Escrow crowdfunding and mortgage-backed securities are distinct investment methods within real estate finance, each offering unique risk profiles and liquidity features. Escrow crowdfunding involves pooling funds from multiple investors to finance property deals, providing direct ownership stakes and greater control over the investment. Explore further to understand how these options compare in returns, risks, and market accessibility.

Why it is important

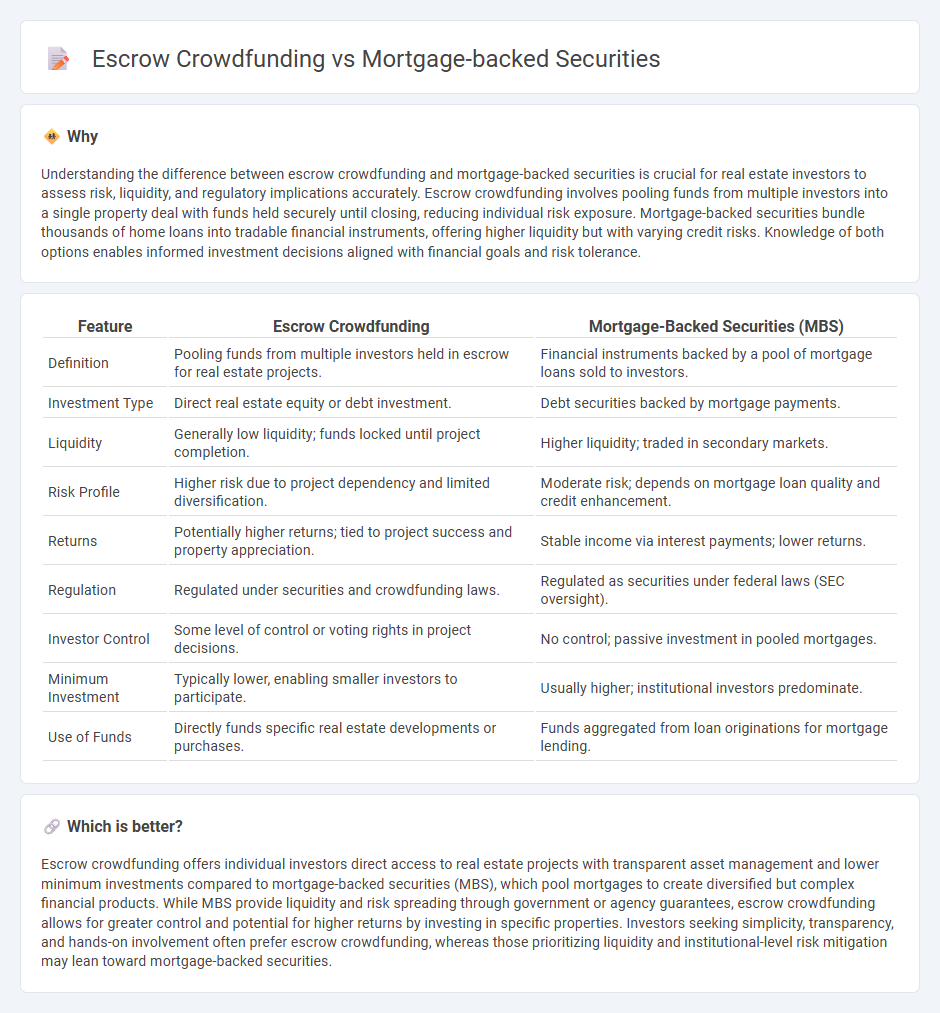

Understanding the difference between escrow crowdfunding and mortgage-backed securities is crucial for real estate investors to assess risk, liquidity, and regulatory implications accurately. Escrow crowdfunding involves pooling funds from multiple investors into a single property deal with funds held securely until closing, reducing individual risk exposure. Mortgage-backed securities bundle thousands of home loans into tradable financial instruments, offering higher liquidity but with varying credit risks. Knowledge of both options enables informed investment decisions aligned with financial goals and risk tolerance.

