Shadow inflation occurs when the quality or quantity of goods decreases while prices remain stable, subtly eroding consumer purchasing power without official inflation rate changes. Disinflation refers to a slowdown in the rate of inflation, signaling a deceleration in price increases rather than a drop in prices themselves. Explore these nuanced economic concepts further to understand their impact on real-world financial stability.

Why it is important

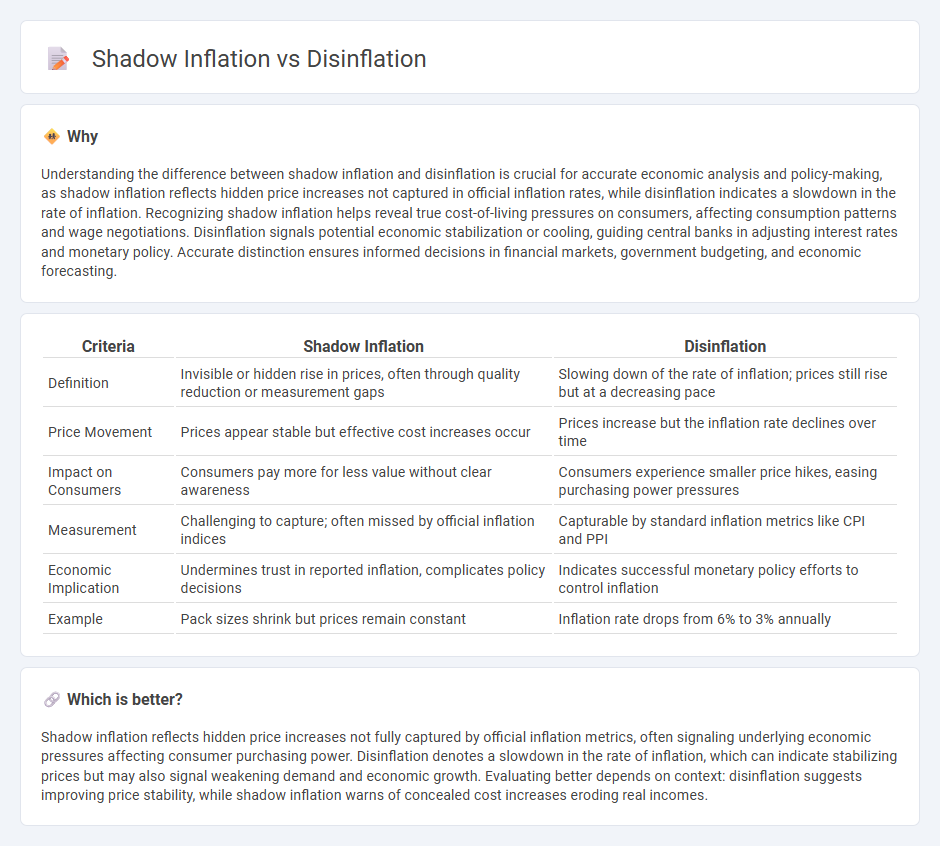

Understanding the difference between shadow inflation and disinflation is crucial for accurate economic analysis and policy-making, as shadow inflation reflects hidden price increases not captured in official inflation rates, while disinflation indicates a slowdown in the rate of inflation. Recognizing shadow inflation helps reveal true cost-of-living pressures on consumers, affecting consumption patterns and wage negotiations. Disinflation signals potential economic stabilization or cooling, guiding central banks in adjusting interest rates and monetary policy. Accurate distinction ensures informed decisions in financial markets, government budgeting, and economic forecasting.

Comparison Table

| Criteria | Shadow Inflation | Disinflation |

|---|---|---|

| Definition | Invisible or hidden rise in prices, often through quality reduction or measurement gaps | Slowing down of the rate of inflation; prices still rise but at a decreasing pace |

| Price Movement | Prices appear stable but effective cost increases occur | Prices increase but the inflation rate declines over time |

| Impact on Consumers | Consumers pay more for less value without clear awareness | Consumers experience smaller price hikes, easing purchasing power pressures |

| Measurement | Challenging to capture; often missed by official inflation indices | Capturable by standard inflation metrics like CPI and PPI |

| Economic Implication | Undermines trust in reported inflation, complicates policy decisions | Indicates successful monetary policy efforts to control inflation |

| Example | Pack sizes shrink but prices remain constant | Inflation rate drops from 6% to 3% annually |

Which is better?

Shadow inflation reflects hidden price increases not fully captured by official inflation metrics, often signaling underlying economic pressures affecting consumer purchasing power. Disinflation denotes a slowdown in the rate of inflation, which can indicate stabilizing prices but may also signal weakening demand and economic growth. Evaluating better depends on context: disinflation suggests improving price stability, while shadow inflation warns of concealed cost increases eroding real incomes.

Connection

Shadow inflation, the rise in prices of goods and services that are not fully captured by official inflation metrics, can obscure the true pace of disinflation, which is the slowdown in the rate of inflation. As traditional indexes underreport price increases in categories affected by shadow inflation, policymakers and economists might misinterpret disinflation signals, delaying necessary adjustments. This interplay complicates accurate economic analysis and affects decisions on interest rates, wage policies, and consumer purchasing power.

Key Terms

Price Levels

Disinflation refers to a decrease in the rate of inflation, meaning price levels continue to rise but at a slower pace, whereas shadow inflation occurs when product sizes shrink or quality declines while prices remain stable, effectively increasing the price per unit. Price levels during disinflation show slower upward trends on indexes like the Consumer Price Index (CPI), but shadow inflation often escapes these official measures, masking the real cost burden on consumers. Explore how both phenomena impact economic perceptions and policymaking to gain a deeper understanding.

Measurement Methods

Disinflation is measured by tracking a decrease in the inflation rate using consumer price indexes (CPI) and producer price indexes (PPI), reflecting slower growth in overall price levels. Shadow inflation, which captures hidden or unmeasured price pressures, relies on alternative measurement methods like adjusted hedonic pricing, quality-adjusted prices, and non-traditional indicators such as changes in product sizes or service quality. Explore more about how advanced measurement techniques reveal the true inflation dynamics beyond official statistics.

Consumer Purchasing Power

Disinflation refers to a slowdown in the rate of inflation, resulting in a moderate increase in prices that helps maintain consumer purchasing power. Shadow inflation, however, involves hidden price increases through reduced product sizes or decreased quality, eroding consumer purchasing power without apparent headline inflation. Explore the nuances of these inflation dynamics to better understand their impact on your financial well-being.

Source and External Links

Disinflation - Definition, How It Works, Examples - Disinflation is the slowing of price inflation, meaning a decrease in the rate of inflation, not a drop in prices themselves.

Disinflation - Wikipedia - Disinflation occurs when the rate of increase in the general price level of goods and services slows down, but prices still continue to rise, not fall.

Inflation, Disinflation and Deflation: What Do They All Mean? - During disinflation, prices increase at a slower rate than before, but the inflation rate remains positive, as opposed to deflation, where prices actually decrease.

dowidth.com

dowidth.com