Build-to-rent homes are newly constructed properties designed specifically for long-term rental, offering modern amenities and cohesive community planning, while single-family rentals typically involve existing homes owned by individual landlords. These two options highlight distinct approaches in the real estate rental market, with build-to-rent focusing on scale and consistency, and single-family rentals providing more varied housing stock. Explore the advantages and challenges of each to determine the best fit for investment or living preferences.

Why it is important

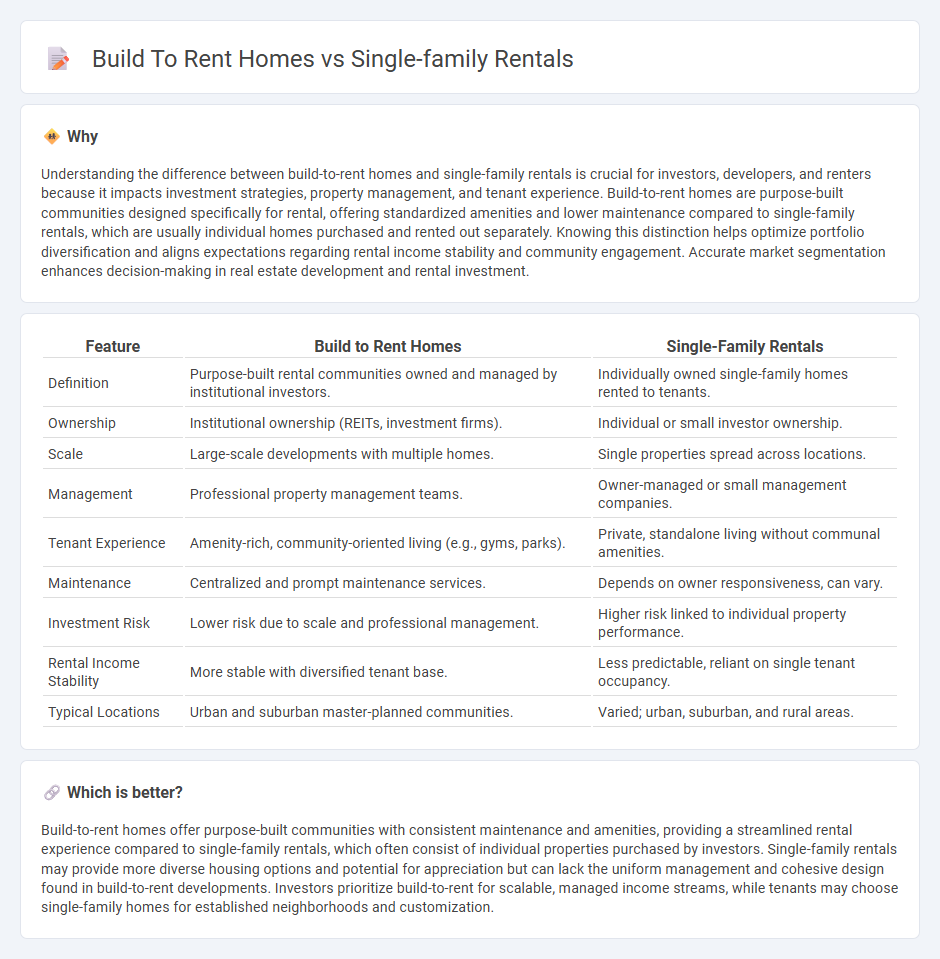

Understanding the difference between build-to-rent homes and single-family rentals is crucial for investors, developers, and renters because it impacts investment strategies, property management, and tenant experience. Build-to-rent homes are purpose-built communities designed specifically for rental, offering standardized amenities and lower maintenance compared to single-family rentals, which are usually individual homes purchased and rented out separately. Knowing this distinction helps optimize portfolio diversification and aligns expectations regarding rental income stability and community engagement. Accurate market segmentation enhances decision-making in real estate development and rental investment.

Comparison Table

| Feature | Build to Rent Homes | Single-Family Rentals |

|---|---|---|

| Definition | Purpose-built rental communities owned and managed by institutional investors. | Individually owned single-family homes rented to tenants. |

| Ownership | Institutional ownership (REITs, investment firms). | Individual or small investor ownership. |

| Scale | Large-scale developments with multiple homes. | Single properties spread across locations. |

| Management | Professional property management teams. | Owner-managed or small management companies. |

| Tenant Experience | Amenity-rich, community-oriented living (e.g., gyms, parks). | Private, standalone living without communal amenities. |

| Maintenance | Centralized and prompt maintenance services. | Depends on owner responsiveness, can vary. |

| Investment Risk | Lower risk due to scale and professional management. | Higher risk linked to individual property performance. |

| Rental Income Stability | More stable with diversified tenant base. | Less predictable, reliant on single tenant occupancy. |

| Typical Locations | Urban and suburban master-planned communities. | Varied; urban, suburban, and rural areas. |

Which is better?

Build-to-rent homes offer purpose-built communities with consistent maintenance and amenities, providing a streamlined rental experience compared to single-family rentals, which often consist of individual properties purchased by investors. Single-family rentals may provide more diverse housing options and potential for appreciation but can lack the uniform management and cohesive design found in build-to-rent developments. Investors prioritize build-to-rent for scalable, managed income streams, while tenants may choose single-family homes for established neighborhoods and customization.

Connection

Build-to-rent homes and single-family rentals are interconnected as both focus on providing purpose-built residential properties for long-term leasing. Build-to-rent developments are specifically designed to meet the growing demand for single-family rental homes, offering amenities and layouts tailored to renters seeking the benefits of detached housing without the commitment of ownership. This synergy supports investor strategies to capitalize on housing market trends favoring rental living and addresses the increasing preference for flexible, community-oriented suburban lifestyles.

Key Terms

Ownership Model

Single-family rentals (SFR) typically involve individual investors or small entities owning standalone homes leased to tenants, emphasizing decentralized ownership and flexibility. Build-to-rent (BTR) homes are professionally developed communities designed from the ground up for rental, featuring corporate or institutional ownership and streamlined property management. Explore the distinctions in ownership models to understand their impact on rental markets and investment strategies.

Property Management

Single-family rentals typically generate steady cash flow with lower tenant turnover, while build-to-rent homes benefit from economies of scale and centralized property management systems that enhance operational efficiency. Property management in build-to-rent communities involves dedicated teams handling maintenance, leasing, and tenant relations, resulting in consistent service standards and tenant satisfaction. Explore comprehensive strategies to optimize property management in both single-family rentals and build-to-rent homes for maximizing investment returns.

Construction Purpose

Single-family rentals are often existing homes purchased for rental income, while build-to-rent homes are specifically constructed with long-term rental occupancy in mind, emphasizing durability and tenant-focused amenities. The construction purpose of build-to-rent properties involves tailored designs for maintenance efficiency and community features, differing from traditional single-family homes adapted for rental use. Explore the distinctions in construction strategies and investment potential between these housing models.

Source and External Links

Single Family Home Rentals in Illinois - Offers single-family rental communities with space and privacy like detached homes, along with professional management perks.

Single Family Rentals - Focuses on building a large-scale portfolio of newly constructed single-family rental homes across high-growth U.S. markets.

What are Single Family Rentals? - Explains single-family rentals as homes rented out to tenants, offering larger spaces and suburban locations attractive to families.

dowidth.com

dowidth.com