Agritourism properties offer unique investment opportunities by combining agricultural production with tourism, attracting visitors seeking rural experiences and farm stays. Multifamily apartment complexes provide steady rental income and high occupancy rates in urban and suburban markets, appealing to investors focused on long-term cash flow and diversification. Explore the distinct advantages of agritourism properties and multifamily apartments to determine the best fit for your real estate portfolio.

Why it is important

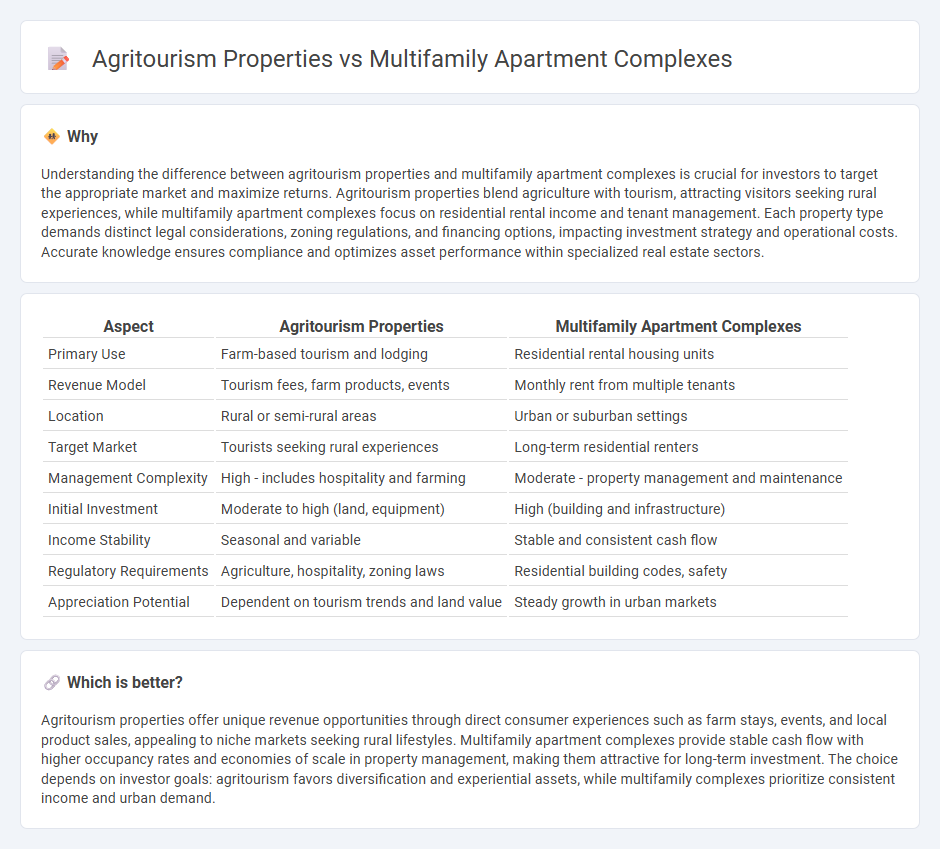

Understanding the difference between agritourism properties and multifamily apartment complexes is crucial for investors to target the appropriate market and maximize returns. Agritourism properties blend agriculture with tourism, attracting visitors seeking rural experiences, while multifamily apartment complexes focus on residential rental income and tenant management. Each property type demands distinct legal considerations, zoning regulations, and financing options, impacting investment strategy and operational costs. Accurate knowledge ensures compliance and optimizes asset performance within specialized real estate sectors.

Comparison Table

| Aspect | Agritourism Properties | Multifamily Apartment Complexes |

|---|---|---|

| Primary Use | Farm-based tourism and lodging | Residential rental housing units |

| Revenue Model | Tourism fees, farm products, events | Monthly rent from multiple tenants |

| Location | Rural or semi-rural areas | Urban or suburban settings |

| Target Market | Tourists seeking rural experiences | Long-term residential renters |

| Management Complexity | High - includes hospitality and farming | Moderate - property management and maintenance |

| Initial Investment | Moderate to high (land, equipment) | High (building and infrastructure) |

| Income Stability | Seasonal and variable | Stable and consistent cash flow |

| Regulatory Requirements | Agriculture, hospitality, zoning laws | Residential building codes, safety |

| Appreciation Potential | Dependent on tourism trends and land value | Steady growth in urban markets |

Which is better?

Agritourism properties offer unique revenue opportunities through direct consumer experiences such as farm stays, events, and local product sales, appealing to niche markets seeking rural lifestyles. Multifamily apartment complexes provide stable cash flow with higher occupancy rates and economies of scale in property management, making them attractive for long-term investment. The choice depends on investor goals: agritourism favors diversification and experiential assets, while multifamily complexes prioritize consistent income and urban demand.

Connection

Agritourism properties and multifamily apartment complexes intersect through the rising demand for mixed-use developments that combine rural, recreational, and residential living spaces to attract diverse tenant demographics. Developers leverage agritourism elements, such as farms and local produce markets, to enhance the appeal and sustainability of multifamily communities, creating unique lifestyle experiences. This integration supports increased property values and community engagement by blending agricultural heritage with urban housing needs.

Key Terms

Cap Rate

Multifamily apartment complexes typically offer stable cap rates ranging from 4% to 6%, driven by consistent rental income and lower vacancy risks. Agritourism properties often present higher cap rates around 6% to 9%, reflecting variable income influenced by seasonal tourism and agricultural production. Explore detailed comparisons to optimize your real estate investment strategy.

Zoning

Zoning regulations for multifamily apartment complexes typically emphasize higher density residential use, requiring specific allocations for parking, open space, and building height to comply with urban planning standards. Agritourism properties often fall under mixed-use or agricultural zoning, which prioritize land conservation and may include restrictions on commercial activities to preserve rural character. Explore detailed zoning differences and regulatory implications to optimize property use and development.

Cash Flow

Multifamily apartment complexes generate steady cash flow through consistent rental income from multiple units, offering a reliable revenue stream with lower vacancy risks. Agritourism properties, while potentially yielding higher seasonal profits from activities like farm tours, lodging, and local product sales, often face fluctuations due to weather and market demand. Explore detailed comparisons to understand which investment aligns best with your financial goals and risk tolerance.

Source and External Links

Multifamily Residential - Wikipedia - This webpage provides comprehensive information about multifamily residential properties, including their types and historical context.

What is Multifamily Housing and What Are the Benefits? - This article explains the concept of multifamily housing, its benefits, and its significance in the real estate market.

Buying Your First Apartment Complex: An Investor Guide - This guide is designed for investors looking to purchase their first apartment complex, covering financing options and investment strategies.

dowidth.com

dowidth.com