Real-time expense recognition records costs exactly when they occur, providing immediate and accurate financial data to improve decision-making and cash flow management. Expense allocation distributes costs over different periods or departments, aligning expenses with related revenues to enhance financial reporting accuracy. Explore the benefits and applications of both methods to optimize your accounting processes.

Why it is important

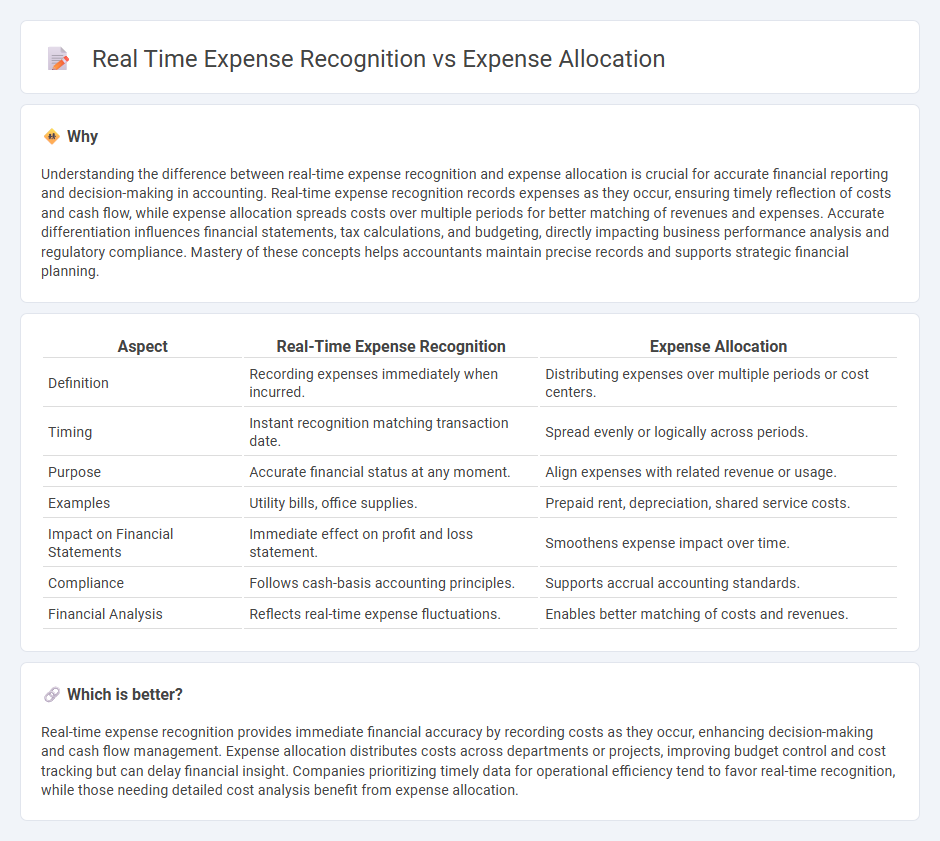

Understanding the difference between real-time expense recognition and expense allocation is crucial for accurate financial reporting and decision-making in accounting. Real-time expense recognition records expenses as they occur, ensuring timely reflection of costs and cash flow, while expense allocation spreads costs over multiple periods for better matching of revenues and expenses. Accurate differentiation influences financial statements, tax calculations, and budgeting, directly impacting business performance analysis and regulatory compliance. Mastery of these concepts helps accountants maintain precise records and supports strategic financial planning.

Comparison Table

| Aspect | Real-Time Expense Recognition | Expense Allocation |

|---|---|---|

| Definition | Recording expenses immediately when incurred. | Distributing expenses over multiple periods or cost centers. |

| Timing | Instant recognition matching transaction date. | Spread evenly or logically across periods. |

| Purpose | Accurate financial status at any moment. | Align expenses with related revenue or usage. |

| Examples | Utility bills, office supplies. | Prepaid rent, depreciation, shared service costs. |

| Impact on Financial Statements | Immediate effect on profit and loss statement. | Smoothens expense impact over time. |

| Compliance | Follows cash-basis accounting principles. | Supports accrual accounting standards. |

| Financial Analysis | Reflects real-time expense fluctuations. | Enables better matching of costs and revenues. |

Which is better?

Real-time expense recognition provides immediate financial accuracy by recording costs as they occur, enhancing decision-making and cash flow management. Expense allocation distributes costs across departments or projects, improving budget control and cost tracking but can delay financial insight. Companies prioritizing timely data for operational efficiency tend to favor real-time recognition, while those needing detailed cost analysis benefit from expense allocation.

Connection

Real-time expense recognition enhances accuracy in financial reporting by immediately capturing costs as they occur, which directly supports precise expense allocation across departments or projects. This connection ensures timely matching of expenses with corresponding revenues, improving budget management and decision-making. Implementing integrated accounting software systems facilitates seamless synchronization between expense recognition and allocation processes.

Key Terms

Accrual Accounting

Expense allocation in accrual accounting involves distributing costs across multiple periods to match revenues accurately, ensuring financial statements reflect true economic activity. Real-time expense recognition records expenses immediately as they occur, enhancing the accuracy of financial reporting by capturing costs promptly. Explore detailed methodologies and best practices for both to optimize your accrual accounting processes.

Matching Principle

Expense allocation distributes costs across accounting periods to align expenses with related revenues, adhering to the matching principle by ensuring accurate financial statements. Real-time expense recognition records costs immediately as they are incurred, improving precision in financial reporting but may challenge period matching. Explore in-depth analysis of how these approaches impact financial accuracy and compliance with accounting standards.

Cash Basis Accounting

Expense allocation in cash basis accounting records expenses when cash is paid, focusing on timing rather than matching expenses to revenues. Real-time expense recognition captures expenses immediately as transactions occur, providing up-to-date financial insights but may conflict with cash basis principles. Explore the nuances and applications of both methods for effective financial management.

Source and External Links

What is Expense Allocation? - Navan - Expense allocation is the method by which businesses distribute costs among different departments, projects, or activities to ensure accurate financial reporting and better financial decisions, using methods such as space occupied or employee count for allocation.

Cost Allocation - Meaning, Types, Methods & Examples - HighRadius - Cost allocation involves identifying costs, selecting cost objects and allocation bases, and distributing costs accordingly to reflect resource consumption for budgeting, pricing, and analysis.

Key Term - Expense Allocation - Aurora Training Advantage - Expense allocation assigns shared or indirect costs to departments or projects using different methods like activity-based costing, percentage, usage, or revenue-based allocation to ensure accurate costing, budgeting, and compliance.

dowidth.com

dowidth.com