Leaseback programs involve property owners selling their real estate while immediately leasing it back, ensuring continuous occupancy and steady rental income. Sublease arrangements occur when tenants rent out their leased property to a third party, often requiring landlord approval and creating a secondary rental agreement. Explore the benefits and risks of leaseback programs versus subleasing to make informed real estate decisions.

Why it is important

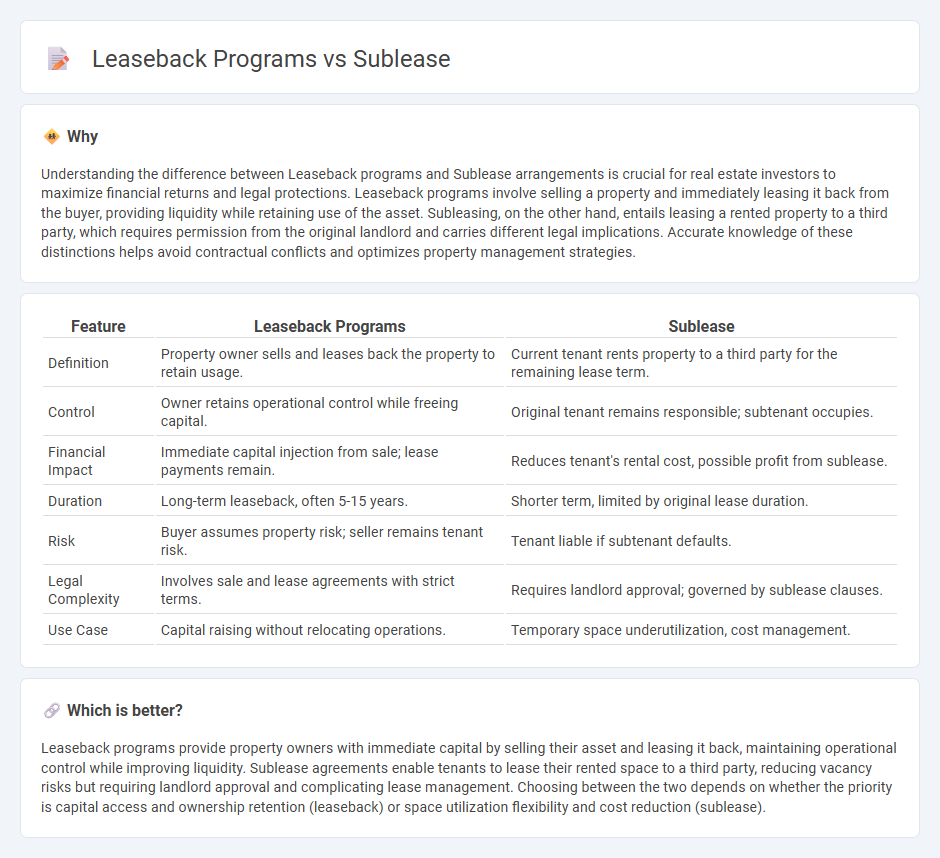

Understanding the difference between Leaseback programs and Sublease arrangements is crucial for real estate investors to maximize financial returns and legal protections. Leaseback programs involve selling a property and immediately leasing it back from the buyer, providing liquidity while retaining use of the asset. Subleasing, on the other hand, entails leasing a rented property to a third party, which requires permission from the original landlord and carries different legal implications. Accurate knowledge of these distinctions helps avoid contractual conflicts and optimizes property management strategies.

Comparison Table

| Feature | Leaseback Programs | Sublease |

|---|---|---|

| Definition | Property owner sells and leases back the property to retain usage. | Current tenant rents property to a third party for the remaining lease term. |

| Control | Owner retains operational control while freeing capital. | Original tenant remains responsible; subtenant occupies. |

| Financial Impact | Immediate capital injection from sale; lease payments remain. | Reduces tenant's rental cost, possible profit from sublease. |

| Duration | Long-term leaseback, often 5-15 years. | Shorter term, limited by original lease duration. |

| Risk | Buyer assumes property risk; seller remains tenant risk. | Tenant liable if subtenant defaults. |

| Legal Complexity | Involves sale and lease agreements with strict terms. | Requires landlord approval; governed by sublease clauses. |

| Use Case | Capital raising without relocating operations. | Temporary space underutilization, cost management. |

Which is better?

Leaseback programs provide property owners with immediate capital by selling their asset and leasing it back, maintaining operational control while improving liquidity. Sublease agreements enable tenants to lease their rented space to a third party, reducing vacancy risks but requiring landlord approval and complicating lease management. Choosing between the two depends on whether the priority is capital access and ownership retention (leaseback) or space utilization flexibility and cost reduction (sublease).

Connection

Leaseback programs involve a property owner selling their asset and then leasing it back to retain usage rights, allowing for capital release while maintaining occupancy. Sublease occurs when the original lessee rents out the leased property to a third party, which can be a strategy to optimize space use or offset lease costs within leaseback arrangements. Both concepts intersect by enabling flexible property management and financial leveraging in real estate investment and occupancy models.

Key Terms

Tenant

Sublease programs allow tenants to rent out their leased space to third parties, reducing occupancy costs and mitigating financial risk during underutilization periods. Leaseback programs involve tenants selling their property to an investor and leasing it back, unlocking capital while retaining operational control of the premises. Explore detailed comparisons and benefits tailored to tenant needs to optimize real estate strategy.

Lessor

Lessor-focused sublease programs involve tenants renting out leased space to third parties while maintaining primary lease obligations, providing lessors with continuous income and reduced vacancy risks. Leaseback arrangements allow lessors to sell properties to investors and lease them back, securing long-term rental income and potential tax advantages. Explore detailed comparisons to determine the best strategy for maximizing lessor returns.

Possession

Sublease programs involve the original tenant retaining the lease agreement while renting out the property to a third party, maintaining possession temporarily. Leaseback programs transfer ownership to the buyer, who leases the property back to the seller, ensuring continuous possession without relocation. Explore the detailed differences and advantages of each possession method to determine the best fit for your real estate strategy.

Source and External Links

Sublease | Wex | US Law | LII / Legal Information Institute - This webpage provides a legal definition of a sublease, outlining it as a contract between a lessee and a sublessee, where the original lessee becomes a sublessor without direct contractual obligations to the property owner.

Subleasing Laws and Regulations In Washington - This article discusses the laws and regulations surrounding subleasing in Washington, emphasizing the need for written landlord consent and the responsibilities of both the sublessor and sublessee.

Sublet: Furnished Apartments, Rentals and Rooms - Sublet.com is a platform for finding short-term and long-term rentals, allowing users to post listings and search for sublease opportunities across different locations.

dowidth.com

dowidth.com