Sale leaseback enables property owners to sell real estate assets while retaining operational control through lease agreements, optimizing capital and improving balance sheets. Synthetic leases offer off-balance-sheet financing by structuring leases as operating rather than capital leases, benefiting companies seeking to minimize debt appearance. Discover the key differences and strategic applications of sale leaseback versus synthetic lease structures in real estate finance.

Why it is important

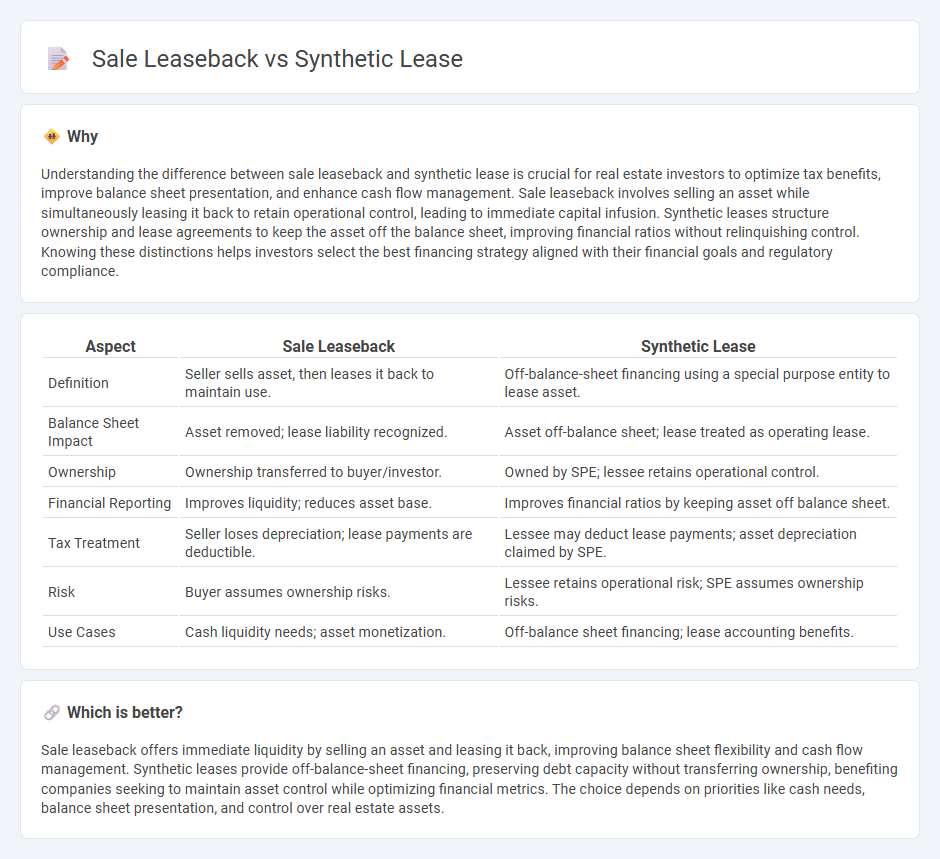

Understanding the difference between sale leaseback and synthetic lease is crucial for real estate investors to optimize tax benefits, improve balance sheet presentation, and enhance cash flow management. Sale leaseback involves selling an asset while simultaneously leasing it back to retain operational control, leading to immediate capital infusion. Synthetic leases structure ownership and lease agreements to keep the asset off the balance sheet, improving financial ratios without relinquishing control. Knowing these distinctions helps investors select the best financing strategy aligned with their financial goals and regulatory compliance.

Comparison Table

| Aspect | Sale Leaseback | Synthetic Lease |

|---|---|---|

| Definition | Seller sells asset, then leases it back to maintain use. | Off-balance-sheet financing using a special purpose entity to lease asset. |

| Balance Sheet Impact | Asset removed; lease liability recognized. | Asset off-balance sheet; lease treated as operating lease. |

| Ownership | Ownership transferred to buyer/investor. | Owned by SPE; lessee retains operational control. |

| Financial Reporting | Improves liquidity; reduces asset base. | Improves financial ratios by keeping asset off balance sheet. |

| Tax Treatment | Seller loses depreciation; lease payments are deductible. | Lessee may deduct lease payments; asset depreciation claimed by SPE. |

| Risk | Buyer assumes ownership risks. | Lessee retains operational risk; SPE assumes ownership risks. |

| Use Cases | Cash liquidity needs; asset monetization. | Off-balance sheet financing; lease accounting benefits. |

Which is better?

Sale leaseback offers immediate liquidity by selling an asset and leasing it back, improving balance sheet flexibility and cash flow management. Synthetic leases provide off-balance-sheet financing, preserving debt capacity without transferring ownership, benefiting companies seeking to maintain asset control while optimizing financial metrics. The choice depends on priorities like cash needs, balance sheet presentation, and control over real estate assets.

Connection

Sale leaseback and synthetic lease both serve as financial strategies in real estate to enhance liquidity without losing operational control of assets. In a sale leaseback, the property owner sells the asset and simultaneously leases it back, converting illiquid real estate into capital while maintaining use. Synthetic leases combine off-balance-sheet financing with operating lease characteristics, often utilized alongside sale leasebacks to optimize balance sheet presentation and tax advantages.

Key Terms

Off-balance Sheet Financing

Synthetic leases enable companies to keep leased assets off their balance sheets by structuring the lease as both a financing and an operating lease for accounting and tax purposes, respectively. Sale-leaseback transactions involve selling an asset and immediately leasing it back, removing the asset and related liability from the balance sheet while providing liquidity. Explore detailed comparisons of synthetic leases and sale-leaseback strategies to optimize off-balance sheet financing.

Ownership Structure

Synthetic leases allow companies to keep leased assets off the balance sheet while retaining operational control, effectively blending ownership benefits with financial leverage. In contrast, sale-leasebacks involve selling an asset to a lessor and then leasing it back, transferring legal ownership to the lessor while maintaining operational usage, which improves liquidity but alters the ownership structure. Explore the detailed distinctions and financial implications of synthetic leases versus sale-leasebacks to optimize your asset management strategy.

Tax Treatment

Synthetic leases provide off-balance-sheet financing benefits by allowing companies to treat leased assets as owned for tax purposes, enabling depreciation deductions that reduce taxable income. Sale-leaseback transactions result in immediate cash inflow by selling assets and leasing them back, but the lease payments are fully deductible as expenses, impacting taxable income differently. Explore the intricacies of tax treatment in synthetic leases versus sale-leaseback arrangements for strategic financial planning.

Source and External Links

Overview of Synthetic Leases Under ASC 842 - CBRE - A synthetic lease is a credit-based financing structure for real estate or equipment, offering 100% project financing, operating lease accounting, and lower rent payments--typically with three end-of-term options: purchase, renew, or vacate and settle the residual value.

A Brief History of Synthetic Leases - CBRE - Synthetic leases achieve operating lease treatment for accounting but are treated as ownership for tax, providing benefits such as depreciation deductions and the ability to purchase the asset at term end for a fixed amount, though they require strong credit and involve complex structuring to maintain off-balance-sheet status.

Renewed Interest in Synthetic Leases - A Refresher and Changes Under the New (ASC 842) Lease Accounting Standard - Synthetic leases are a financing technique allowing lessees to finance acquisitions or construction with operating lease accounting and ownership tax treatment, enabling tax depreciation and purchase rights, but are complex and best suited for creditworthy entities.

dowidth.com

dowidth.com