House hacking involves purchasing a residential property to live in while renting out parts of it to cover mortgage costs, maximizing personal cash flow and lowering living expenses. Commercial real estate focuses on properties used for business purposes, such as office buildings or retail spaces, often requiring larger investments but offering higher income potential and longer lease terms. Explore the advantages and challenges of house hacking versus commercial real estate to determine the best investment strategy for your goals.

Why it is important

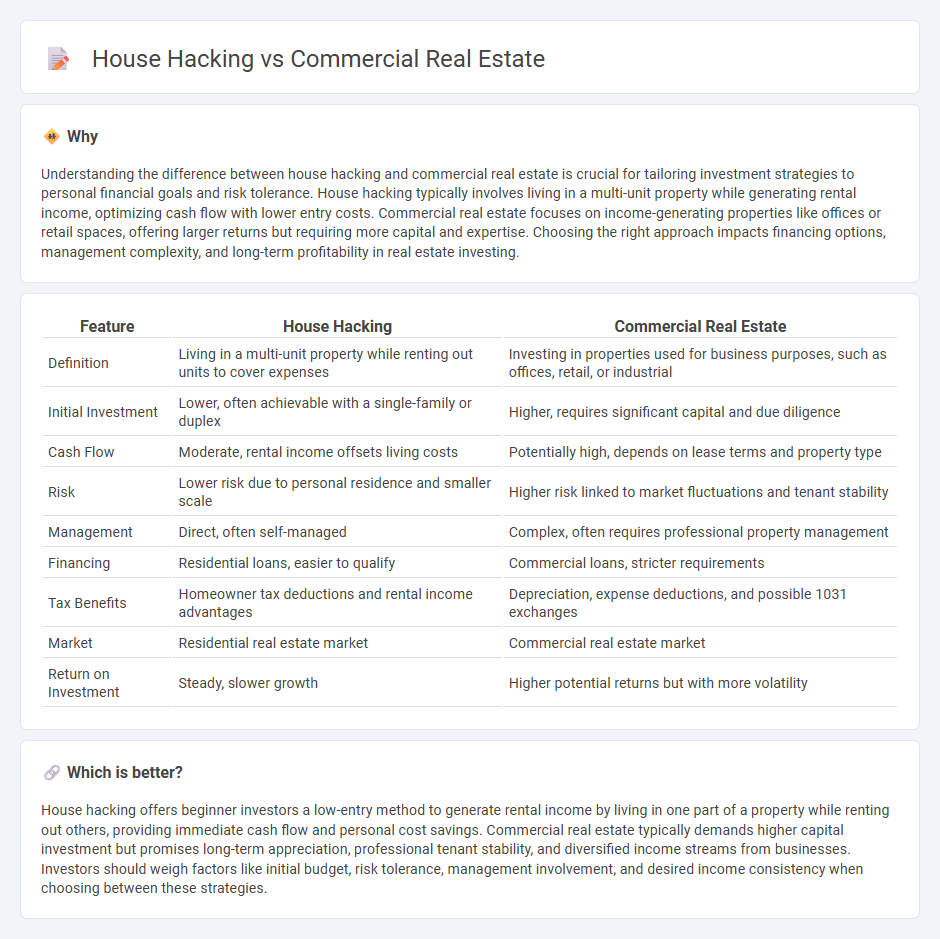

Understanding the difference between house hacking and commercial real estate is crucial for tailoring investment strategies to personal financial goals and risk tolerance. House hacking typically involves living in a multi-unit property while generating rental income, optimizing cash flow with lower entry costs. Commercial real estate focuses on income-generating properties like offices or retail spaces, offering larger returns but requiring more capital and expertise. Choosing the right approach impacts financing options, management complexity, and long-term profitability in real estate investing.

Comparison Table

| Feature | House Hacking | Commercial Real Estate |

|---|---|---|

| Definition | Living in a multi-unit property while renting out units to cover expenses | Investing in properties used for business purposes, such as offices, retail, or industrial |

| Initial Investment | Lower, often achievable with a single-family or duplex | Higher, requires significant capital and due diligence |

| Cash Flow | Moderate, rental income offsets living costs | Potentially high, depends on lease terms and property type |

| Risk | Lower risk due to personal residence and smaller scale | Higher risk linked to market fluctuations and tenant stability |

| Management | Direct, often self-managed | Complex, often requires professional property management |

| Financing | Residential loans, easier to qualify | Commercial loans, stricter requirements |

| Tax Benefits | Homeowner tax deductions and rental income advantages | Depreciation, expense deductions, and possible 1031 exchanges |

| Market | Residential real estate market | Commercial real estate market |

| Return on Investment | Steady, slower growth | Higher potential returns but with more volatility |

Which is better?

House hacking offers beginner investors a low-entry method to generate rental income by living in one part of a property while renting out others, providing immediate cash flow and personal cost savings. Commercial real estate typically demands higher capital investment but promises long-term appreciation, professional tenant stability, and diversified income streams from businesses. Investors should weigh factors like initial budget, risk tolerance, management involvement, and desired income consistency when choosing between these strategies.

Connection

House hacking leverages residential properties to generate rental income, providing cash flow strategies that mirror commercial real estate investment tactics. Both approaches focus on maximizing property value through income generation and efficient space utilization. Investors often transition from house hacking to commercial real estate to scale their portfolios and diversify revenue streams.

Key Terms

Commercial real estate:

Commercial real estate offers significant income potential through rental yields and long-term property appreciation, often involving office buildings, retail spaces, and industrial properties. Investors benefit from diversified tenant bases and professional lease agreements that enhance cash flow stability and reduce vacancy risks. Explore how commercial real estate can transform your investment strategy and generate sustained wealth.

Net Operating Income (NOI)

Commercial real estate typically generates higher Net Operating Income (NOI) due to multiple tenant streams and longer lease terms, enhancing cash flow stability. House hacking offers lower NOI but provides value through reduced personal living expenses and potential appreciation in residential markets. Explore detailed strategies to maximize NOI in both investment approaches.

Cap Rate (Capitalization Rate)

Commercial real estate typically offers higher cap rates, ranging from 6% to 12%, compared to residential properties involved in house hacking, which usually present cap rates between 3% and 6%. Cap rate, calculated by dividing net operating income by property value, serves as a key metric to evaluate the potential return on investment in both strategies. Explore in-depth analyses to determine which approach aligns best with your financial goals and risk tolerance.

Source and External Links

LoopNet: #1 in Commercial Real Estate for Sale & Lease - LoopNet is a leading global marketplace offering listings for commercial properties including offices, retail, and multifamily units, providing tools and insights for buyers and investors.

Commercial Real Estate Listings - Provides detailed listings of commercial properties in North Carolina, including office buildings, retail sites, industrial spaces, with features like zoning information and amenities.

Greensboro, NC Commercial Real Estate for Lease and Sale - Offers a searchable database of nearly 300 commercial real estate properties for lease and purchase in Greensboro, encompassing office, retail, and industrial spaces.

dowidth.com

dowidth.com