Green leases promote energy-efficient and sustainable building practices by aligning landlord and tenant incentives to reduce environmental impact. Sale-leaseback transactions involve a property owner selling an asset and leasing it back to free up capital while retaining operational control. Explore how each strategy impacts financial flexibility and environmental responsibility in real estate.

Why it is important

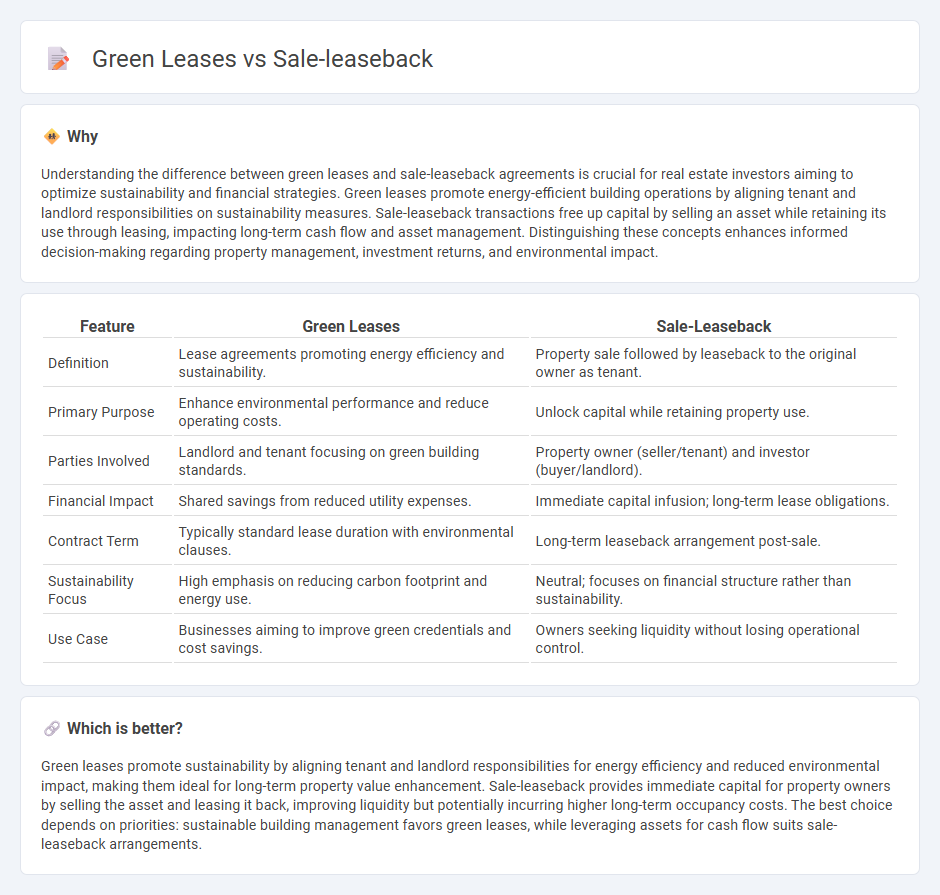

Understanding the difference between green leases and sale-leaseback agreements is crucial for real estate investors aiming to optimize sustainability and financial strategies. Green leases promote energy-efficient building operations by aligning tenant and landlord responsibilities on sustainability measures. Sale-leaseback transactions free up capital by selling an asset while retaining its use through leasing, impacting long-term cash flow and asset management. Distinguishing these concepts enhances informed decision-making regarding property management, investment returns, and environmental impact.

Comparison Table

| Feature | Green Leases | Sale-Leaseback |

|---|---|---|

| Definition | Lease agreements promoting energy efficiency and sustainability. | Property sale followed by leaseback to the original owner as tenant. |

| Primary Purpose | Enhance environmental performance and reduce operating costs. | Unlock capital while retaining property use. |

| Parties Involved | Landlord and tenant focusing on green building standards. | Property owner (seller/tenant) and investor (buyer/landlord). |

| Financial Impact | Shared savings from reduced utility expenses. | Immediate capital infusion; long-term lease obligations. |

| Contract Term | Typically standard lease duration with environmental clauses. | Long-term leaseback arrangement post-sale. |

| Sustainability Focus | High emphasis on reducing carbon footprint and energy use. | Neutral; focuses on financial structure rather than sustainability. |

| Use Case | Businesses aiming to improve green credentials and cost savings. | Owners seeking liquidity without losing operational control. |

Which is better?

Green leases promote sustainability by aligning tenant and landlord responsibilities for energy efficiency and reduced environmental impact, making them ideal for long-term property value enhancement. Sale-leaseback provides immediate capital for property owners by selling the asset and leasing it back, improving liquidity but potentially incurring higher long-term occupancy costs. The best choice depends on priorities: sustainable building management favors green leases, while leveraging assets for cash flow suits sale-leaseback arrangements.

Connection

Green leases and sale-leaseback transactions are connected through their shared focus on optimizing property sustainability and financial performance. Green leases integrate environmental performance standards into lease agreements, incentivizing both landlords and tenants to reduce energy consumption and carbon emissions. Sale-leaseback arrangements enable property owners to unlock capital by selling assets while retaining occupancy, often incorporating green lease clauses to ensure ongoing commitment to sustainable building operations.

Key Terms

Ownership Transfer

Sale-leaseback transactions involve transferring property ownership to a buyer while the seller remains as a tenant, enabling capital release and continued operational control. Green leases embed sustainability clauses, promoting energy efficiency and environmental responsibility without changing property ownership. Explore detailed comparisons to understand how ownership transfer impacts financial strategies and sustainability goals.

Energy Efficiency

Sale-leaseback transactions free up capital for companies by selling assets while continuing to use them, often allowing for energy efficiency retrofits to be funded through the sale proceeds. Green leases incorporate energy efficiency clauses directly into lease agreements, promoting sustainable practices like reduced energy consumption and improved building performance. Explore how integrating these strategies can maximize energy savings and ESG goals.

Lease Structure

Sale-leaseback transactions involve a company selling an asset and immediately leasing it back, optimizing capital allocation and off-balance-sheet financing, while green leases incorporate sustainability clauses that align landlord and tenant responsibilities for energy efficiency and environmental performance. The lease structure in sale-leasebacks centers on favorable financial terms and long-term occupancy security, whereas green leases emphasize collaborative commitments to reduce carbon footprint and operational costs through shared sustainability goals. Explore the distinct advantages of each lease structure to determine the optimal strategy for your commercial real estate portfolio.

Source and External Links

Sale-Leasebacks: A Tool for the Times | Publications - Cleary Gottlieb - A sale-leaseback is an arrangement where a company sells an asset like real estate or equipment and immediately leases it back from the buyer, obtaining a lump sum while retaining use of the asset.

Understanding sale-leaseback transactions | Insights - Elliott Davis - Sale-leasebacks allow businesses to raise cash by selling property or equipment and then leasing it back, providing immediate funding without interrupting the use of essential assets.

SALE-LEASEBACK TRANSACTIONS Solutions to liquidity and ... - Sale-leaseback financing enables the seller to realize 100% or more of the real estate asset's value, convert it into working capital, and continue occupying and operating from the property under a lease.

dowidth.com

dowidth.com