Data lake auditing involves comprehensive examination of vast, unstructured data repositories to ensure data integrity, security, and compliance with regulatory standards, leveraging advanced analytics and automated tools. Internal controls assessment focuses on evaluating the effectiveness of policies and procedures designed to prevent errors, fraud, and ensure accurate financial reporting within an organization. Explore the differences and benefits of data lake auditing versus internal controls assessment to enhance your accounting practices.

Why it is important

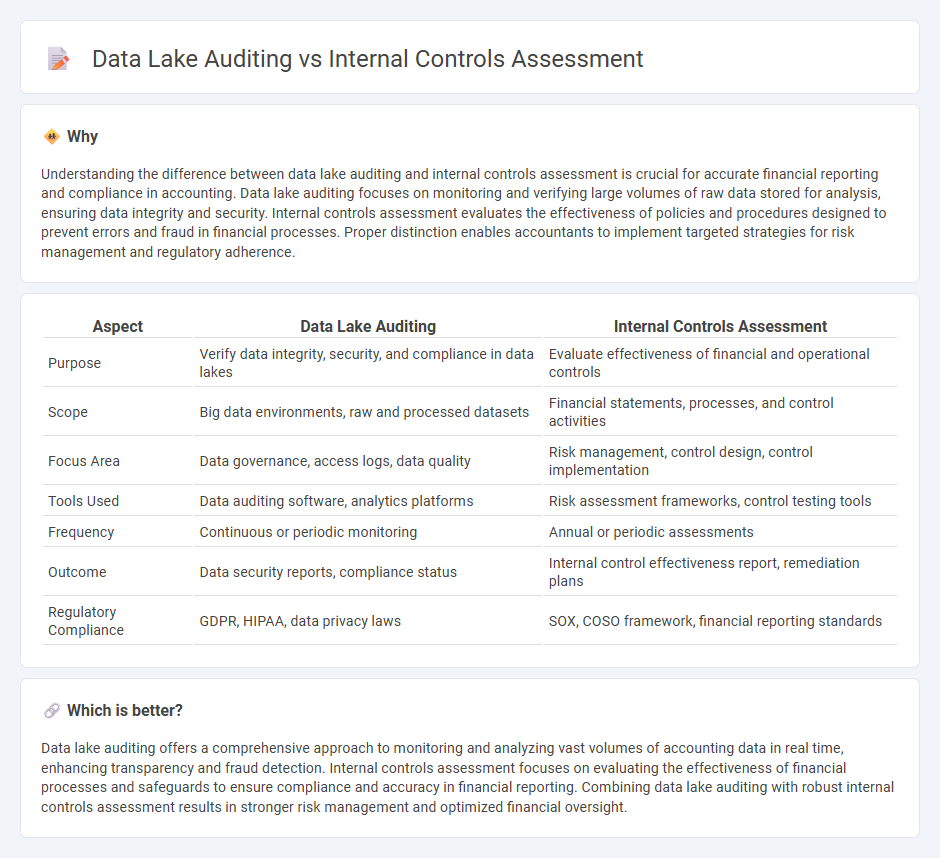

Understanding the difference between data lake auditing and internal controls assessment is crucial for accurate financial reporting and compliance in accounting. Data lake auditing focuses on monitoring and verifying large volumes of raw data stored for analysis, ensuring data integrity and security. Internal controls assessment evaluates the effectiveness of policies and procedures designed to prevent errors and fraud in financial processes. Proper distinction enables accountants to implement targeted strategies for risk management and regulatory adherence.

Comparison Table

| Aspect | Data Lake Auditing | Internal Controls Assessment |

|---|---|---|

| Purpose | Verify data integrity, security, and compliance in data lakes | Evaluate effectiveness of financial and operational controls |

| Scope | Big data environments, raw and processed datasets | Financial statements, processes, and control activities |

| Focus Area | Data governance, access logs, data quality | Risk management, control design, control implementation |

| Tools Used | Data auditing software, analytics platforms | Risk assessment frameworks, control testing tools |

| Frequency | Continuous or periodic monitoring | Annual or periodic assessments |

| Outcome | Data security reports, compliance status | Internal control effectiveness report, remediation plans |

| Regulatory Compliance | GDPR, HIPAA, data privacy laws | SOX, COSO framework, financial reporting standards |

Which is better?

Data lake auditing offers a comprehensive approach to monitoring and analyzing vast volumes of accounting data in real time, enhancing transparency and fraud detection. Internal controls assessment focuses on evaluating the effectiveness of financial processes and safeguards to ensure compliance and accuracy in financial reporting. Combining data lake auditing with robust internal controls assessment results in stronger risk management and optimized financial oversight.

Connection

Data lake auditing enhances accounting accuracy by systematically tracking data access and modifications, ensuring compliance with internal controls. Internal controls assessment relies on this audit trail to evaluate the effectiveness of financial reporting processes and risk management. Integrating data lake auditing strengthens transparency, reduces fraud risks, and supports regulatory compliance in accounting systems.

Key Terms

**Internal controls assessment:**

Internal controls assessment evaluates the effectiveness of an organization's risk management, compliance, and operational processes through systematic testing of financial and operational controls. This process identifies control weaknesses that could lead to errors or fraud, ensuring data integrity and regulatory adherence. Explore how internal controls assessment strengthens organizational governance and risk mitigation.

Segregation of duties

Internal controls assessment evaluates the effectiveness of policies and procedures designed to enforce Segregation of Duties (SoD) by mitigating risks of fraud and errors within business processes. Data lake auditing, on the other hand, focuses on monitoring access controls, user activities, and data modifications to ensure SoD compliance in vast, unstructured datasets stored across platforms. Explore further how combining both approaches strengthens organizational governance and risk management.

Authorization procedures

Internal controls assessment evaluates the effectiveness of authorization procedures to ensure only approved users access sensitive systems and data, mitigating the risk of fraud or errors. Data lake auditing continuously monitors data access and modification logs to detect unauthorized activities or policy violations in large-scale storage environments. Explore best practices to balance robust authorization controls with comprehensive data lake auditing for enhanced security.

Source and External Links

The 6-step process for evaluating internal controls - Explains a practical six-step method to assess internal controls, including assessing compliance culture, analyzing risks, reviewing controls, evaluating communication, inspecting monitoring, and reporting results for organizational assurance.

Internal Controls Assessments: Understanding Its ... - Describes how internal controls assessments measure control effectiveness, identify weaknesses, improve efficiency, and ensure compliance, similar to a detailed home inspection for organizational processes.

Assessing the system of internal control - Provides key questions and considerations for audit committees on evaluating risk management, control adjustments, resource adequacy, organizational culture, authority segregation, and reporting reliability in internal controls.

dowidth.com

dowidth.com