Real estate crowdfunding allows individual investors to directly fund specific property projects, offering potentially higher returns with increased risk and less liquidity. Real estate mutual funds provide diversification by pooling investor capital to buy shares in multiple properties or real estate companies, typically delivering more stability and professional management. Explore the differences between these investment types to find the best fit for your financial goals.

Why it is important

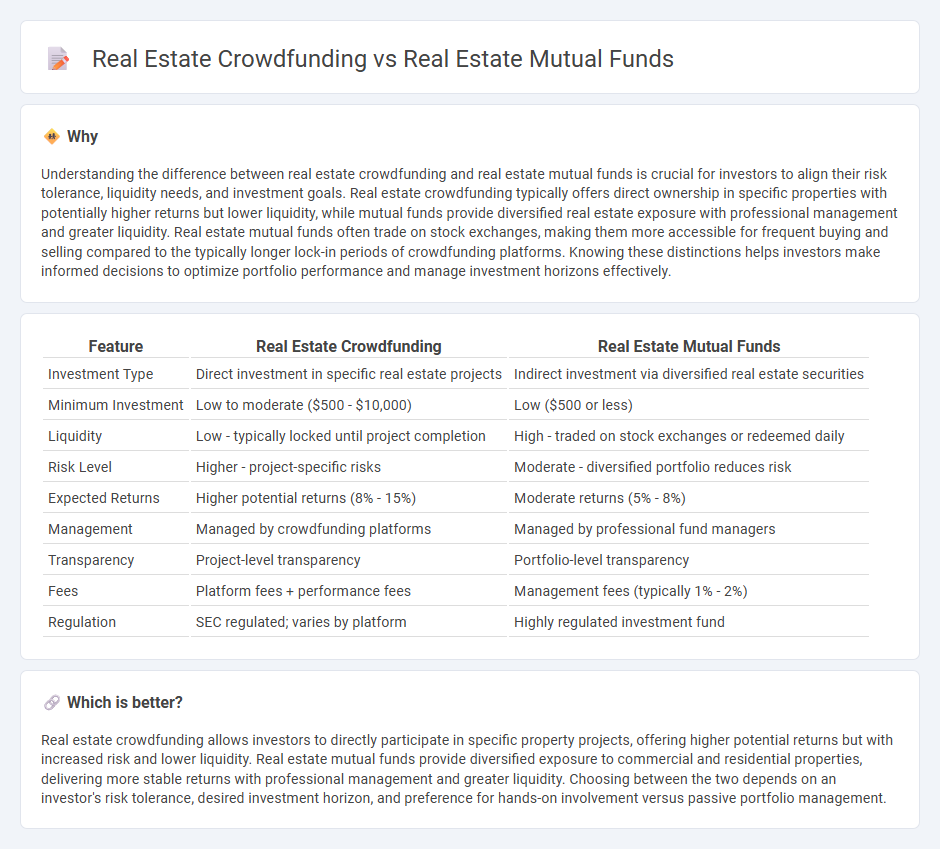

Understanding the difference between real estate crowdfunding and real estate mutual funds is crucial for investors to align their risk tolerance, liquidity needs, and investment goals. Real estate crowdfunding typically offers direct ownership in specific properties with potentially higher returns but lower liquidity, while mutual funds provide diversified real estate exposure with professional management and greater liquidity. Real estate mutual funds often trade on stock exchanges, making them more accessible for frequent buying and selling compared to the typically longer lock-in periods of crowdfunding platforms. Knowing these distinctions helps investors make informed decisions to optimize portfolio performance and manage investment horizons effectively.

Comparison Table

| Feature | Real Estate Crowdfunding | Real Estate Mutual Funds |

|---|---|---|

| Investment Type | Direct investment in specific real estate projects | Indirect investment via diversified real estate securities |

| Minimum Investment | Low to moderate ($500 - $10,000) | Low ($500 or less) |

| Liquidity | Low - typically locked until project completion | High - traded on stock exchanges or redeemed daily |

| Risk Level | Higher - project-specific risks | Moderate - diversified portfolio reduces risk |

| Expected Returns | Higher potential returns (8% - 15%) | Moderate returns (5% - 8%) |

| Management | Managed by crowdfunding platforms | Managed by professional fund managers |

| Transparency | Project-level transparency | Portfolio-level transparency |

| Fees | Platform fees + performance fees | Management fees (typically 1% - 2%) |

| Regulation | SEC regulated; varies by platform | Highly regulated investment fund |

Which is better?

Real estate crowdfunding allows investors to directly participate in specific property projects, offering higher potential returns but with increased risk and lower liquidity. Real estate mutual funds provide diversified exposure to commercial and residential properties, delivering more stable returns with professional management and greater liquidity. Choosing between the two depends on an investor's risk tolerance, desired investment horizon, and preference for hands-on involvement versus passive portfolio management.

Connection

Real estate crowdfunding and real estate mutual funds both provide investors access to property markets through pooled capital, enabling diversification and lower entry costs compared to direct real estate ownership. Crowdfunding platforms often focus on specific projects with potential for higher returns and risks, while mutual funds invest in a broad portfolio of real estate assets or real estate investment trusts (REITs) for more stable, long-term income. Both investment vehicles harness collective funding to democratize real estate investment opportunities beyond traditional, high-capital requirements.

Key Terms

Diversification

Real estate mutual funds offer diversified portfolios by pooling investments across various property types and geographic locations, reducing risk through professional management and broad asset allocation. In contrast, real estate crowdfunding platforms allow investors to target specific projects or niches, often resulting in more concentrated holdings but with potentially higher returns. Explore the benefits and limitations of each approach to optimize your real estate investment strategy.

Liquidity

Real estate mutual funds offer higher liquidity by allowing investors to buy and sell shares on the stock market with relative ease, often daily or weekly. Real estate crowdfunding typically involves locking funds into specific projects for months or years, resulting in limited liquidity until the project's completion or exit. Explore detailed comparisons of liquidity features to determine the best option for your investment goals.

Investment Minimums

Real estate mutual funds typically require low minimum investments, often starting at $1,000, making them accessible to a broad range of investors. Real estate crowdfunding platforms, however, may have higher minimums, commonly ranging from $5,000 to $25,000, reflecting their direct investment nature in specific properties. Explore the differences further to determine which option aligns best with your investment goals.

Source and External Links

Understanding REITs and Mutual Funds - Real estate mutual funds invest in a diverse mix of REITs and real estate companies and offer potential for medium- to long-term capital appreciation, distinguishing them from REITs which must distribute 90% of revenues as dividends and are considered more liquid with fewer tax implications.

List of REITs & Real Estate Funds - Mutual funds are a common way for investors to access the real estate asset class, providing diversified exposure and serving as portfolio diversifiers with competitive returns based on income and capital appreciation.

Real Estate - Fidelity Investments - Fidelity offers sector-specific mutual funds and ETFs focused on real estate, providing access to real estate investments with in-depth research, though sector investing may be more volatile due to real estate market fluctuations.

dowidth.com

dowidth.com