Lease-to-own models allow tenants to rent a property with the option to purchase it later, often with a portion of the rent applied toward the down payment, enabling gradual homeownership. Land contracts involve a buyer making installment payments directly to the seller while gaining equitable title, which transfers full ownership only after all payments are completed. Explore the key differences between these financing options to determine which best fits your path to owning real estate.

Why it is important

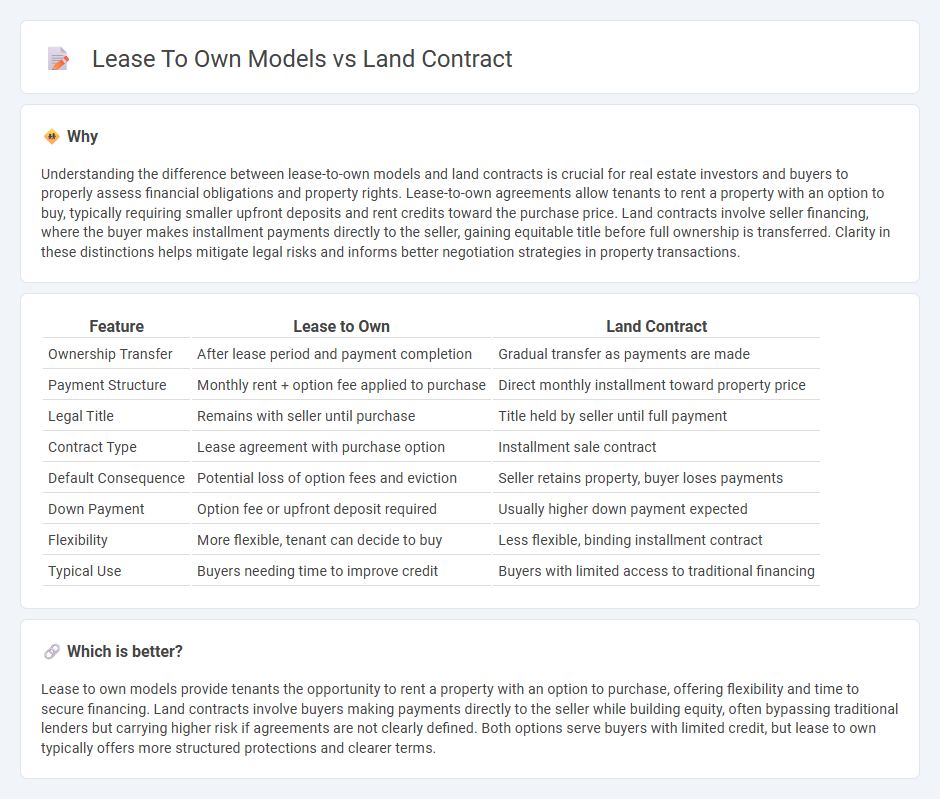

Understanding the difference between lease-to-own models and land contracts is crucial for real estate investors and buyers to properly assess financial obligations and property rights. Lease-to-own agreements allow tenants to rent a property with an option to buy, typically requiring smaller upfront deposits and rent credits toward the purchase price. Land contracts involve seller financing, where the buyer makes installment payments directly to the seller, gaining equitable title before full ownership is transferred. Clarity in these distinctions helps mitigate legal risks and informs better negotiation strategies in property transactions.

Comparison Table

| Feature | Lease to Own | Land Contract |

|---|---|---|

| Ownership Transfer | After lease period and payment completion | Gradual transfer as payments are made |

| Payment Structure | Monthly rent + option fee applied to purchase | Direct monthly installment toward property price |

| Legal Title | Remains with seller until purchase | Title held by seller until full payment |

| Contract Type | Lease agreement with purchase option | Installment sale contract |

| Default Consequence | Potential loss of option fees and eviction | Seller retains property, buyer loses payments |

| Down Payment | Option fee or upfront deposit required | Usually higher down payment expected |

| Flexibility | More flexible, tenant can decide to buy | Less flexible, binding installment contract |

| Typical Use | Buyers needing time to improve credit | Buyers with limited access to traditional financing |

Which is better?

Lease to own models provide tenants the opportunity to rent a property with an option to purchase, offering flexibility and time to secure financing. Land contracts involve buyers making payments directly to the seller while building equity, often bypassing traditional lenders but carrying higher risk if agreements are not clearly defined. Both options serve buyers with limited credit, but lease to own typically offers more structured protections and clearer terms.

Connection

Lease to own models and land contracts both serve as alternative pathways to homeownership by allowing buyers to occupy property while making payments over time. In lease to own agreements, tenants pay rent with an option to purchase the property later, often with part of the rent credited toward the purchase price. Land contracts involve buyers making installment payments directly to the seller while gaining equitable title, with full ownership transferring only after completion of all payments.

Key Terms

Purchase Agreement

A land contract is a purchase agreement where the buyer takes possession of the property and makes payments directly to the seller until the full price is paid, while a lease-to-own model involves renting with an option to buy later, often with rent credits applied to the purchase price. In a land contract, ownership transfers only after the final payment, making it essential to understand the specific terms and rights outlined in the contract. Explore detailed comparisons of purchase agreements to determine which model best suits your real estate needs.

Option to Purchase

Land contracts and lease-to-own models both offer an Option to Purchase, granting buyers the right to acquire property after fulfilling specific terms. Land contracts typically involve direct seller financing with installment payments applied toward ownership, while lease-to-own agreements combine rental payments with future purchase credits. Explore detailed comparisons to determine which Option to Purchase model best fits your property acquisition needs.

Seller Financing

Land contracts and lease-to-own models are popular seller financing options that allow buyers to acquire property with flexible payment terms directly negotiated with the seller. Land contracts transfer equitable title upon full payment, while lease-to-own agreements combine rental payments with an option to purchase, often requiring a separate purchase agreement. Explore detailed comparisons to understand which seller financing strategy best suits your real estate investment goals.

Source and External Links

Land Contracts: What They Are and How They Work - Explains how land contracts work as seller-financed alternatives to traditional mortgages, including traditional and wrap-around contracts.

Land Contract - Describes land contracts as agreements where sellers provide financing to buyers, with the seller retaining legal title until the purchase price is fully paid.

What Is a Land Contract and How Does It Work? - Discusses how land contracts function, including the risks associated with them and the different types, such as traditional and wrap-around contracts.

dowidth.com

dowidth.com