Comparison Table

| Feature | Escrow Crowdfunding | Mortgage-Backed Securities (MBS) |

|---|---|---|

| Definition | Pooling funds from multiple investors held in escrow for real estate projects. | Financial instruments backed by a pool of mortgage loans sold to investors. |

| Investment Type | Direct real estate equity or debt investment. | Debt securities backed by mortgage payments. |

| Liquidity | Generally low liquidity; funds locked until project completion. | Higher liquidity; traded in secondary markets. |

| Risk Profile | Higher risk due to project dependency and limited diversification. | Moderate risk; depends on mortgage loan quality and credit enhancement. |

| Returns | Potentially higher returns; tied to project success and property appreciation. | Stable income via interest payments; lower returns. |

| Regulation | Regulated under securities and crowdfunding laws. | Regulated as securities under federal laws (SEC oversight). |

| Investor Control | Some level of control or voting rights in project decisions. | No control; passive investment in pooled mortgages. |

| Minimum Investment | Typically lower, enabling smaller investors to participate. | Usually higher; institutional investors predominate. |

| Use of Funds | Directly funds specific real estate developments or purchases. | Funds aggregated from loan originations for mortgage lending. |

Which is better?

Escrow crowdfunding offers individual investors direct access to real estate projects with transparent asset management and lower minimum investments compared to mortgage-backed securities (MBS), which pool mortgages to create diversified but complex financial products. While MBS provide liquidity and risk spreading through government or agency guarantees, escrow crowdfunding allows for greater control and potential for higher returns by investing in specific properties. Investors seeking simplicity, transparency, and hands-on involvement often prefer escrow crowdfunding, whereas those prioritizing liquidity and institutional-level risk mitigation may lean toward mortgage-backed securities.

Connection

Escrow accounts in real estate transactions ensure secure handling of funds until closing, protecting both buyers and sellers. Crowdfunding platforms pool investor capital to finance real estate projects, often using escrow services to manage contributions transparently. Mortgage-backed securities bundle home loans into investment products, indirectly linked to crowdfunding through shared reliance on escrow mechanisms for safeguarding funds and ensuring contractual compliance.

Key Terms

Securitization

Mortgage-backed securities (MBS) involve pooling home loans into tradable financial instruments, allowing investors to receive payments derived from mortgage principal and interest, exemplifying traditional securitization. Escrow crowdfunding, by contrast, leverages a collective investment model where funds are held in escrow until a project meets predefined criteria, lacking the structured issuance and liquidity of MBS securitization. Explore the nuances of how securitization transforms asset liquidity and investor access in diverse funding models.

Escrow Account

Mortgage-backed securities (MBS) pool home loans to create investment products, whereas escrow crowdfunding involves holding funds in an escrow account until project milestones are met, ensuring security and accountability for contributors. An escrow account facilitates transparent management of collected funds by a neutral third party, reducing risk for investors or lenders in crowdfunding. Explore how escrow accounts optimize trust and financial control in crowdfunding projects to better understand their impact.

Crowdfunding Platform

Crowdfunding platforms facilitating mortgage-backed securities (MBS) offer investors access to pooled mortgage loans, providing diversification and potential steady income through interest payments. Escrow crowdfunding platforms, on the other hand, hold funds in escrow accounts until project milestones or funding goals are met, ensuring higher security and trust between investors and borrowers. Explore how leading crowdfunding platforms implement these models to optimize investment safety and returns.

Source and External Links

Mortgage-Backed Securities and Collateralized Mortgage Obligations - This webpage explains how mortgage-backed securities represent claims to cash flows from pools of mortgage loans, often issued by government agencies like Ginnie Mae or government-sponsored enterprises like Fannie Mae and Freddie Mac.

Mortgage-Backed Securities: A Guide - This guide provides an overview of mortgage-backed securities as investments in collections of home mortgages, discussing their appeal to investors and the associated risks and benefits.

Understanding Mortgage-Backed Securities Investing - This article describes the basics of mortgage-backed securities, including how they are backed by pools of mortgages, and discusses the risks such as prepayment and extension risks that investors should consider.

dowidth.com

dowidth.com