Blockchain technology revolutionizes mortgage processing by enhancing transparency, reducing fraud, and accelerating transaction times in real estate. Traditional mortgage procedures often involve lengthy paperwork and multiple intermediaries, whereas blockchain streamlines verification and securely records property ownership. Discover how integrating blockchain can transform real estate finance and mortgage workflows.

Why it is important

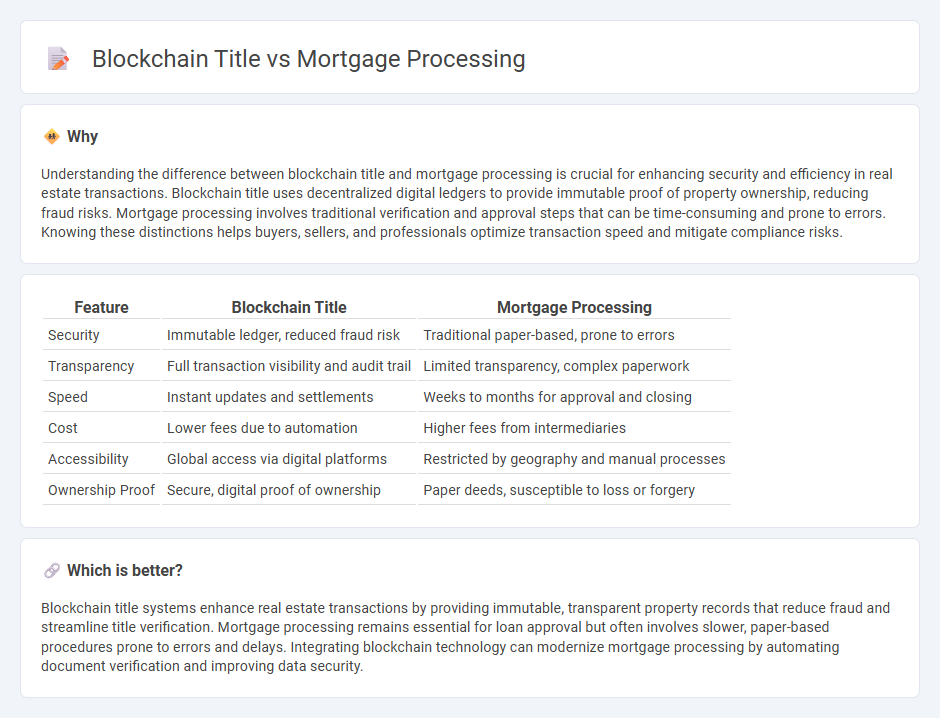

Understanding the difference between blockchain title and mortgage processing is crucial for enhancing security and efficiency in real estate transactions. Blockchain title uses decentralized digital ledgers to provide immutable proof of property ownership, reducing fraud risks. Mortgage processing involves traditional verification and approval steps that can be time-consuming and prone to errors. Knowing these distinctions helps buyers, sellers, and professionals optimize transaction speed and mitigate compliance risks.

Comparison Table

| Feature | Blockchain Title | Mortgage Processing |

|---|---|---|

| Security | Immutable ledger, reduced fraud risk | Traditional paper-based, prone to errors |

| Transparency | Full transaction visibility and audit trail | Limited transparency, complex paperwork |

| Speed | Instant updates and settlements | Weeks to months for approval and closing |

| Cost | Lower fees due to automation | Higher fees from intermediaries |

| Accessibility | Global access via digital platforms | Restricted by geography and manual processes |

| Ownership Proof | Secure, digital proof of ownership | Paper deeds, susceptible to loss or forgery |

Which is better?

Blockchain title systems enhance real estate transactions by providing immutable, transparent property records that reduce fraud and streamline title verification. Mortgage processing remains essential for loan approval but often involves slower, paper-based procedures prone to errors and delays. Integrating blockchain technology can modernize mortgage processing by automating document verification and improving data security.

Connection

Blockchain technology revolutionizes title and mortgage processing by enhancing transparency, security, and efficiency in real estate transactions. Blockchain-based title systems ensure immutable records, reducing fraud and disputes, while smart contracts automate mortgage approvals and payments, streamlining the entire lending process. Integrating blockchain reduces processing times from weeks to days and lowers costs by minimizing intermediaries, creating a more reliable and faster real estate market.

Key Terms

Loan Origination

Mortgage processing in loan origination traditionally involves manual verification, documentation, and approval steps that can take weeks to complete. Blockchain technology streamlines loan origination by providing secure, transparent, and immutable records, reducing fraud risk and accelerating transaction times. Explore how blockchain transforms mortgage loan origination for faster, more reliable processing.

Smart Contracts

Smart contracts revolutionize mortgage processing by automating title verification, payment schedules, and escrow management, reducing errors and enhancing transparency on blockchain networks. Traditional mortgage processing often relies on manual title checks and intermediaries, causing delays and increasing costs. Explore how smart contracts streamline title handling and secure mortgage transactions for a more efficient lending experience.

Title Deed Verification

Title deed verification in mortgage processing traditionally involves manual document checks, which can be time-consuming and prone to errors. Blockchain technology offers a transparent, tamper-proof ledger that automates and secures the verification process through decentralized record-keeping. Explore how blockchain enhances accuracy and efficiency in title deed verification.

Source and External Links

Explaining the Home Loan Process Part 3 - Pennymac - Mortgage processing is the step after loan application where loan processors verify your income and documentation, order credit reports and appraisals, and ensure compliance with all regulations before submitting to underwriting for final approval.

What is a mortgage processor, and what do they do? - A mortgage processor organizes and reviews all required loan documents after application and before underwriting, verifying accuracy and completeness while acting as an intermediary between the loan officer and underwriter.

The Mortgage Process: A 10-Step Guide | LendingTree - Mortgage processing involves steps like gathering your financial documents (pay stubs, tax returns, bank statements), ordering credit checks and appraisals, and ultimately preparing your loan for underwriting and approval.

dowidth.com

dowidth.com