Micro flipping focuses on quickly purchasing, renovating, and reselling residential properties for short-term profits, appealing to investors seeking fast returns with lower capital requirements. Commercial real estate investing involves acquiring office buildings, retail centers, or industrial properties, offering long-term income through leases and asset appreciation. Explore the key differences and advantages of micro flipping versus commercial real estate investing to determine which strategy aligns with your financial goals.

Why it is important

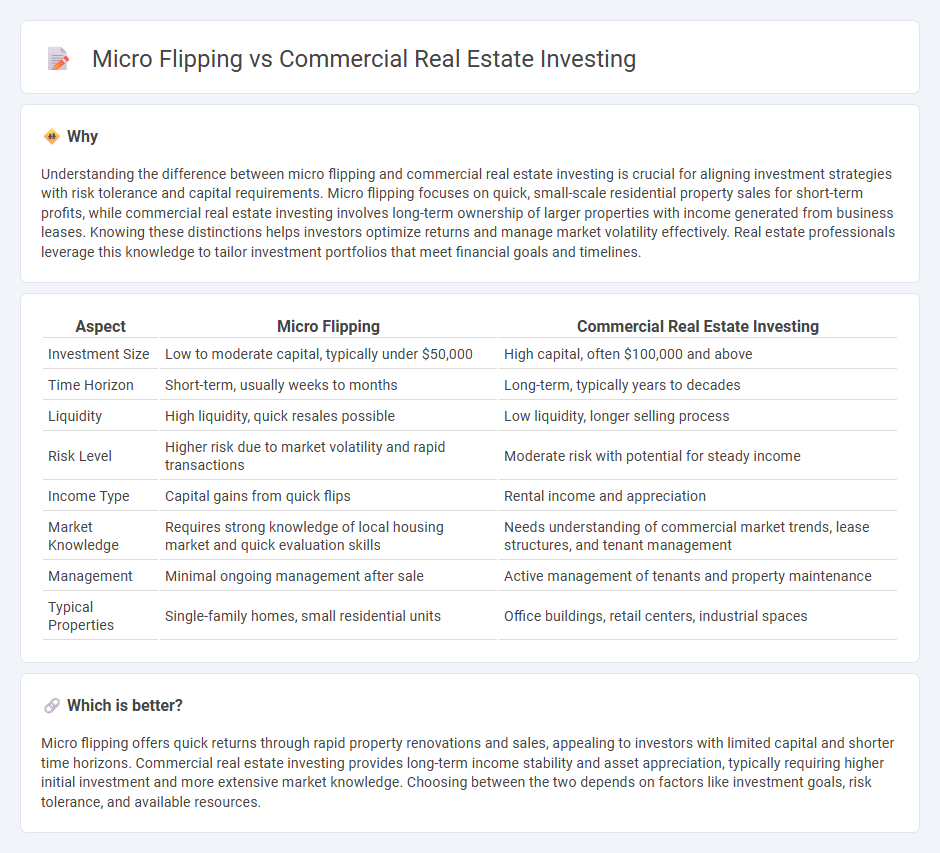

Understanding the difference between micro flipping and commercial real estate investing is crucial for aligning investment strategies with risk tolerance and capital requirements. Micro flipping focuses on quick, small-scale residential property sales for short-term profits, while commercial real estate investing involves long-term ownership of larger properties with income generated from business leases. Knowing these distinctions helps investors optimize returns and manage market volatility effectively. Real estate professionals leverage this knowledge to tailor investment portfolios that meet financial goals and timelines.

Comparison Table

| Aspect | Micro Flipping | Commercial Real Estate Investing |

|---|---|---|

| Investment Size | Low to moderate capital, typically under $50,000 | High capital, often $100,000 and above |

| Time Horizon | Short-term, usually weeks to months | Long-term, typically years to decades |

| Liquidity | High liquidity, quick resales possible | Low liquidity, longer selling process |

| Risk Level | Higher risk due to market volatility and rapid transactions | Moderate risk with potential for steady income |

| Income Type | Capital gains from quick flips | Rental income and appreciation |

| Market Knowledge | Requires strong knowledge of local housing market and quick evaluation skills | Needs understanding of commercial market trends, lease structures, and tenant management |

| Management | Minimal ongoing management after sale | Active management of tenants and property maintenance |

| Typical Properties | Single-family homes, small residential units | Office buildings, retail centers, industrial spaces |

Which is better?

Micro flipping offers quick returns through rapid property renovations and sales, appealing to investors with limited capital and shorter time horizons. Commercial real estate investing provides long-term income stability and asset appreciation, typically requiring higher initial investment and more extensive market knowledge. Choosing between the two depends on factors like investment goals, risk tolerance, and available resources.

Connection

Micro flipping involves quickly buying and reselling residential properties for small profits, often capitalizing on market inefficiencies, while commercial real estate investing focuses on acquiring income-generating assets like office buildings or retail spaces. Both strategies require strong market analysis skills, understanding property valuation, and identifying growth opportunities within specific real estate sectors. Investors often use micro flipping insights to recognize emerging trends that can inform commercial property acquisitions and portfolio diversification.

Key Terms

Cash Flow

Commercial real estate investing offers consistent cash flow through rental income from office buildings, retail spaces, and industrial properties, often providing long-term financial stability. Micro flipping involves purchasing residential properties below market value, making minor improvements, and quickly reselling them for an immediate profit, generating rapid but less predictable cash flow. Explore the advantages and cash flow potentials of both strategies to determine which aligns with your investment goals.

Holding Period

Commercial real estate investing typically involves a longer holding period, often ranging from several years to decades, allowing for asset appreciation and stable rental income. Micro flipping in real estate focuses on short-term holds, sometimes just weeks or months, aiming for quick profit through minor property improvements and rapid resale. Explore more to understand how holding periods impact your investment strategies and returns.

Transaction Volume

Commercial real estate investing typically involves fewer, high-value transactions often exceeding millions of dollars, while micro-flipping centers on numerous smaller deals that can range from a few thousand to tens of thousands of dollars each. The higher transaction volume in micro-flipping allows for quicker turnover and more frequent cash flows compared to the long-term, capital-intensive nature of commercial real estate investing. Discover how transaction volume impacts investment strategy and profitability in each market segment.

Source and External Links

Commercial Real Estate Investment Strategies - J.P. Morgan - Commercial real estate investing involves strategies like core, core-plus, value-add, and opportunistic investments, balancing risk and return to generate both stable income and capital appreciation.

Buying commercial property for beginners: How to start - Common tactics in commercial real estate investing include land banking, development, fix and flip, wholesaling, BRRRR (Buy, Rehab, Rent, Refinance, Repeat), and passive investing through stock market or crowdfunding.

The Beginner's Guide To Commercial Real Estate Investing - Investors choose direct ownership of commercial properties or indirect methods like REITs, syndications, and private equity to suit their control preferences, capital, and involvement levels in commercial real estate.

dowidth.com

dowidth.com