Smart contract leasing automates rental agreements using blockchain technology, ensuring secure, transparent, and tamper-proof transactions between landlords and tenants. Tokenized property ownership divides real estate assets into digital tokens, enabling fractional ownership, increased liquidity, and easier access to investment opportunities. Explore how these innovative blockchain applications are transforming traditional real estate models.

Why it is important

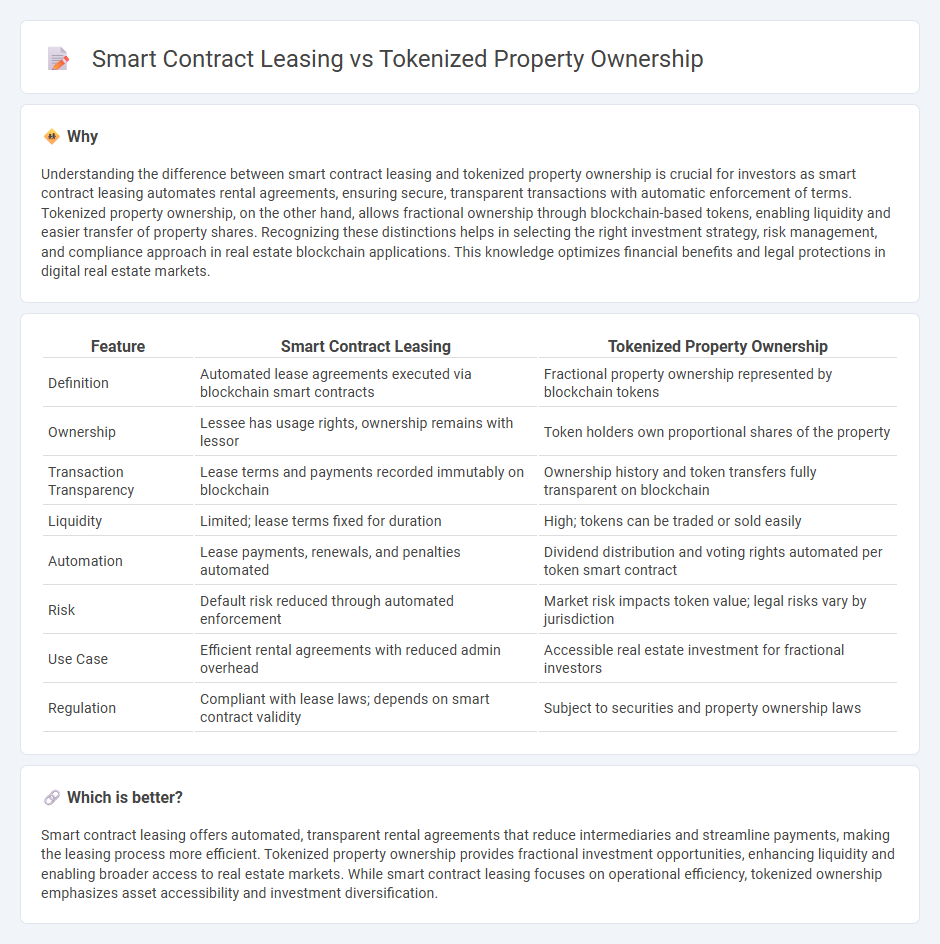

Understanding the difference between smart contract leasing and tokenized property ownership is crucial for investors as smart contract leasing automates rental agreements, ensuring secure, transparent transactions with automatic enforcement of terms. Tokenized property ownership, on the other hand, allows fractional ownership through blockchain-based tokens, enabling liquidity and easier transfer of property shares. Recognizing these distinctions helps in selecting the right investment strategy, risk management, and compliance approach in real estate blockchain applications. This knowledge optimizes financial benefits and legal protections in digital real estate markets.

Comparison Table

| Feature | Smart Contract Leasing | Tokenized Property Ownership |

|---|---|---|

| Definition | Automated lease agreements executed via blockchain smart contracts | Fractional property ownership represented by blockchain tokens |

| Ownership | Lessee has usage rights, ownership remains with lessor | Token holders own proportional shares of the property |

| Transaction Transparency | Lease terms and payments recorded immutably on blockchain | Ownership history and token transfers fully transparent on blockchain |

| Liquidity | Limited; lease terms fixed for duration | High; tokens can be traded or sold easily |

| Automation | Lease payments, renewals, and penalties automated | Dividend distribution and voting rights automated per token smart contract |

| Risk | Default risk reduced through automated enforcement | Market risk impacts token value; legal risks vary by jurisdiction |

| Use Case | Efficient rental agreements with reduced admin overhead | Accessible real estate investment for fractional investors |

| Regulation | Compliant with lease laws; depends on smart contract validity | Subject to securities and property ownership laws |

Which is better?

Smart contract leasing offers automated, transparent rental agreements that reduce intermediaries and streamline payments, making the leasing process more efficient. Tokenized property ownership provides fractional investment opportunities, enhancing liquidity and enabling broader access to real estate markets. While smart contract leasing focuses on operational efficiency, tokenized ownership emphasizes asset accessibility and investment diversification.

Connection

Smart contract leasing automates rental agreements by using blockchain technology to execute terms and payments securely without intermediaries. Tokenized property ownership divides real estate assets into digital tokens, enabling fractional ownership and easier transferability on blockchain platforms. Together, they enhance transparency, reduce transaction costs, and increase liquidity in real estate markets.

Key Terms

Fractional Ownership

Tokenized property ownership enables multiple investors to hold fractional shares of real estate assets, enhancing liquidity and accessibility without transferring entire titles. Smart contract leasing automates rental agreements and payments but typically involves managing lease rights rather than dividing ownership stakes. Explore how fractional ownership transforms property investment by blending blockchain technology with traditional real estate markets.

Automated Lease Execution

Tokenized property ownership enables fractionalized real estate investments through blockchain, enhancing liquidity and provenance transparency. Smart contract leasing automates lease execution by embedding rental terms directly into code, ensuring secure, real-time enforcement of payments and conditions without intermediaries. Explore how automated lease execution revolutionizes property management for modern investors and tenants.

Digital Asset Tokenization

Tokenized property ownership enables fractional investment by converting real estate assets into tradeable digital tokens on blockchain platforms, enhancing liquidity and transparency. Smart contract leasing automates rental agreements, ensuring secure, tamper-proof transactions and real-time enforcement without intermediaries. Explore how digital asset tokenization revolutionizes property management and investment for deeper insights.

Source and External Links

Real Estate Tokenization: Transforming Property Investment - This process involves converting real estate into digital tokens, allowing for fractional ownership and direct income rights linked to specific properties.

Real Estate Tokenization: Unlocking the Future of Property Investment - Tokenization enables fractional ownership of properties by dividing them into digital tokens, which can be traded on blockchain platforms.

Real Estate Tokenization: A New Era for Property Investment - Tokenization provides increased accessibility and liquidity to real estate investments by allowing fractional ownership through digital tokens.

dowidth.com

dowidth.com