Escrow crowdfunding in real estate allows multiple investors to pool funds securely for property investments, ensuring transparency and legal protection throughout the transaction. Property flipping involves purchasing properties, renovating them, and selling at a profit, which can yield quicker returns but carries higher risk and capital requirements. Explore the differences and benefits of escrow crowdfunding versus property flipping to discover the best investment strategy for your goals.

Why it is important

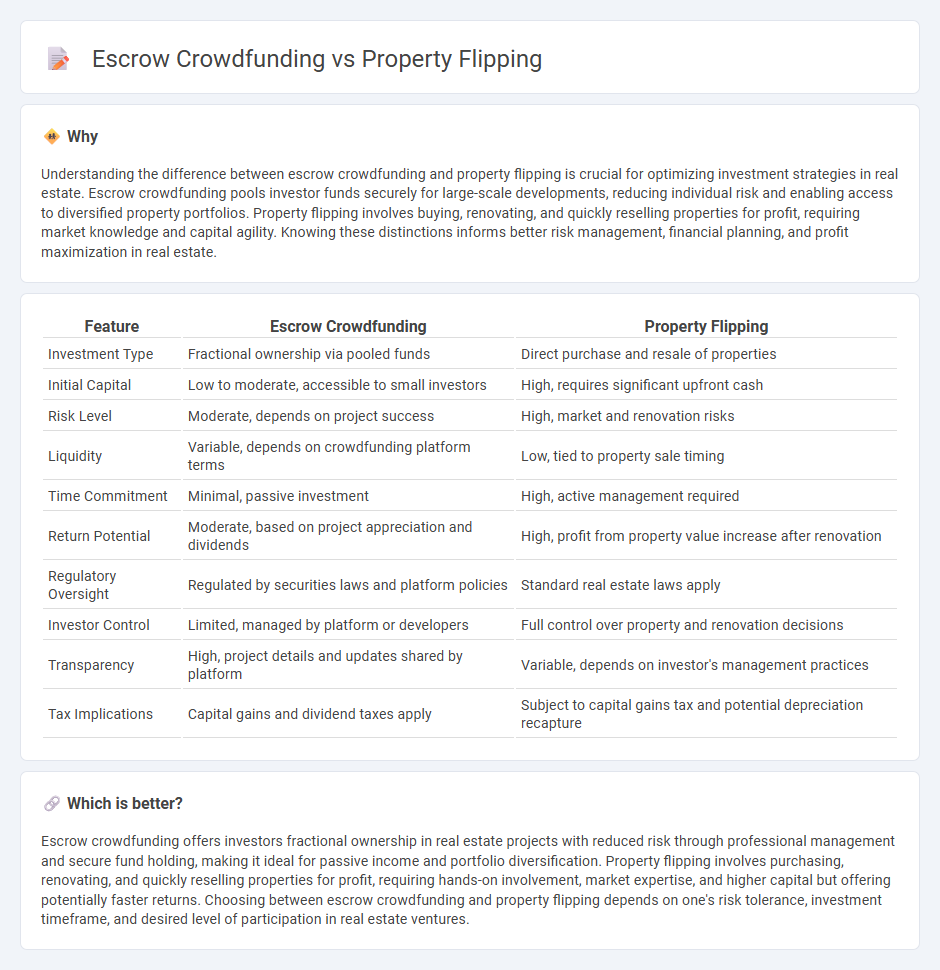

Understanding the difference between escrow crowdfunding and property flipping is crucial for optimizing investment strategies in real estate. Escrow crowdfunding pools investor funds securely for large-scale developments, reducing individual risk and enabling access to diversified property portfolios. Property flipping involves buying, renovating, and quickly reselling properties for profit, requiring market knowledge and capital agility. Knowing these distinctions informs better risk management, financial planning, and profit maximization in real estate.

Comparison Table

| Feature | Escrow Crowdfunding | Property Flipping |

|---|---|---|

| Investment Type | Fractional ownership via pooled funds | Direct purchase and resale of properties |

| Initial Capital | Low to moderate, accessible to small investors | High, requires significant upfront cash |

| Risk Level | Moderate, depends on project success | High, market and renovation risks |

| Liquidity | Variable, depends on crowdfunding platform terms | Low, tied to property sale timing |

| Time Commitment | Minimal, passive investment | High, active management required |

| Return Potential | Moderate, based on project appreciation and dividends | High, profit from property value increase after renovation |

| Regulatory Oversight | Regulated by securities laws and platform policies | Standard real estate laws apply |

| Investor Control | Limited, managed by platform or developers | Full control over property and renovation decisions |

| Transparency | High, project details and updates shared by platform | Variable, depends on investor's management practices |

| Tax Implications | Capital gains and dividend taxes apply | Subject to capital gains tax and potential depreciation recapture |

Which is better?

Escrow crowdfunding offers investors fractional ownership in real estate projects with reduced risk through professional management and secure fund holding, making it ideal for passive income and portfolio diversification. Property flipping involves purchasing, renovating, and quickly reselling properties for profit, requiring hands-on involvement, market expertise, and higher capital but offering potentially faster returns. Choosing between escrow crowdfunding and property flipping depends on one's risk tolerance, investment timeframe, and desired level of participation in real estate ventures.

Connection

Escrow crowdfunding facilitates property flipping by securely pooling investor funds, ensuring transparent transactions and reducing financial risks. This method enables multiple investors to participate in short-term real estate projects, accelerating property acquisition and renovation processes. Efficient escrow management enhances trust and liquidity, making property flipping more accessible and scalable in the real estate market.

Key Terms

**Property Flipping:**

Property flipping involves purchasing real estate at a lower price, renovating it, and selling it quickly for a profit, leveraging market trends and property valuation techniques. This strategy requires substantial capital, deep knowledge of renovation costs, and market timing to maximize returns while minimizing risks. Explore more about the financial strategies and market analysis involved in successful property flipping.

After Repair Value (ARV)

After Repair Value (ARV) serves as a critical metric in property flipping, guiding investors to estimate a renovated property's market worth and potential profit margin. In escrow crowdfunding, ARV helps gauge the feasibility and expected return on investment by aggregating funds for property improvement projects. Explore how leveraging ARV differences can maximize gains in these two investment approaches.

Holding Costs

Property flipping involves purchasing, renovating, and quickly selling properties, often incurring significant holding costs such as mortgage payments, property taxes, insurance, and utilities during the holding period. Escrow crowdfunding minimizes holding costs by pooling investor funds directly into an escrow account, reducing the need for extended property ownership and associated expenses. Explore how these models compare in financial efficiency and risk management.

dowidth.com

dowidth.com