Blockchain title transfer offers a secure, transparent method for property ownership changes by recording transactions on a decentralized ledger, reducing fraud and processing times. Escrow services act as trusted third parties, holding funds and documents until all contractual conditions are met, ensuring protection for both buyers and sellers. Explore how these innovative solutions transform real estate transactions for greater safety and efficiency.

Why it is important

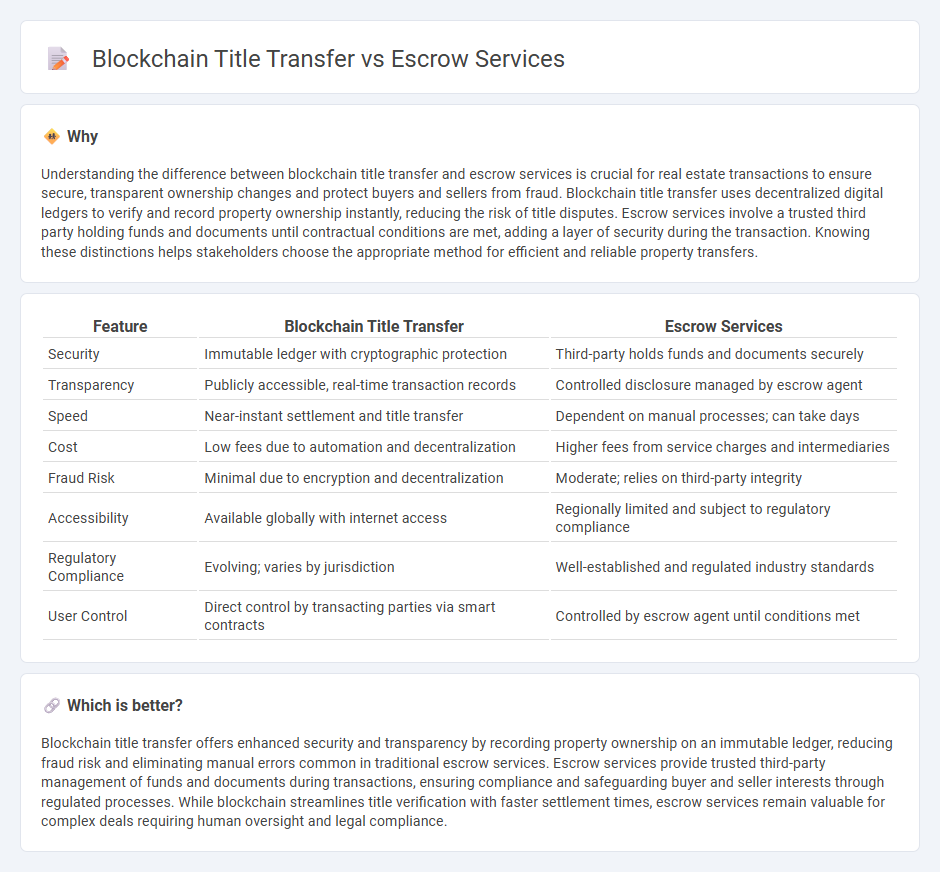

Understanding the difference between blockchain title transfer and escrow services is crucial for real estate transactions to ensure secure, transparent ownership changes and protect buyers and sellers from fraud. Blockchain title transfer uses decentralized digital ledgers to verify and record property ownership instantly, reducing the risk of title disputes. Escrow services involve a trusted third party holding funds and documents until contractual conditions are met, adding a layer of security during the transaction. Knowing these distinctions helps stakeholders choose the appropriate method for efficient and reliable property transfers.

Comparison Table

| Feature | Blockchain Title Transfer | Escrow Services |

|---|---|---|

| Security | Immutable ledger with cryptographic protection | Third-party holds funds and documents securely |

| Transparency | Publicly accessible, real-time transaction records | Controlled disclosure managed by escrow agent |

| Speed | Near-instant settlement and title transfer | Dependent on manual processes; can take days |

| Cost | Low fees due to automation and decentralization | Higher fees from service charges and intermediaries |

| Fraud Risk | Minimal due to encryption and decentralization | Moderate; relies on third-party integrity |

| Accessibility | Available globally with internet access | Regionally limited and subject to regulatory compliance |

| Regulatory Compliance | Evolving; varies by jurisdiction | Well-established and regulated industry standards |

| User Control | Direct control by transacting parties via smart contracts | Controlled by escrow agent until conditions met |

Which is better?

Blockchain title transfer offers enhanced security and transparency by recording property ownership on an immutable ledger, reducing fraud risk and eliminating manual errors common in traditional escrow services. Escrow services provide trusted third-party management of funds and documents during transactions, ensuring compliance and safeguarding buyer and seller interests through regulated processes. While blockchain streamlines title verification with faster settlement times, escrow services remain valuable for complex deals requiring human oversight and legal compliance.

Connection

Blockchain title transfers enhance real estate transactions by providing a secure, transparent ledger that records property ownership changes, reducing fraud and errors. Escrow services complement this by holding funds and documents in trust until all contract conditions are met, ensuring both buyer and seller fulfill their obligations. Integrating blockchain with escrow accelerates closing times and increases trust through automated, tamper-proof verification processes.

Key Terms

Third-party intermediary

Escrow services rely on a trusted third-party intermediary to securely hold funds until contractual obligations are met, ensuring protection against fraud. Blockchain title transfer eliminates this middleman by using decentralized, immutable ledgers that automatically execute and record transactions. Explore how these distinct approaches redefine trust and security in property transactions.

Smart contract

Smart contract technology in blockchain title transfers automates and secures property transactions by enforcing predefined conditions without intermediaries, reducing fraud risks and transaction delays. In contrast, traditional escrow services rely on third-party agents to hold funds and documents until contractual obligations are met, which can increase costs and processing times. Explore how smart contracts revolutionize ownership transfer efficiency and transparency.

Decentralization

Escrow services provide a trusted third party to hold funds during transactions, ensuring security but relying on centralized intermediaries. Blockchain title transfer eliminates intermediaries by utilizing decentralized ledgers, offering transparent and immutable records that enhance trust and reduce fraud risks. Explore the advantages of decentralized blockchain solutions for secure title transfers.

Source and External Links

Escrow Services | Corporate Trust Services - Regions Bank - Regions Bank offers specialized escrow services for various business transactions, including mergers and acquisitions, 1031 exchanges, and more.

Escrow.com - Escrow.com provides secure online payment processing for transactions, ensuring buyers and sellers are protected throughout the process.

Escrow services - BOK Financial - BOK Financial offers escrow services for business transactions, including acquisitions and bankruptcy resolutions, with quick turnaround times.

dowidth.com

dowidth.com