Automated valuation models (AVMs) leverage advanced algorithms and extensive data sets to provide fast, objective property valuations with high consistency. Expert opinions, drawn from seasoned real estate professionals, incorporate nuanced local knowledge and market trends that may not be captured by algorithms alone. Explore the strengths and limitations of both approaches to determine the best valuation method for your real estate needs.

Why it is important

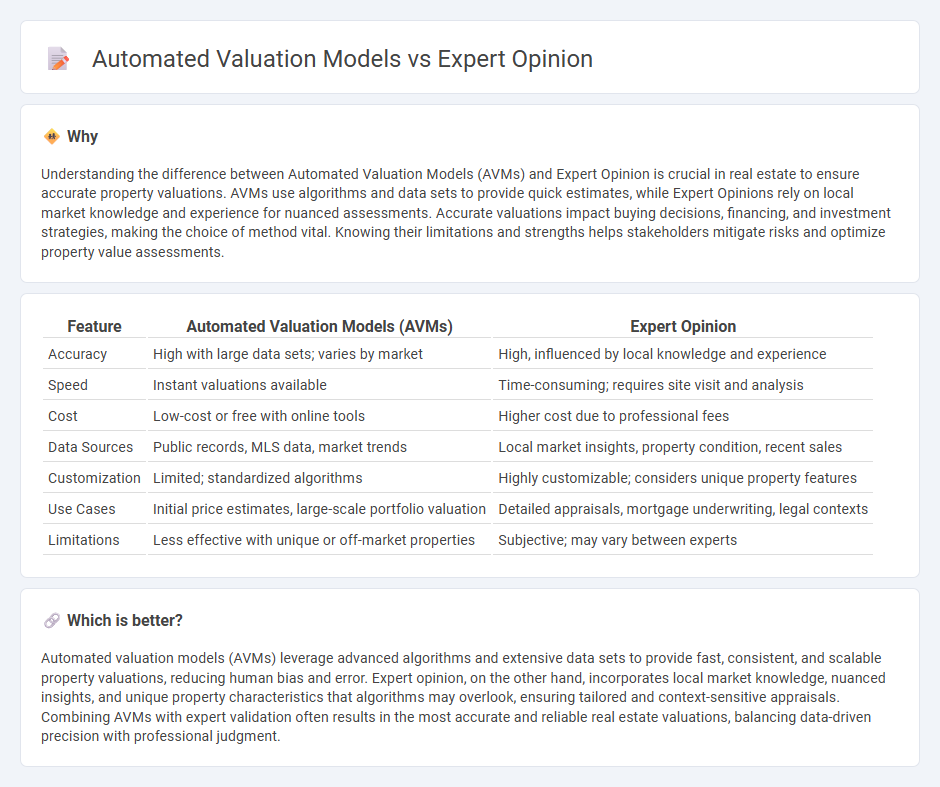

Understanding the difference between Automated Valuation Models (AVMs) and Expert Opinion is crucial in real estate to ensure accurate property valuations. AVMs use algorithms and data sets to provide quick estimates, while Expert Opinions rely on local market knowledge and experience for nuanced assessments. Accurate valuations impact buying decisions, financing, and investment strategies, making the choice of method vital. Knowing their limitations and strengths helps stakeholders mitigate risks and optimize property value assessments.

Comparison Table

| Feature | Automated Valuation Models (AVMs) | Expert Opinion |

|---|---|---|

| Accuracy | High with large data sets; varies by market | High, influenced by local knowledge and experience |

| Speed | Instant valuations available | Time-consuming; requires site visit and analysis |

| Cost | Low-cost or free with online tools | Higher cost due to professional fees |

| Data Sources | Public records, MLS data, market trends | Local market insights, property condition, recent sales |

| Customization | Limited; standardized algorithms | Highly customizable; considers unique property features |

| Use Cases | Initial price estimates, large-scale portfolio valuation | Detailed appraisals, mortgage underwriting, legal contexts |

| Limitations | Less effective with unique or off-market properties | Subjective; may vary between experts |

Which is better?

Automated valuation models (AVMs) leverage advanced algorithms and extensive data sets to provide fast, consistent, and scalable property valuations, reducing human bias and error. Expert opinion, on the other hand, incorporates local market knowledge, nuanced insights, and unique property characteristics that algorithms may overlook, ensuring tailored and context-sensitive appraisals. Combining AVMs with expert validation often results in the most accurate and reliable real estate valuations, balancing data-driven precision with professional judgment.

Connection

Automated valuation models (AVMs) utilize algorithms and vast datasets to estimate property values quickly and consistently, while expert opinion provides contextual insights and local market knowledge. Combining AVMs with expert opinion enhances valuation accuracy by integrating data-driven metrics with professional judgment. This synergy improves real estate decision-making for buyers, sellers, and lenders.

Key Terms

Appraisal

Expert opinions in appraisals provide nuanced insights by incorporating local market trends and property specifics that Automated Valuation Models (AVMs) may overlook. AVMs utilize algorithms and extensive datasets to deliver quick, data-driven property valuations but may lack the contextual understanding of unique property features. Explore how combining expert appraisal judgment with AVM technology can enhance valuation accuracy.

Algorithm

Expert opinions rely on human experience and market intuition to assess property value, while Automated Valuation Models (AVMs) use sophisticated algorithms analyzing large datasets such as recent sales, property characteristics, and market trends to provide rapid estimates. AVMs leverage machine learning and statistical techniques to enhance accuracy, offering scalability and consistency absent in manual appraisals. Discover how advanced algorithms are transforming real estate valuation with greater precision and efficiency.

Market Analysis

Expert opinion leverages deep local market knowledge and nuanced insights, capturing factors like neighborhood trends and buyer sentiment that automated valuation models (AVMs) might miss. AVMs rely on algorithmic analysis of extensive datasets, including recent sales, property characteristics, and economic indicators, providing fast and consistent market value estimates. Explore further to understand how combining expert judgment and AVM data enhances market analysis accuracy.

Source and External Links

Understanding the Scope and Limitations of Expert Opinions - This article explores the scope and limitations of expert opinions, including requirements for admissibility and how they should be grounded in reliable methods and data.

Rule 702. Testimony by Expert Witnesses - This rule outlines the criteria for expert testimony in court, including the necessity for the testimony to be based on sufficient facts, reliable principles, and methods.

Expert Opinion vs. Empirical Evidence - This article discusses the role of expert opinion in regulatory contexts and emphasizes the importance of prioritizing empirical evidence over expert opinion in policy-making.

dowidth.com

dowidth.com