Institutional landlords typically manage large-scale commercial properties with diversified portfolios, focusing on maximizing rental income and long-term asset appreciation. Pension fund landlords invest in real estate to generate steady, long-term returns that support retirement benefits, often favoring stable, income-producing properties like office buildings and multifamily units. Explore the nuances and strategic differences between these two landlord types to optimize real estate investment decisions.

Why it is important

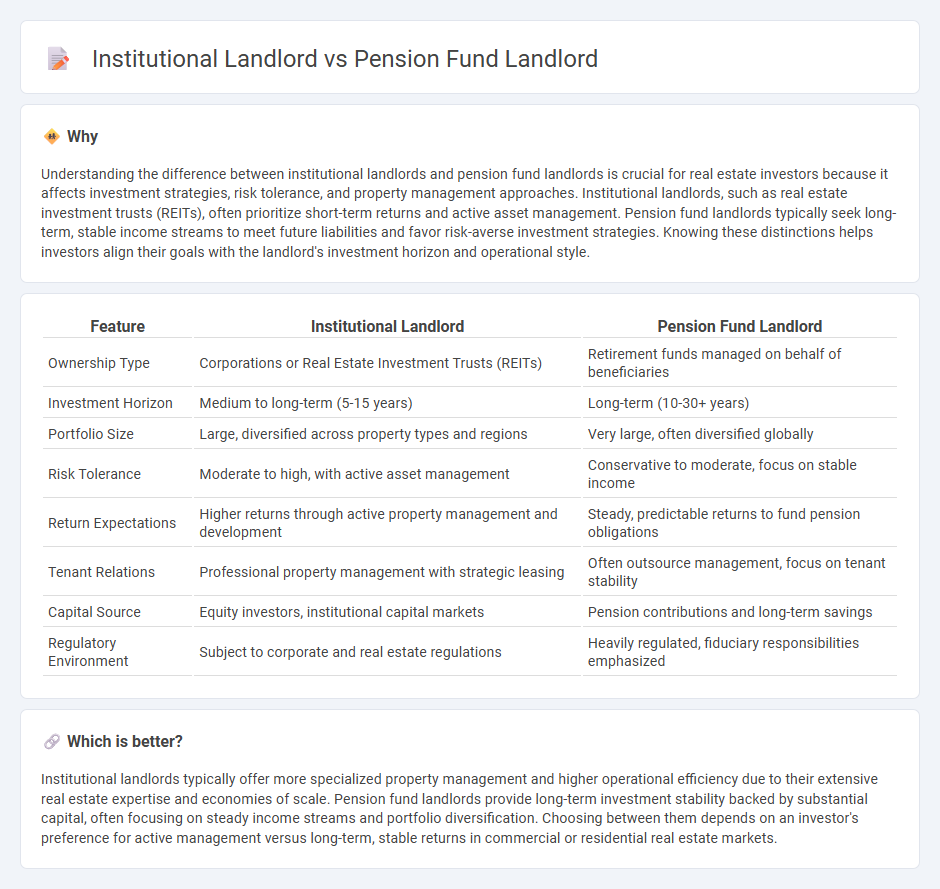

Understanding the difference between institutional landlords and pension fund landlords is crucial for real estate investors because it affects investment strategies, risk tolerance, and property management approaches. Institutional landlords, such as real estate investment trusts (REITs), often prioritize short-term returns and active asset management. Pension fund landlords typically seek long-term, stable income streams to meet future liabilities and favor risk-averse investment strategies. Knowing these distinctions helps investors align their goals with the landlord's investment horizon and operational style.

Comparison Table

| Feature | Institutional Landlord | Pension Fund Landlord |

|---|---|---|

| Ownership Type | Corporations or Real Estate Investment Trusts (REITs) | Retirement funds managed on behalf of beneficiaries |

| Investment Horizon | Medium to long-term (5-15 years) | Long-term (10-30+ years) |

| Portfolio Size | Large, diversified across property types and regions | Very large, often diversified globally |

| Risk Tolerance | Moderate to high, with active asset management | Conservative to moderate, focus on stable income |

| Return Expectations | Higher returns through active property management and development | Steady, predictable returns to fund pension obligations |

| Tenant Relations | Professional property management with strategic leasing | Often outsource management, focus on tenant stability |

| Capital Source | Equity investors, institutional capital markets | Pension contributions and long-term savings |

| Regulatory Environment | Subject to corporate and real estate regulations | Heavily regulated, fiduciary responsibilities emphasized |

Which is better?

Institutional landlords typically offer more specialized property management and higher operational efficiency due to their extensive real estate expertise and economies of scale. Pension fund landlords provide long-term investment stability backed by substantial capital, often focusing on steady income streams and portfolio diversification. Choosing between them depends on an investor's preference for active management versus long-term, stable returns in commercial or residential real estate markets.

Connection

Institutional landlords and pension fund landlords are interconnected through their investment strategies, as pension funds allocate significant capital into real estate portfolios managed by institutional landlords to achieve stable, long-term returns. Institutional landlords specialize in acquiring, managing, and optimizing large-scale commercial and residential properties on behalf of pension funds, leveraging their expertise to enhance asset performance and generate consistent income streams. This symbiotic relationship supports pension funds' objectives of risk diversification and steady cash flows while allowing institutional landlords to scale property management operations and maximize portfolio value.

Key Terms

Capital Allocation

Pension fund landlords primarily allocate capital with a long-term perspective, balancing stable income generation and risk mitigation to meet future retirement obligations. Institutional landlords, including insurance companies and REITs, often pursue a more diversified and active capital allocation strategy, targeting higher returns through dynamic asset management and market timing. Explore how these differing capital allocation approaches impact portfolio performance and investment outcomes.

Asset Management

Pension fund landlords prioritize long-term asset growth and stable income through strategic property acquisitions and proactive portfolio diversification, leveraging sophisticated asset management frameworks to optimize returns. Institutional landlords, such as REITs and insurance companies, emphasize liquidity, market responsiveness, and scalable asset management practices to balance risk and maximized value extraction. Explore detailed comparisons to understand how asset management strategies differ between pension funds and institutional landlords.

Risk Profile

Pension fund landlords typically exhibit a lower risk profile due to their long-term investment horizons and conservative asset allocation strategies, favoring stable, income-generating properties. Institutional landlords may balance higher risk and return by diversifying portfolios across various real estate sectors, including opportunistic and value-added assets. Explore deeper insights on how risk profiles influence landlord investment decisions and portfolio management strategies.

Source and External Links

Parsonage Financial's Guide to Property Within a Pension - A pension fund can become a landlord by buying property and leasing it either to your own business or a third party, thus generating rental income that goes directly into the pension fund.

Pension Funded Properties (SIPS & SASS) | Solicitors - Using a self-invested pension scheme to buy business premises allows your pension to act as the landlord, receiving rent tax-free while providing tax advantages and investment growth potential.

How to Invest in Property Through Your Pension Fund - Investing your pension fund in property requires choosing the right pension structure such as a SIPP or SSAS, ensuring pension eligibility, and possibly combining pension funding with borrowing to purchase real estate.

dowidth.com

dowidth.com