distinguishing between these phenomena helps policymakers, businesses, and consumers make informed decisions about spending, pricing, and economic policy.

Comparison Table

| Aspect | Shrinkflation | Disinflation |

|---|---|---|

| Definition | Reducing product size or quantity while maintaining price | Slowing down the rate of inflation, price increases become smaller |

| Impact on Consumers | Pay same price for less product, subtle price increase effect | Prices still rise but at a reduced pace, preserving purchasing power better |

| Economic Indicator | Hidden inflation tactic, affects real cost measurement | Clear indicator of easing inflation pressures |

| Business Strategy | Maintains profit margins without overt price hikes | Responds to economic conditions by adjusting prices more gradually |

| Consumer Perception | Often seen as deceptive or misleading | Generally understood as positive economic signal |

Which is better?

Shrinkflation subtly reduces product sizes while maintaining prices, often leading to consumer dissatisfaction and perceived deception. Disinflation involves a slowdown in the rate of inflation, preserving purchasing power and stabilizing the economy without price or size reductions. For sustainable economic health, disinflation is generally preferred over shrinkflation due to its transparency and positive impact on consumer confidence.

Connection

Shrinkflation and disinflation are interconnected phenomena impacting consumer purchasing power and price trends. Shrinkflation occurs when product sizes decrease while prices remain stable, effectively masking inflation, whereas disinflation reflects a slowdown in the rate of inflation, signaling economic adjustments. Both influence inflation metrics and consumer behavior, demonstrating nuanced challenges in measuring true cost-of-living changes.

Key Terms

Price Levels

Disinflation refers to a slowdown in the rate of inflation, meaning prices are still rising but at a slower pace, which impacts overall price levels without reducing them outright. Shrinkflation involves maintaining stable or slightly increased price points while reducing product quantity or size, effectively increasing the per-unit price and altering consumer perception of price levels. Explore the detailed mechanisms and effects of disinflation and shrinkflation on market dynamics to understand their influence on purchasing power.

Consumer Goods

Disinflation refers to a slowdown in the rate of inflation, where prices of consumer goods rise more slowly but still increase over time. Shrinkflation involves reducing the size or quantity of consumer products while maintaining or slightly increasing the price, effectively increasing the unit cost for consumers. Explore the impacts of disinflation and shrinkflation on consumer purchasing power and product value to understand market trends better.

Purchasing Power

Disinflation refers to a slowdown in the rate of inflation, leading to smaller increases in prices and relatively better preservation of purchasing power. Shrinkflation occurs when product sizes reduce while prices remain the same, effectively decreasing the quantity consumers get without lowering costs, thus subtly eroding purchasing power. Explore the impacts of these phenomena on consumer budgets and market dynamics to understand their effects more deeply.

Source and External Links

Disinflation - Definition, How It Works, Examples - Disinflation is the slowing down of the rate of inflation, meaning prices continue to rise but at a slower pace than before; it is distinct from deflation, where prices actually fall.

Disinflation - Wikipedia - Disinflation refers to a decrease in the rate of inflation -- prices rise less quickly than before, and if inflation is low enough, disinflation can lead to deflation.

Inflation, Disinflation and Deflation: What Do They All Mean? - Disinflation means prices are still increasing, but more slowly than previously; it is illustrated by a gradual decrease in the inflation rate, as opposed to deflation which involves falling prices.

dowidth.com

dowidth.com