Blockchain title transfer enhances real estate transactions by securely recording ownership changes on a decentralized ledger, eliminating fraud and reducing processing time. Automated title clearing uses advanced software algorithms to efficiently verify and resolve title issues, streamlining the closing process without manual intervention. Explore the differences between blockchain title transfer and automated title clearing to understand which technology best suits your real estate needs.

Why it is important

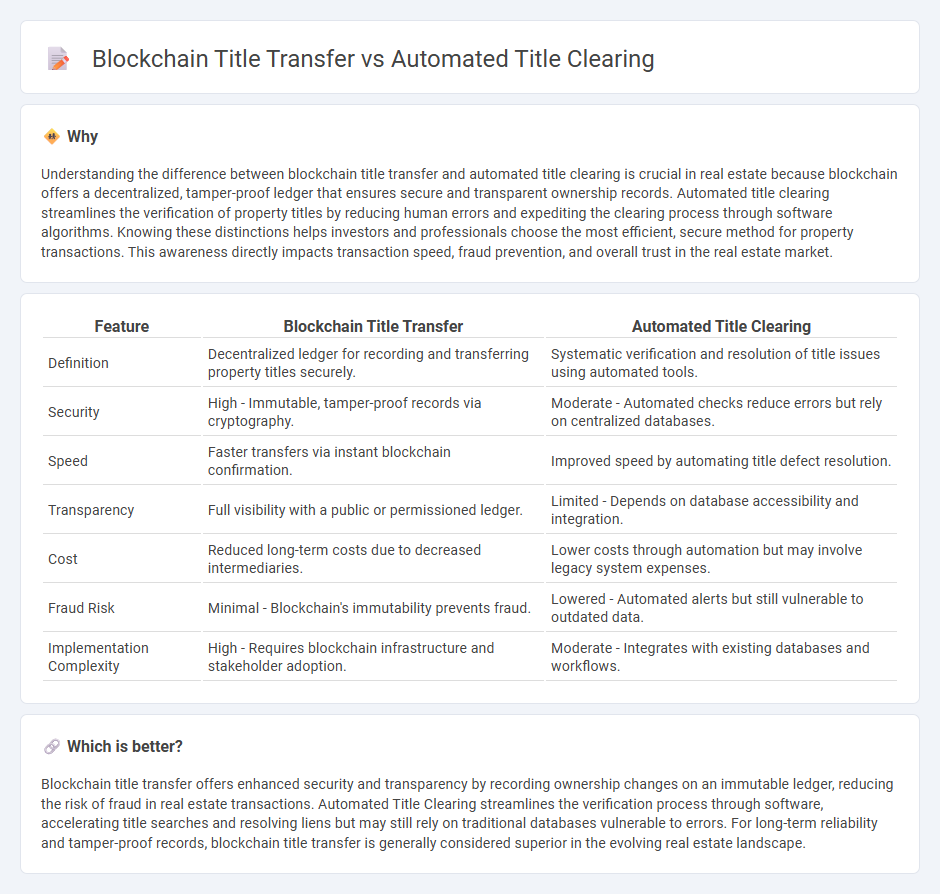

Understanding the difference between blockchain title transfer and automated title clearing is crucial in real estate because blockchain offers a decentralized, tamper-proof ledger that ensures secure and transparent ownership records. Automated title clearing streamlines the verification of property titles by reducing human errors and expediting the clearing process through software algorithms. Knowing these distinctions helps investors and professionals choose the most efficient, secure method for property transactions. This awareness directly impacts transaction speed, fraud prevention, and overall trust in the real estate market.

Comparison Table

| Feature | Blockchain Title Transfer | Automated Title Clearing |

|---|---|---|

| Definition | Decentralized ledger for recording and transferring property titles securely. | Systematic verification and resolution of title issues using automated tools. |

| Security | High - Immutable, tamper-proof records via cryptography. | Moderate - Automated checks reduce errors but rely on centralized databases. |

| Speed | Faster transfers via instant blockchain confirmation. | Improved speed by automating title defect resolution. |

| Transparency | Full visibility with a public or permissioned ledger. | Limited - Depends on database accessibility and integration. |

| Cost | Reduced long-term costs due to decreased intermediaries. | Lower costs through automation but may involve legacy system expenses. |

| Fraud Risk | Minimal - Blockchain's immutability prevents fraud. | Lowered - Automated alerts but still vulnerable to outdated data. |

| Implementation Complexity | High - Requires blockchain infrastructure and stakeholder adoption. | Moderate - Integrates with existing databases and workflows. |

Which is better?

Blockchain title transfer offers enhanced security and transparency by recording ownership changes on an immutable ledger, reducing the risk of fraud in real estate transactions. Automated Title Clearing streamlines the verification process through software, accelerating title searches and resolving liens but may still rely on traditional databases vulnerable to errors. For long-term reliability and tamper-proof records, blockchain title transfer is generally considered superior in the evolving real estate landscape.

Connection

Blockchain title transfer enhances real estate transactions by providing a secure, immutable ledger that records property ownership, reducing fraud and errors. Automated title clearing leverages this blockchain technology to streamline verification and settlement processes, accelerating title searches and approvals. Together, these innovations increase transparency, lower transaction costs, and improve efficiency in the real estate title transfer process.

Key Terms

Title Search

Automated title clearing streamlines the title search process by utilizing centralized databases and advanced software to quickly verify ownership and uncover encumbrances, reducing the risk of errors and delays common in manual searches. Blockchain title transfer enhances this by providing a decentralized, immutable ledger that ensures transparent and tamper-proof records, eliminating fraud and simplifying title verification. Explore the benefits and practical applications of both methods to determine the best solution for your real estate transactions.

Smart Contract

Automated title clearing leverages centralized databases and algorithms to streamline ownership verification, while blockchain title transfer utilizes decentralized ledgers and smart contracts to ensure secure, transparent, and immutable record-keeping. Smart contracts automate title transfers by executing predefined conditions without intermediaries, reducing fraud risks and increasing transaction efficiency. Explore the transformative potential of smart contracts in real estate title management to enhance security and trust.

Chain of Title

Automated title clearing streamlines the verification and consolidation of property ownership records, reducing errors and processing time in the traditional Chain of Title system. Blockchain title transfer enhances transparency and security by creating an immutable, decentralized ledger that records every transaction in the Chain of Title, preventing fraud and simplifying audits. Explore how these technologies reshape property ownership documentation and the future of real estate transactions.

Source and External Links

Exploit Automated Data Entry in Title Searches to Boost Efficiency - Automated data entry in title searches improves efficiency and accuracy through technologies like AI and machine learning, reducing manual errors and enhancing operational effectiveness.

Instant Title Look up and Closing Protection Process Automation - This platform automates the real estate closing process with features like online title research, title clearing, and document generation, enhancing efficiency and security.

EquityClear - Automated Title Search & Lien Clearance - Accurate Group's EquityClear automates title and lien clearance using public and non-public data, reducing risk and facilitating faster home equity loan closings.

dowidth.com

dowidth.com