Sale leaseback transactions involve a company selling an asset and simultaneously leasing it back, providing liquidity without losing operational control, while purchase and sale agreements focus on the transfer of property ownership from seller to buyer under agreed terms. Sale leasebacks are popular in commercial real estate for freeing up capital, whereas purchase and sale agreements are fundamental in traditional property acquisitions, detailing conditions like price, contingencies, and closing dates. Explore the benefits and considerations of each method to determine the best strategy for your real estate needs.

Why it is important

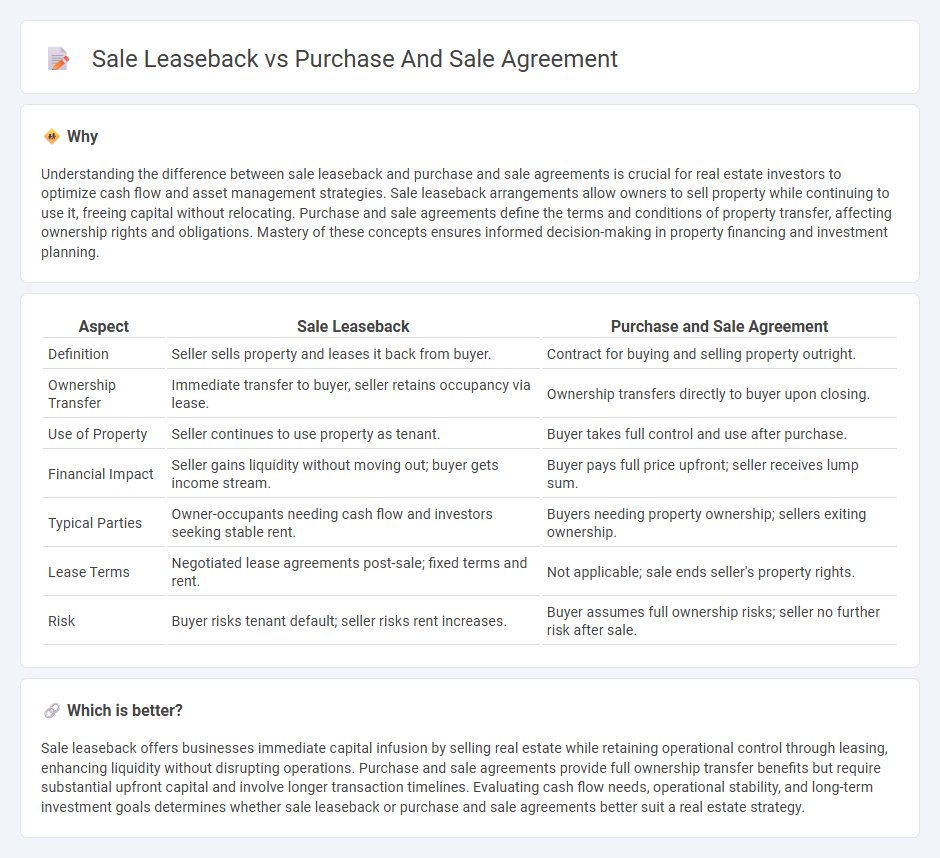

Understanding the difference between sale leaseback and purchase and sale agreements is crucial for real estate investors to optimize cash flow and asset management strategies. Sale leaseback arrangements allow owners to sell property while continuing to use it, freeing capital without relocating. Purchase and sale agreements define the terms and conditions of property transfer, affecting ownership rights and obligations. Mastery of these concepts ensures informed decision-making in property financing and investment planning.

Comparison Table

| Aspect | Sale Leaseback | Purchase and Sale Agreement |

|---|---|---|

| Definition | Seller sells property and leases it back from buyer. | Contract for buying and selling property outright. |

| Ownership Transfer | Immediate transfer to buyer, seller retains occupancy via lease. | Ownership transfers directly to buyer upon closing. |

| Use of Property | Seller continues to use property as tenant. | Buyer takes full control and use after purchase. |

| Financial Impact | Seller gains liquidity without moving out; buyer gets income stream. | Buyer pays full price upfront; seller receives lump sum. |

| Typical Parties | Owner-occupants needing cash flow and investors seeking stable rent. | Buyers needing property ownership; sellers exiting ownership. |

| Lease Terms | Negotiated lease agreements post-sale; fixed terms and rent. | Not applicable; sale ends seller's property rights. |

| Risk | Buyer risks tenant default; seller risks rent increases. | Buyer assumes full ownership risks; seller no further risk after sale. |

Which is better?

Sale leaseback offers businesses immediate capital infusion by selling real estate while retaining operational control through leasing, enhancing liquidity without disrupting operations. Purchase and sale agreements provide full ownership transfer benefits but require substantial upfront capital and involve longer transaction timelines. Evaluating cash flow needs, operational stability, and long-term investment goals determines whether sale leaseback or purchase and sale agreements better suit a real estate strategy.

Connection

Sale leaseback and purchase and sale agreement are connected through the transfer of property ownership and subsequent leasing arrangements. In a sale leaseback transaction, the seller transfers property ownership to the buyer via a purchase and sale agreement, then leases the property back from the buyer to continue occupancy. This arrangement provides the seller with immediate capital while allowing the buyer to secure a stable tenant and predictable income stream.

Key Terms

**Purchase and Sale Agreement:**

A Purchase and Sale Agreement (PSA) is a legally binding contract outlining the terms and conditions for transferring ownership of assets or property from seller to buyer, including price, payment terms, and closing date. It ensures clear title transfer and defines obligations, representations, and warranties to protect both parties throughout the transaction process. Explore the key differences and advantages by learning more about how Purchase and Sale Agreements compare to sale-leaseback arrangements.

Earnest Money

In a purchase and sale agreement, earnest money serves as a deposit demonstrating the buyer's serious intent and is typically held in escrow until closing or forfeited upon default. In a sale leaseback transaction, earnest money may be less emphasized or structured differently since the seller simultaneously becomes the lessee, focusing more on lease terms post-sale. Explore detailed comparisons of earnest money roles to optimize contractual negotiations.

Contingencies

Purchase and sale agreements typically include contingencies such as financing, inspections, and due diligence periods that protect the buyer and seller until certain conditions are met. In sale leaseback transactions, contingencies often focus on lease terms, tenant rights, and the continued use of the property, ensuring the seller remains the tenant post-sale. Explore more about how contingencies affect these agreements to make informed real estate decisions.

Source and External Links

What is a Purchase and Sale Agreement? - Icertis - A purchase and sale agreement (PSA) is a binding contract outlining how property or assets transfer between buyer and seller, including details like parties involved, property description, purchase price, and payment terms to protect both parties' interests.

Real estate purchase and sale agreement - Rocket Mortgage - A PSA is a detailed document signed after buyer and seller agree on price and terms in a real estate transaction, specifying earnest money deposit, contingencies, closing date, and other conditions necessary to proceed to closing.

Purchase agreement vs contract of sale | PandaDoc Blog - A purchase agreement outlines sale details before transfer of goods or property occurs, serving as a legal contract to protect buyers and sellers until transaction conditions are met, whereas a contract of sale finalizes ownership transfer immediately upon signing in some cases.

dowidth.com

dowidth.com