iBuyer platforms use advanced algorithms and AI technology to provide instant offers on homes, streamlining the selling process with speed and convenience for homeowners. Real estate investment companies focus on acquiring, managing, and profiting from a diverse portfolio of properties, leveraging market expertise to maximize returns over time. Explore the key differences between iBuyer platforms and traditional investment firms to determine the best fit for your real estate goals.

Why it is important

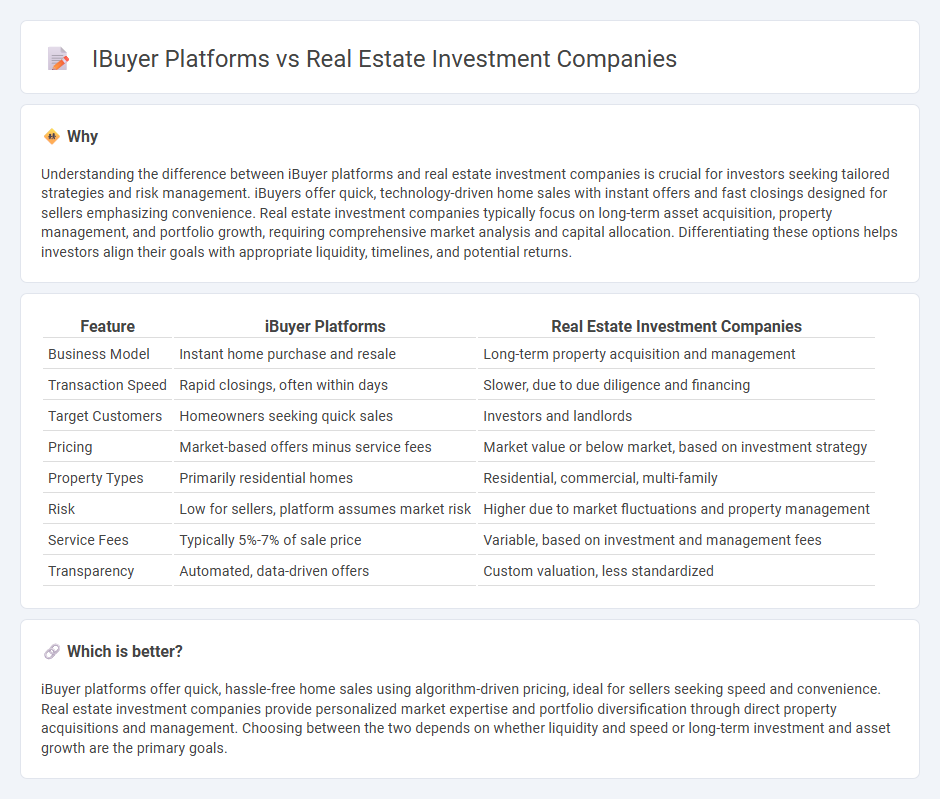

Understanding the difference between iBuyer platforms and real estate investment companies is crucial for investors seeking tailored strategies and risk management. iBuyers offer quick, technology-driven home sales with instant offers and fast closings designed for sellers emphasizing convenience. Real estate investment companies typically focus on long-term asset acquisition, property management, and portfolio growth, requiring comprehensive market analysis and capital allocation. Differentiating these options helps investors align their goals with appropriate liquidity, timelines, and potential returns.

Comparison Table

| Feature | iBuyer Platforms | Real Estate Investment Companies |

|---|---|---|

| Business Model | Instant home purchase and resale | Long-term property acquisition and management |

| Transaction Speed | Rapid closings, often within days | Slower, due to due diligence and financing |

| Target Customers | Homeowners seeking quick sales | Investors and landlords |

| Pricing | Market-based offers minus service fees | Market value or below market, based on investment strategy |

| Property Types | Primarily residential homes | Residential, commercial, multi-family |

| Risk | Low for sellers, platform assumes market risk | Higher due to market fluctuations and property management |

| Service Fees | Typically 5%-7% of sale price | Variable, based on investment and management fees |

| Transparency | Automated, data-driven offers | Custom valuation, less standardized |

Which is better?

iBuyer platforms offer quick, hassle-free home sales using algorithm-driven pricing, ideal for sellers seeking speed and convenience. Real estate investment companies provide personalized market expertise and portfolio diversification through direct property acquisitions and management. Choosing between the two depends on whether liquidity and speed or long-term investment and asset growth are the primary goals.

Connection

iBuyer platforms revolutionize the real estate market by offering instant cash offers on properties, streamlining transactions and increasing liquidity for sellers and investors. Real estate investment companies leverage iBuyer data and technology to identify market trends, optimize property portfolios, and enhance acquisition strategies with faster deal turnarounds. This synergy enables more efficient asset management and accelerates capital deployment in dynamic housing markets.

Key Terms

Acquisition Strategy

Real estate investment companies utilize targeted acquisition strategies involving thorough market analysis, direct property purchases, and partnerships with brokers to secure undervalued assets. iBuyer platforms, such as Opendoor and Zillow Offers, leverage algorithm-driven instant offers and cash transactions to rapidly acquire residential properties at scale. Explore the nuances of these acquisition approaches to enhance your understanding of real estate market dynamics.

Holding Period

Real estate investment companies typically hold properties for extended periods, often years, to maximize rental income and capital appreciation, aligning with long-term market trends. iBuyer platforms, conversely, focus on rapid transactions, frequently reselling homes within days or weeks to capitalize on immediate market demand and turnover. Explore the distinct holding strategies to understand which model aligns better with your investment goals.

Transaction Speed

Real estate investment companies typically offer thorough property evaluations and negotiate terms that can extend transaction timelines up to several weeks. iBuyer platforms leverage advanced algorithms and streamlined processes to provide near-instant offers, often closing deals within days. Explore the nuances of how transaction speed impacts your selling strategy by learning more about both options.

dowidth.com

dowidth.com