Single family rental portfolios offer investors diversification through individually owned homes, typically generating steady cash flow with moderate risk and appreciating property values. Affordable housing portfolios focus on providing subsidized or income-restricted living options, often supported by government programs designed to ensure housing stability for low-income families. Explore the key differences in investment strategies and social impact between these portfolio types to make informed decisions.

Why it is important

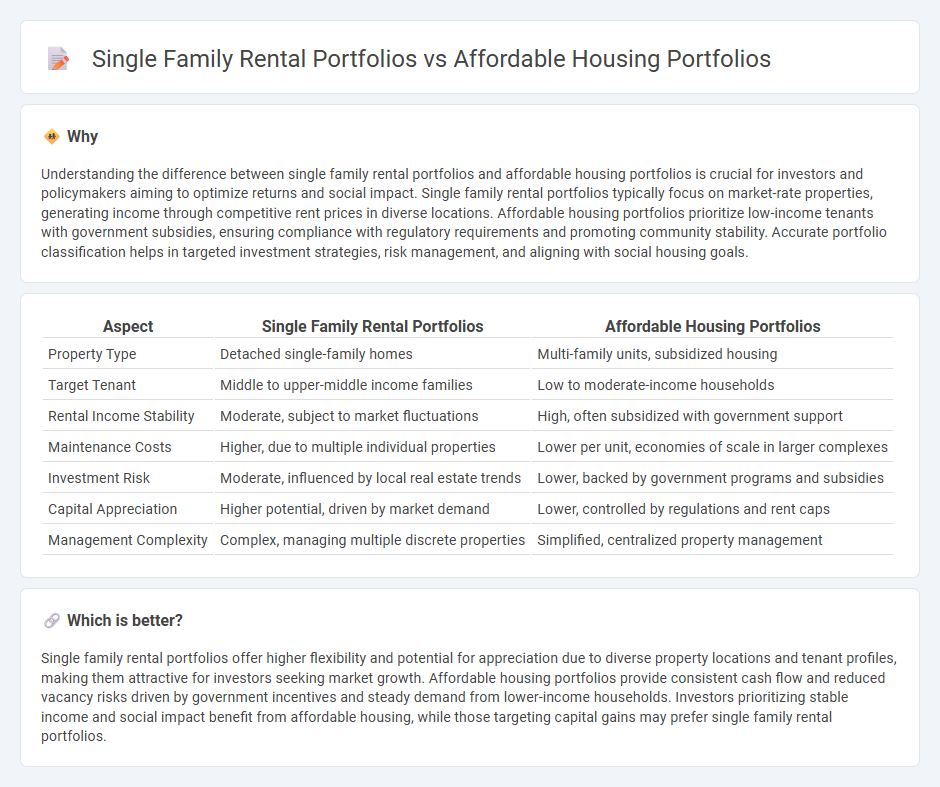

Understanding the difference between single family rental portfolios and affordable housing portfolios is crucial for investors and policymakers aiming to optimize returns and social impact. Single family rental portfolios typically focus on market-rate properties, generating income through competitive rent prices in diverse locations. Affordable housing portfolios prioritize low-income tenants with government subsidies, ensuring compliance with regulatory requirements and promoting community stability. Accurate portfolio classification helps in targeted investment strategies, risk management, and aligning with social housing goals.

Comparison Table

| Aspect | Single Family Rental Portfolios | Affordable Housing Portfolios |

|---|---|---|

| Property Type | Detached single-family homes | Multi-family units, subsidized housing |

| Target Tenant | Middle to upper-middle income families | Low to moderate-income households |

| Rental Income Stability | Moderate, subject to market fluctuations | High, often subsidized with government support |

| Maintenance Costs | Higher, due to multiple individual properties | Lower per unit, economies of scale in larger complexes |

| Investment Risk | Moderate, influenced by local real estate trends | Lower, backed by government programs and subsidies |

| Capital Appreciation | Higher potential, driven by market demand | Lower, controlled by regulations and rent caps |

| Management Complexity | Complex, managing multiple discrete properties | Simplified, centralized property management |

Which is better?

Single family rental portfolios offer higher flexibility and potential for appreciation due to diverse property locations and tenant profiles, making them attractive for investors seeking market growth. Affordable housing portfolios provide consistent cash flow and reduced vacancy risks driven by government incentives and steady demand from lower-income households. Investors prioritizing stable income and social impact benefit from affordable housing, while those targeting capital gains may prefer single family rental portfolios.

Connection

Single family rental portfolios and affordable housing portfolios are interconnected through their shared focus on providing accessible rental options in diverse markets. Both portfolio types leverage property management strategies and government incentives to meet housing demand while ensuring long-term investment stability. The integration of these portfolios supports community development by addressing shortages in affordable, quality rental housing.

Key Terms

Scalability

Affordable housing portfolios offer enhanced scalability through diversified asset management and access to larger funding pools, enabling investments in multiple properties simultaneously. Single family rental portfolios provide flexibility but often face limitations in rapid expansion due to higher individual transaction costs and market variability. Explore comprehensive strategies to scale your real estate investments effectively.

Tenant Demographics

Affordable housing portfolios primarily attract low- to moderate-income tenants, including families, seniors, and individuals with diverse socioeconomic backgrounds, seeking stable and budget-conscious living options. Single-family rental portfolios typically draw middle-income households desiring more space, privacy, and community amenities, often appealing to families with children and working professionals. Explore deeper insights on how tenant demographics influence investment strategies and portfolio performance.

Financing Structure

Affordable housing portfolios typically leverage a mix of government subsidies, tax credits, and low-interest loans to enhance financing structures, reducing overall borrowing costs compared to single family rental portfolios. Single family rental portfolios often rely more heavily on conventional mortgages and private capital, which may lead to higher interest rates and shorter loan terms. Explore how different financing structures impact portfolio performance and investment strategies to optimize returns.

Source and External Links

NAHMA Affordable 100 List - Portfolio of Affordable Units - The NAHMA Affordable 100 lists the largest affordable multifamily property management companies ranked by the number of subsidized units, providing key data on affordable housing portfolios receiving federal subsidies in the U.S.

The Investment Upside to Affordable Housing | Multifamily Loans - Affordable housing portfolios benefit from attractive financing options such as long-term HUD loans with high loan-to-value ratios and lower mortgage insurance premiums, making investing in affordable housing an effective portfolio diversification strategy.

The Top 4 Reasons Large Investors Are Expanding Their Affordable Housing Portfolios - Large investors are expanding affordable housing portfolios due to strong demand, attractive yields, portfolio diversification, and the positive social impact of addressing housing shortages in urban, suburban, and rural communities.

dowidth.com

dowidth.com