Lease-to-own models allow buyers to rent a property with the option to purchase it later, often benefiting those with limited credit or savings. Seller financing involves the property owner providing a loan to the buyer, bypassing traditional lenders and potentially offering more flexible terms. Explore the advantages and considerations of each option to determine the best path to homeownership.

Why it is important

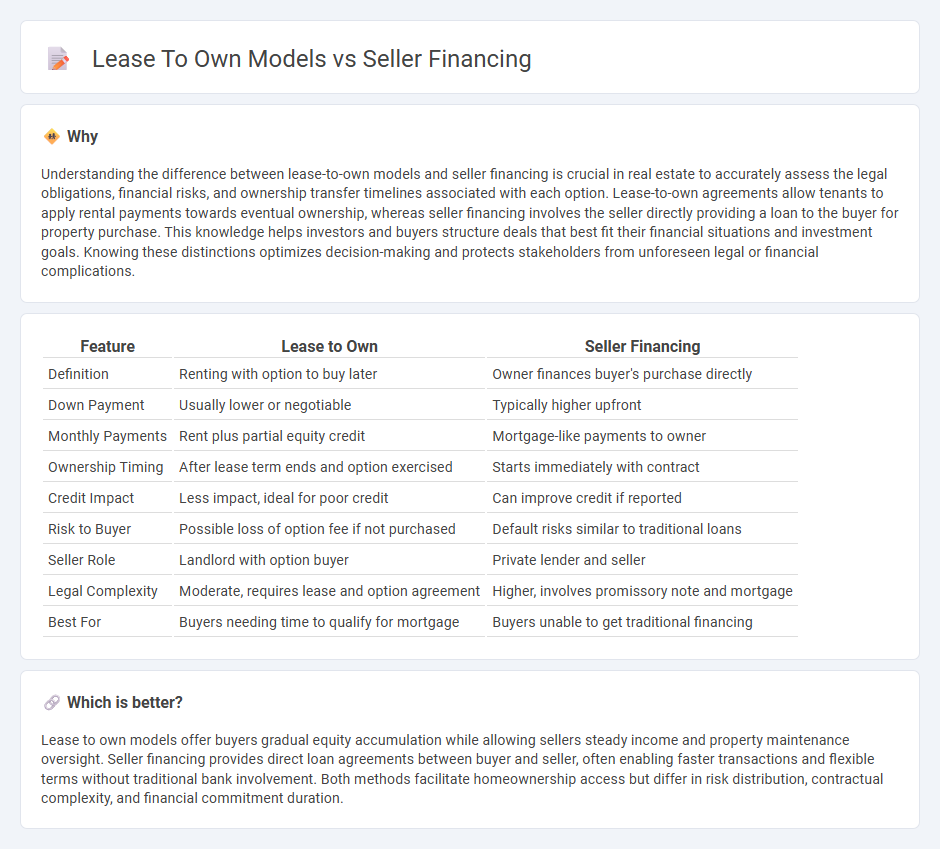

Understanding the difference between lease-to-own models and seller financing is crucial in real estate to accurately assess the legal obligations, financial risks, and ownership transfer timelines associated with each option. Lease-to-own agreements allow tenants to apply rental payments towards eventual ownership, whereas seller financing involves the seller directly providing a loan to the buyer for property purchase. This knowledge helps investors and buyers structure deals that best fit their financial situations and investment goals. Knowing these distinctions optimizes decision-making and protects stakeholders from unforeseen legal or financial complications.

Comparison Table

| Feature | Lease to Own | Seller Financing |

|---|---|---|

| Definition | Renting with option to buy later | Owner finances buyer's purchase directly |

| Down Payment | Usually lower or negotiable | Typically higher upfront |

| Monthly Payments | Rent plus partial equity credit | Mortgage-like payments to owner |

| Ownership Timing | After lease term ends and option exercised | Starts immediately with contract |

| Credit Impact | Less impact, ideal for poor credit | Can improve credit if reported |

| Risk to Buyer | Possible loss of option fee if not purchased | Default risks similar to traditional loans |

| Seller Role | Landlord with option buyer | Private lender and seller |

| Legal Complexity | Moderate, requires lease and option agreement | Higher, involves promissory note and mortgage |

| Best For | Buyers needing time to qualify for mortgage | Buyers unable to get traditional financing |

Which is better?

Lease to own models offer buyers gradual equity accumulation while allowing sellers steady income and property maintenance oversight. Seller financing provides direct loan agreements between buyer and seller, often enabling faster transactions and flexible terms without traditional bank involvement. Both methods facilitate homeownership access but differ in risk distribution, contractual complexity, and financial commitment duration.

Connection

Lease-to-own models and seller financing are interconnected through their shared goal of providing alternative pathways to homeownership, especially for buyers who face challenges qualifying for traditional mortgages. Both methods enable buyers to build equity over time while making payments directly to the seller, with lease-to-own agreements typically involving an option to purchase at a set price and seller financing involving the seller acting as the lender. This connection allows sellers to expand their market by attracting buyers with flexible financing terms and fosters smoother transactions in real estate markets with stringent credit requirements.

Key Terms

Promissory Note

Seller financing often involves a Promissory Note outlining the buyer's promise to repay the loan under agreed terms, providing clear legal protection and formal debt acknowledgment. Lease-to-own models may use a Promissory Note to document future purchase obligations but generally emphasize rental agreements with purchase options, offering flexibility with less immediate debt responsibility. Explore the key differences in Promissory Note usage to choose the right path for your real estate transaction.

Option to Purchase

Seller financing provides buyers a loan from the seller to purchase the property directly, while lease to own models allow tenants to rent with an option to purchase later. The option to purchase in lease to own agreements secures the right, but not the obligation, to buy the property at a predetermined price after the lease term. Explore the differences and benefits of each approach to determine the best fit for your real estate goals.

Purchase Price

Seller financing often allows buyers to negotiate a purchase price closer to the market value since the seller extends credit directly, reducing reliance on traditional lenders. Lease-to-own models typically set the purchase price upfront, which can be higher than current market rates to account for rent credits and option premiums. Explore detailed comparisons to understand which model better suits your financial strategy.

Source and External Links

M&A Seller Financing: A Complete Guide - Seller financing involves the seller receiving a down payment and then periodic payments from the buyer until the balance is paid in full, often with terms ranging 3-7 years and down payments typically 50% for small businesses.

Seller financing: Definition and how it's used in real estate - Seller financing is a private agreement where the seller extends a loan to the buyer directly, with common types including holding mortgages, land contracts, lease-options, and hybrid arrangements involving some bank financing.

How does seller financing work? - Seller financing allows buyers to pay the seller directly over time instead of using a bank loan, with agreements like land contracts and assumable mortgages, but buyers should watch for terms like balloon payments and potentially higher interest rates.

dowidth.com

dowidth.com