Sale leaseback allows property owners to sell their real estate while continuing to occupy the space through a lease, freeing up capital without disrupting operations. Option to purchase grants a tenant the right, but not the obligation, to buy the property within a specified timeframe, providing flexibility and potential investment advantage. Explore the differences between these strategies to determine which real estate solution aligns with your financial and operational goals.

Why it is important

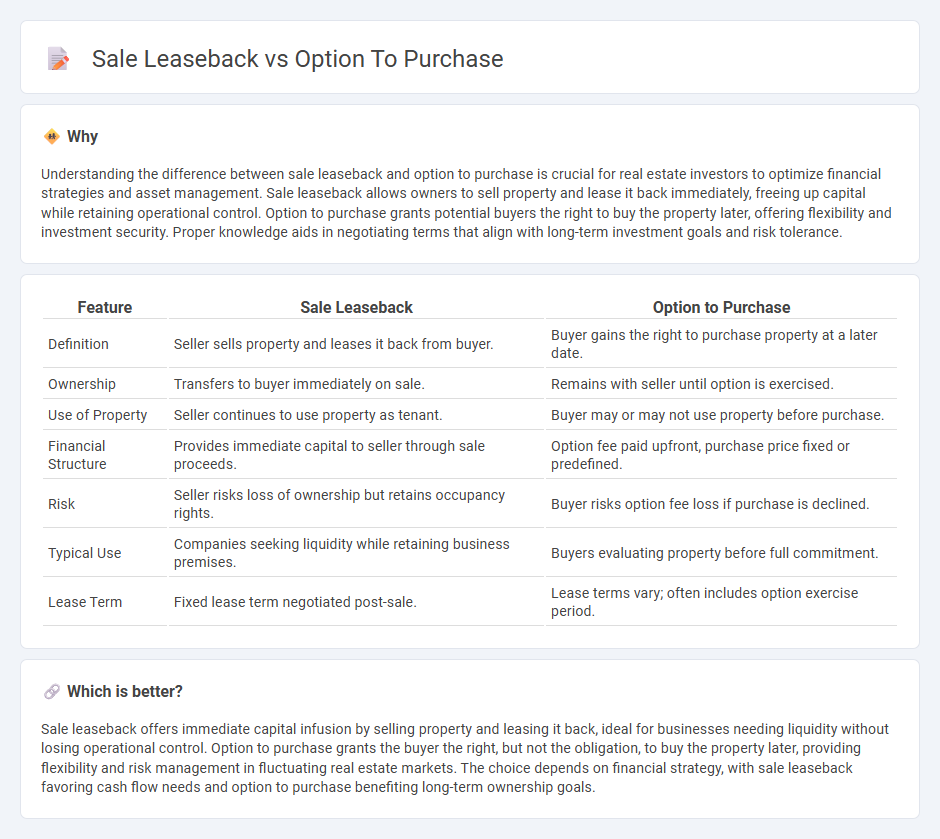

Understanding the difference between sale leaseback and option to purchase is crucial for real estate investors to optimize financial strategies and asset management. Sale leaseback allows owners to sell property and lease it back immediately, freeing up capital while retaining operational control. Option to purchase grants potential buyers the right to buy the property later, offering flexibility and investment security. Proper knowledge aids in negotiating terms that align with long-term investment goals and risk tolerance.

Comparison Table

| Feature | Sale Leaseback | Option to Purchase |

|---|---|---|

| Definition | Seller sells property and leases it back from buyer. | Buyer gains the right to purchase property at a later date. |

| Ownership | Transfers to buyer immediately on sale. | Remains with seller until option is exercised. |

| Use of Property | Seller continues to use property as tenant. | Buyer may or may not use property before purchase. |

| Financial Structure | Provides immediate capital to seller through sale proceeds. | Option fee paid upfront, purchase price fixed or predefined. |

| Risk | Seller risks loss of ownership but retains occupancy rights. | Buyer risks option fee loss if purchase is declined. |

| Typical Use | Companies seeking liquidity while retaining business premises. | Buyers evaluating property before full commitment. |

| Lease Term | Fixed lease term negotiated post-sale. | Lease terms vary; often includes option exercise period. |

Which is better?

Sale leaseback offers immediate capital infusion by selling property and leasing it back, ideal for businesses needing liquidity without losing operational control. Option to purchase grants the buyer the right, but not the obligation, to buy the property later, providing flexibility and risk management in fluctuating real estate markets. The choice depends on financial strategy, with sale leaseback favoring cash flow needs and option to purchase benefiting long-term ownership goals.

Connection

Sale leaseback and option to purchase are connected through their collaborative roles in real estate financing strategies, where the property owner sells the asset and leases it back to maintain operational use, while the option to purchase grants the lessee the right to buy the property later at predetermined terms. This combination allows businesses to unlock capital tied in real estate while retaining occupancy and control with the potential for future ownership. Investors and companies leverage these mechanisms to optimize liquidity, manage risk, and align long-term property planning with financial objectives.

Key Terms

Purchase Price

Option to purchase agreements specify a predetermined purchase price, providing clear financial expectations for buyers and sellers, often aligned with market value or an agreed-upon amount. Sale leaseback transactions involve an initial sale at the current market value, with the original owner leasing the property back, allowing for immediate capital infusion while retaining operational control. Explore more to understand how these structures impact financial planning and asset management.

Lease Agreement

An option to purchase in a lease agreement grants the lessee the right to buy the leased asset at a predetermined price during or at the end of the lease term, providing flexibility for future ownership. A sale leaseback involves the owner selling the asset to a buyer and immediately leasing it back, converting ownership into a lease liability while maintaining operational use. Understanding the nuances of these lease agreement structures can significantly impact financial planning and asset management; explore detailed comparisons to optimize your leasing strategy.

Option Period

The Option Period in an Option to Purchase agreement defines a specific timeframe during which the buyer can exercise their right to buy the property, typically providing flexibility and control over the acquisition timing. In contrast, a Sale Leaseback transaction involves the seller immediately leasing the property back from the buyer, with no separate Option Period, as ownership transitions instantly upon sale. Explore further to understand how these differing timelines impact financial planning and operational strategy.

Source and External Links

What is a Purchase Option - Agreement Requirements California - A purchase option in real estate law is a written agreement included in a lease or other contract, giving the tenant or buyer the right to purchase the property at a predetermined or appraised price within a set time, binding on successors and enforceable even if the landlord dies during the lease term.

Option To Purchase & Right Of First Refusal - An option to purchase agreement grants an exclusive right to buy property within a specified period for a fixed or sometimes variable price, preventing the seller from selling to others during that time, with several types including straight options and letter of credit options available.

Purchase Options - WeConservePA Library - A purchase option is a contractual right to buy property at a certain price within a certain time frame without obligation, ensuring the property is not sold or developed during the option period and commonly used in real estate and conservation land transactions.

dowidth.com

dowidth.com