Green leases prioritize environmental sustainability by incorporating energy-efficient practices and shared responsibilities for utility costs between landlords and tenants, reducing carbon footprints. Modified gross leases assign a fixed base rent with tenants covering variable expenses like utilities and maintenance, offering clarity in financial obligations. Explore the key differences and benefits of these lease types to optimize property management strategies.

Why it is important

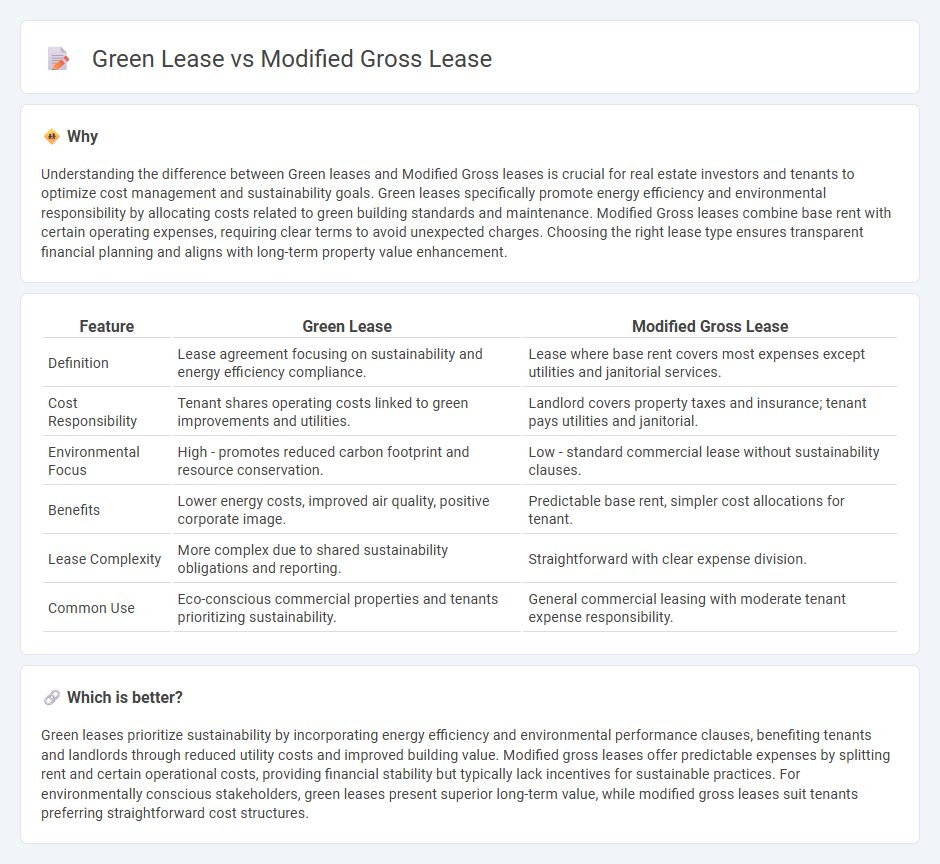

Understanding the difference between Green leases and Modified Gross leases is crucial for real estate investors and tenants to optimize cost management and sustainability goals. Green leases specifically promote energy efficiency and environmental responsibility by allocating costs related to green building standards and maintenance. Modified Gross leases combine base rent with certain operating expenses, requiring clear terms to avoid unexpected charges. Choosing the right lease type ensures transparent financial planning and aligns with long-term property value enhancement.

Comparison Table

| Feature | Green Lease | Modified Gross Lease |

|---|---|---|

| Definition | Lease agreement focusing on sustainability and energy efficiency compliance. | Lease where base rent covers most expenses except utilities and janitorial services. |

| Cost Responsibility | Tenant shares operating costs linked to green improvements and utilities. | Landlord covers property taxes and insurance; tenant pays utilities and janitorial. |

| Environmental Focus | High - promotes reduced carbon footprint and resource conservation. | Low - standard commercial lease without sustainability clauses. |

| Benefits | Lower energy costs, improved air quality, positive corporate image. | Predictable base rent, simpler cost allocations for tenant. |

| Lease Complexity | More complex due to shared sustainability obligations and reporting. | Straightforward with clear expense division. |

| Common Use | Eco-conscious commercial properties and tenants prioritizing sustainability. | General commercial leasing with moderate tenant expense responsibility. |

Which is better?

Green leases prioritize sustainability by incorporating energy efficiency and environmental performance clauses, benefiting tenants and landlords through reduced utility costs and improved building value. Modified gross leases offer predictable expenses by splitting rent and certain operational costs, providing financial stability but typically lack incentives for sustainable practices. For environmentally conscious stakeholders, green leases present superior long-term value, while modified gross leases suit tenants preferring straightforward cost structures.

Connection

Green leases and modified gross leases intersect in their approach to allocating expenses and promoting sustainability within commercial real estate agreements. A green lease incorporates specific clauses to encourage energy efficiency and environmental responsibility, while a modified gross lease outlines shared costs between landlords and tenants, often including utilities and maintenance. Combining these structures allows landlords and tenants to collaboratively manage operational costs and implement eco-friendly practices, enhancing property value and reducing carbon footprints.

Key Terms

Operating Expenses

A modified gross lease typically requires tenants to pay a base rent plus a portion of operating expenses such as utilities, maintenance, and taxes, providing more cost predictability compared to a triple net lease. Green leases incorporate sustainability clauses that allocate operating expenses for energy-efficient improvements and environmental management, promoting shared responsibility for reducing operational costs and environmental impact. Explore how these lease structures impact your financial and sustainability goals to optimize your commercial property agreements.

Energy Efficiency

A modified gross lease typically includes a base rent covering most operating expenses, with tenants responsible for specific costs, often leading to less emphasis on energy efficiency improvements. Green leases explicitly prioritize sustainability by incorporating energy-efficient practices, such as shared incentives for reducing utility consumption and implementing renewable energy solutions. Explore how green leases drive long-term cost savings and environmental benefits in commercial properties.

Expense Reimbursement

Modified gross leases require tenants to pay base rent plus a portion of operating expenses, often capped or negotiated, while landlords cover structural repairs and property taxes. Green leases emphasize sustainability by incorporating clauses for shared costs of energy efficiency improvements and waste reduction initiatives to promote environmental responsibility. Explore detailed comparisons of lease expense reimbursements to optimize commercial property agreements.

Source and External Links

Modified Gross Lease - A lease where the landlord and tenant share the responsibility for property expenses, differing from triple net leases by the specific allocation of costs like taxes and insurance.

What Is a Modified Gross Lease, and How Does It Work? - This article explains how modified gross leases split property operating expenses between landlords and tenants, providing flexibility and control in commercial real estate leases.

What is a Modified Gross Lease & How Does It Work? - A modified gross lease involves both landlords and tenants sharing property operating expenses, with responsibilities varying based on market conditions and negotiations.

dowidth.com

dowidth.com