Institutional landlords own and manage large portfolios of rental properties, often focusing on maximizing returns through professional property management and standardized leasing agreements. Housing cooperatives are collectively owned and governed by residents who share decision-making responsibilities and prioritize community control and affordability. Explore the key differences to understand which housing model aligns best with your investment or living preferences.

Why it is important

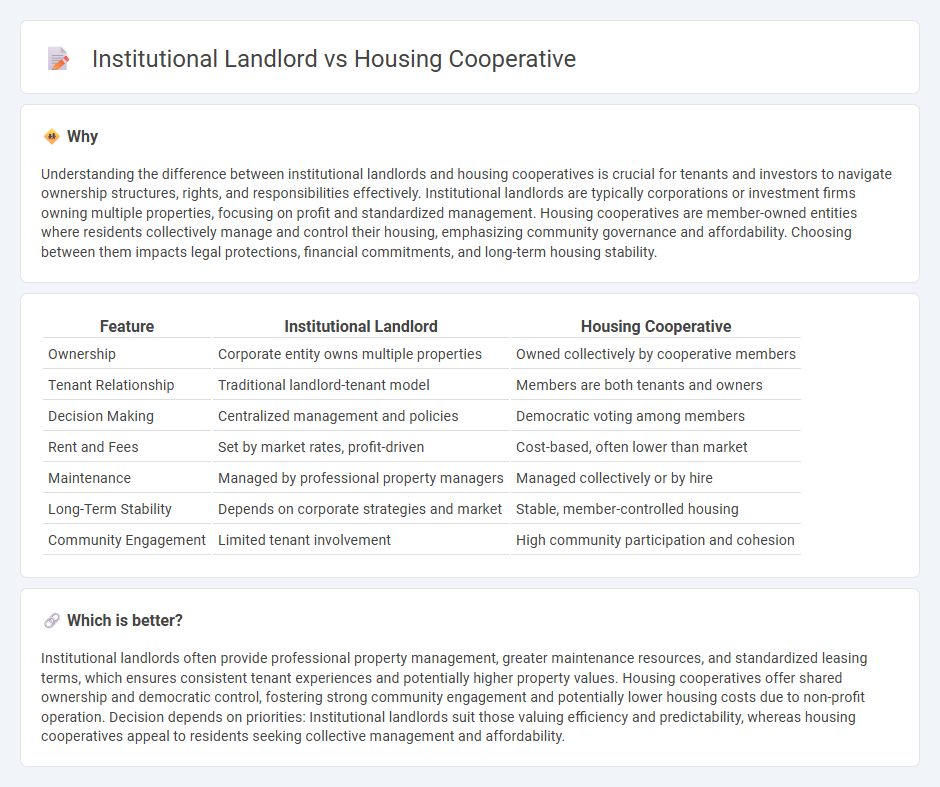

Understanding the difference between institutional landlords and housing cooperatives is crucial for tenants and investors to navigate ownership structures, rights, and responsibilities effectively. Institutional landlords are typically corporations or investment firms owning multiple properties, focusing on profit and standardized management. Housing cooperatives are member-owned entities where residents collectively manage and control their housing, emphasizing community governance and affordability. Choosing between them impacts legal protections, financial commitments, and long-term housing stability.

Comparison Table

| Feature | Institutional Landlord | Housing Cooperative |

|---|---|---|

| Ownership | Corporate entity owns multiple properties | Owned collectively by cooperative members |

| Tenant Relationship | Traditional landlord-tenant model | Members are both tenants and owners |

| Decision Making | Centralized management and policies | Democratic voting among members |

| Rent and Fees | Set by market rates, profit-driven | Cost-based, often lower than market |

| Maintenance | Managed by professional property managers | Managed collectively or by hire |

| Long-Term Stability | Depends on corporate strategies and market | Stable, member-controlled housing |

| Community Engagement | Limited tenant involvement | High community participation and cohesion |

Which is better?

Institutional landlords often provide professional property management, greater maintenance resources, and standardized leasing terms, which ensures consistent tenant experiences and potentially higher property values. Housing cooperatives offer shared ownership and democratic control, fostering strong community engagement and potentially lower housing costs due to non-profit operation. Decision depends on priorities: Institutional landlords suit those valuing efficiency and predictability, whereas housing cooperatives appeal to residents seeking collective management and affordability.

Connection

Institutional landlords often collaborate with housing cooperatives to provide affordable, well-managed rental housing options, leveraging cooperative models to enhance tenant engagement and community stability. Housing cooperatives benefit from institutional landlord investments that supply capital and professional property management expertise, facilitating long-term sustainability. This partnership supports diversified real estate portfolios while promoting inclusive housing solutions in urban development.

Key Terms

Ownership Structure

Housing cooperatives are owned and managed collectively by residents who hold shares, giving them direct influence over decision-making and property management. Institutional landlords, typically corporations or investment firms, own rental properties and operate them primarily for profit, without resident ownership or control. Explore further to understand how ownership models impact tenant experience and property governance.

Governance

Housing cooperatives operate under democratic governance where members have equal voting rights, ensuring collective decision-making and accountability. Institutional landlords are typically governed by corporate boards or management teams focused on financial returns with limited tenant input in policies. Explore the differences in governance models to understand their impact on tenant engagement and property management.

Profit Distribution

Housing cooperatives prioritize member benefits by distributing profits through reduced rents or reinvestments into community services, contrasting with institutional landlords who focus on maximizing shareholder returns by allocating profits as dividends or reinvestments aimed at increasing property values. Cooperative profit distribution typically supports affordability and member control, while institutional landlords target financial growth and investor payouts. Explore how these different profit strategies impact housing affordability and community stability for deeper insights.

Source and External Links

Housing cooperative - Wikipedia - A housing cooperative is a legal entity owning residential buildings where members buy shares to gain occupancy rights, pooling resources to lower costs and collectively managing membership and community rules.

Housing Co-ops - Cooperatives for a Better World - Housing co-ops empower residents with shared ownership and democratic control, operating on an at-cost basis to create more affordable and financially stable living communities.

Housing Co-ops - NCBA CLUSA - Housing co-ops are member-operated organizations offering affordable, collectively owned housing with shared decision-making, costs, and responsibility among residents.

dowidth.com

dowidth.com