Proptech platforms leverage advanced technology to streamline property transactions, enhance market transparency, and provide innovative tools for buyers, sellers, and investors. Real Estate Investment Trusts (REITs) offer a traditional investment vehicle that pools capital to invest in income-generating real estate, providing liquidity and diversification to individual investors. Discover how these two distinct approaches are transforming the real estate landscape and what opportunities they present for savvy investors.

Why it is important

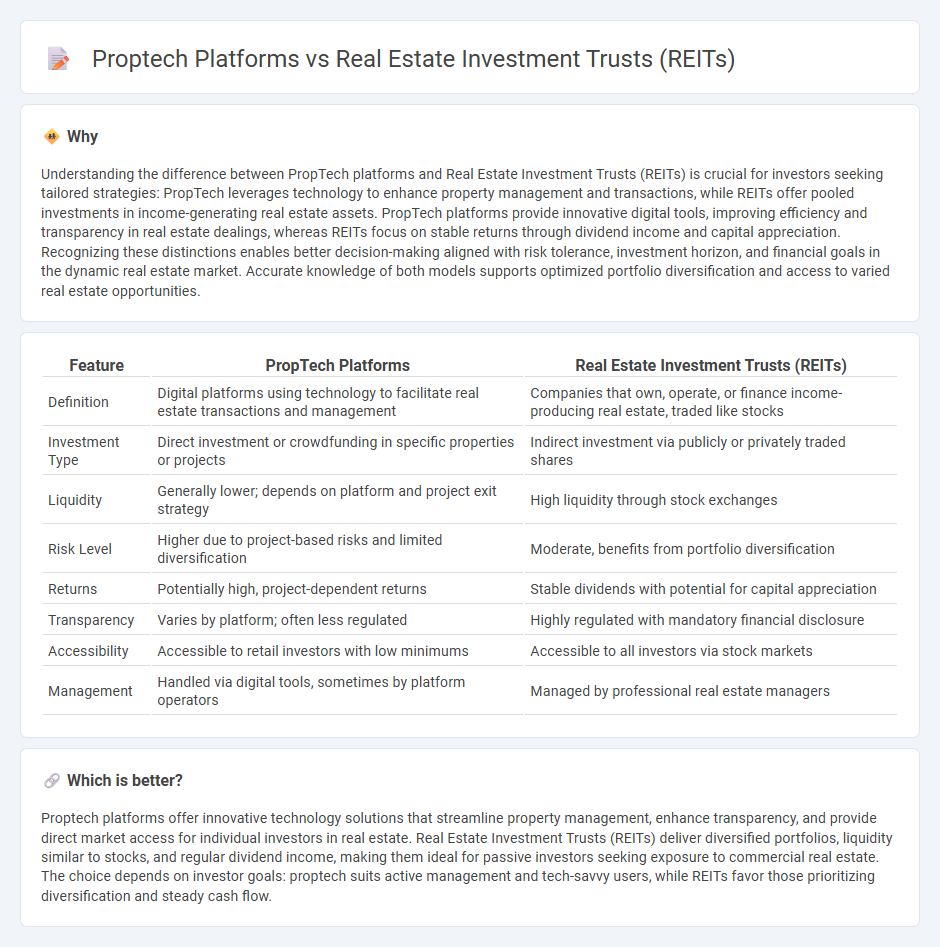

Understanding the difference between PropTech platforms and Real Estate Investment Trusts (REITs) is crucial for investors seeking tailored strategies: PropTech leverages technology to enhance property management and transactions, while REITs offer pooled investments in income-generating real estate assets. PropTech platforms provide innovative digital tools, improving efficiency and transparency in real estate dealings, whereas REITs focus on stable returns through dividend income and capital appreciation. Recognizing these distinctions enables better decision-making aligned with risk tolerance, investment horizon, and financial goals in the dynamic real estate market. Accurate knowledge of both models supports optimized portfolio diversification and access to varied real estate opportunities.

Comparison Table

| Feature | PropTech Platforms | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Definition | Digital platforms using technology to facilitate real estate transactions and management | Companies that own, operate, or finance income-producing real estate, traded like stocks |

| Investment Type | Direct investment or crowdfunding in specific properties or projects | Indirect investment via publicly or privately traded shares |

| Liquidity | Generally lower; depends on platform and project exit strategy | High liquidity through stock exchanges |

| Risk Level | Higher due to project-based risks and limited diversification | Moderate, benefits from portfolio diversification |

| Returns | Potentially high, project-dependent returns | Stable dividends with potential for capital appreciation |

| Transparency | Varies by platform; often less regulated | Highly regulated with mandatory financial disclosure |

| Accessibility | Accessible to retail investors with low minimums | Accessible to all investors via stock markets |

| Management | Handled via digital tools, sometimes by platform operators | Managed by professional real estate managers |

Which is better?

Proptech platforms offer innovative technology solutions that streamline property management, enhance transparency, and provide direct market access for individual investors in real estate. Real Estate Investment Trusts (REITs) deliver diversified portfolios, liquidity similar to stocks, and regular dividend income, making them ideal for passive investors seeking exposure to commercial real estate. The choice depends on investor goals: proptech suits active management and tech-savvy users, while REITs favor those prioritizing diversification and steady cash flow.

Connection

Proptech platforms leverage digital technology to streamline property management and investment processes, enhancing transparency and accessibility in the real estate market. Real Estate Investment Trusts (REITs) benefit from proptech by utilizing data-driven analytics and automated transaction systems to improve asset management and investor relations. Integration of proptech tools with REITs facilitates efficient portfolio monitoring and expands opportunities for fractional property investment.

Key Terms

Liquidity

Real Estate Investment Trusts (REITs) offer higher liquidity through publicly traded shares, enabling investors to buy or sell holdings quickly compared to traditional real estate. Proptech platforms, while innovative, often involve longer transaction times and lower liquidity due to direct property investments or fractional ownership models. Explore the differences further to understand which option aligns best with your investment goals.

Asset Ownership

Real Estate Investment Trusts (REITs) offer investors direct ownership in income-generating real estate assets, providing access to commercial properties like office buildings, shopping centers, and apartments without the complexities of property management. Proptech platforms, by contrast, leverage technology to facilitate real estate transactions, leasing, and management but typically do not grant direct asset ownership, focusing on enhancing user experience and operational efficiency. Explore more about how REITs and proptech platforms shape the future of real estate investments and asset ownership.

Technology Integration

Real Estate Investment Trusts (REITs) steadily incorporate technology to enhance asset management and investor transparency, using data analytics and AI-driven market insights to optimize portfolio performance. Proptech platforms revolutionize property transactions and management through blockchain, virtual reality tours, and automated valuation models, significantly improving user engagement and efficiency. Explore how these technological advancements are shaping the future of real estate investment and management.

Source and External Links

Real Estate Investment Trust - Wikipedia - This page provides an overview of REITs, including their structure, types, and tax benefits.

Real Estate Investment Trusts (REITs) - Investor.gov - Offers insights into what REITs are, their operation, and why individuals might invest in them.

What's a REIT (Real Estate Investment Trust)? - Nareit - Describes how REITs function and their benefits to investors.

dowidth.com

dowidth.com