Single family rental portfolios offer stable cash flow and strong tenant demand fueled by housing shortages and shifting demographics. Industrial property portfolios benefit from robust e-commerce growth, driving high occupancy rates and long-term lease agreements. Explore the unique advantages and investment strategies of each portfolio type to maximize your real estate returns.

Why it is important

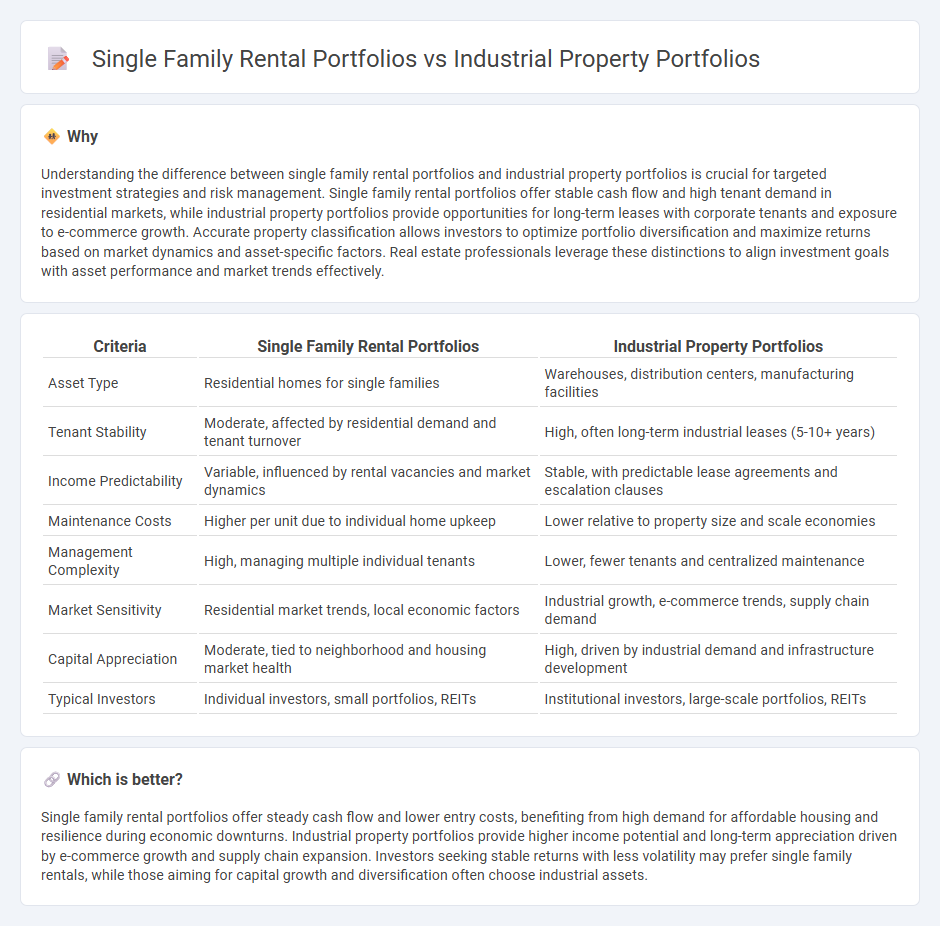

Understanding the difference between single family rental portfolios and industrial property portfolios is crucial for targeted investment strategies and risk management. Single family rental portfolios offer stable cash flow and high tenant demand in residential markets, while industrial property portfolios provide opportunities for long-term leases with corporate tenants and exposure to e-commerce growth. Accurate property classification allows investors to optimize portfolio diversification and maximize returns based on market dynamics and asset-specific factors. Real estate professionals leverage these distinctions to align investment goals with asset performance and market trends effectively.

Comparison Table

| Criteria | Single Family Rental Portfolios | Industrial Property Portfolios |

|---|---|---|

| Asset Type | Residential homes for single families | Warehouses, distribution centers, manufacturing facilities |

| Tenant Stability | Moderate, affected by residential demand and tenant turnover | High, often long-term industrial leases (5-10+ years) |

| Income Predictability | Variable, influenced by rental vacancies and market dynamics | Stable, with predictable lease agreements and escalation clauses |

| Maintenance Costs | Higher per unit due to individual home upkeep | Lower relative to property size and scale economies |

| Management Complexity | High, managing multiple individual tenants | Lower, fewer tenants and centralized maintenance |

| Market Sensitivity | Residential market trends, local economic factors | Industrial growth, e-commerce trends, supply chain demand |

| Capital Appreciation | Moderate, tied to neighborhood and housing market health | High, driven by industrial demand and infrastructure development |

| Typical Investors | Individual investors, small portfolios, REITs | Institutional investors, large-scale portfolios, REITs |

Which is better?

Single family rental portfolios offer steady cash flow and lower entry costs, benefiting from high demand for affordable housing and resilience during economic downturns. Industrial property portfolios provide higher income potential and long-term appreciation driven by e-commerce growth and supply chain expansion. Investors seeking stable returns with less volatility may prefer single family rentals, while those aiming for capital growth and diversification often choose industrial assets.

Connection

Single family rental portfolios and industrial property portfolios are connected through their role in diversified real estate investment strategies, targeting stable income streams and long-term capital appreciation. Both asset classes benefit from demographic trends, such as population growth driving housing demand and e-commerce fueling industrial space needs for logistics and distribution. Integrating these portfolios allows investors to balance residential rental income stability with the growth potential of industrial real estate driven by supply chain expansion.

Key Terms

Diversification

Industrial property portfolios offer substantial diversification benefits by encompassing various sectors such as manufacturing, warehousing, and logistics, reducing sector-specific risks compared to single family rental portfolios. Single family rental portfolios, while providing stable cash flow through residential leasing, are more concentrated in housing market dynamics, making them vulnerable to localized economic shifts. Explore the strategic advantages and risk profiles of industrial versus single family rental portfolios to optimize your investment diversification.

Asset Management

Industrial property portfolios demand robust asset management strategies emphasizing operational efficiency, lease optimization, and tenant retention to maximize long-term returns. In contrast, single family rental portfolios require focused asset management on property maintenance, tenant relations, and localized market dynamics to ensure stable cash flow and value appreciation. Discover in-depth techniques tailored to each portfolio type to enhance overall asset performance and investment yield.

Tenant Profile

Industrial property portfolios typically feature long-term leases with corporate tenants such as logistics companies, manufacturers, and distribution centers, offering stable and predictable cash flow. Single family rental portfolios attract individual or family tenants with varying lease terms and higher turnover rates, influencing income consistency and management complexity. Explore detailed analyses to understand tenant profiles' impact on investment strategies and portfolio performance.

Source and External Links

Investcorp Grows U.S. Industrial Portfolio with Acquisitions in Minneapolis, Baltimore - Investcorp has acquired two major industrial portfolios, totaling 27 properties and 2.7 million square feet in Minneapolis and Baltimore, to expand its presence in key U.S. markets with strong fundamentals and high rent growth.

Scaling an Industrial Real Estate Portfolio: Tips for Investors Looking to Grow - Effective scaling of an industrial real estate portfolio requires strategic diversification across property types and geographies, an understanding of market trends, and disciplined timing for acquisitions and sales.

The Ultimate Guide to Industrial Real Estate - Industrial property portfolios can include Class A, B, and C buildings, each offering different risk-return profiles, with Class B and C assets often presenting value-add or conversion opportunities for savvy investors.

dowidth.com

dowidth.com