Single family rental portfolios offer diversified residential properties that cater to long-term tenants seeking privacy and space, often resulting in stable cash flows and lower turnover rates. In contrast, student housing portfolios focus on high-density units near universities, generating consistent demand driven by academic calendars but facing seasonal occupancy fluctuations. Explore the unique advantages and challenges of each investment type to optimize your real estate portfolio strategy.

Why it is important

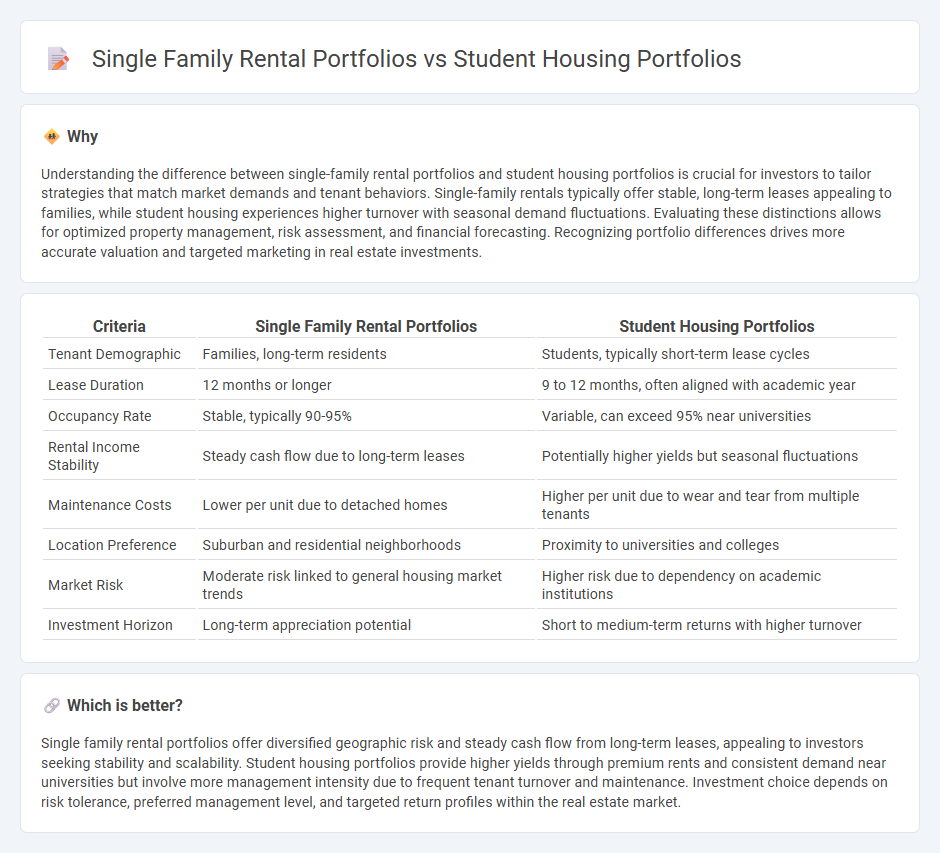

Understanding the difference between single-family rental portfolios and student housing portfolios is crucial for investors to tailor strategies that match market demands and tenant behaviors. Single-family rentals typically offer stable, long-term leases appealing to families, while student housing experiences higher turnover with seasonal demand fluctuations. Evaluating these distinctions allows for optimized property management, risk assessment, and financial forecasting. Recognizing portfolio differences drives more accurate valuation and targeted marketing in real estate investments.

Comparison Table

| Criteria | Single Family Rental Portfolios | Student Housing Portfolios |

|---|---|---|

| Tenant Demographic | Families, long-term residents | Students, typically short-term lease cycles |

| Lease Duration | 12 months or longer | 9 to 12 months, often aligned with academic year |

| Occupancy Rate | Stable, typically 90-95% | Variable, can exceed 95% near universities |

| Rental Income Stability | Steady cash flow due to long-term leases | Potentially higher yields but seasonal fluctuations |

| Maintenance Costs | Lower per unit due to detached homes | Higher per unit due to wear and tear from multiple tenants |

| Location Preference | Suburban and residential neighborhoods | Proximity to universities and colleges |

| Market Risk | Moderate risk linked to general housing market trends | Higher risk due to dependency on academic institutions |

| Investment Horizon | Long-term appreciation potential | Short to medium-term returns with higher turnover |

Which is better?

Single family rental portfolios offer diversified geographic risk and steady cash flow from long-term leases, appealing to investors seeking stability and scalability. Student housing portfolios provide higher yields through premium rents and consistent demand near universities but involve more management intensity due to frequent tenant turnover and maintenance. Investment choice depends on risk tolerance, preferred management level, and targeted return profiles within the real estate market.

Connection

Single family rental portfolios and student housing portfolios share a strong connection through their focus on residential real estate investments targeting specific tenant demographics. Both asset classes prioritize consistent cash flow, property management efficiency, and long-term appreciation in suburban or urban markets near universities and employment centers. Investors leverage data analytics and market trends to optimize occupancy rates and reduce vacancy risk across these complementary housing segments.

Key Terms

Occupancy Rates

Student housing portfolios consistently achieve higher occupancy rates, often exceeding 95%, driven by strong demand during academic terms and shorter vacancy periods between leases. Single family rental portfolios typically experience variable occupancy rates, averaging around 90%, influenced by broader market conditions and tenant turnover cycles. Explore detailed occupancy trends and performance metrics in student housing versus single family rentals to optimize your investment strategy.

Lease Structure

Student housing portfolios typically feature shorter lease terms aligned with academic calendars, often spanning 9 to 12 months, fostering higher tenant turnover but consistent demand. Single-family rental portfolios generally offer 12-month leases, providing stable occupancy and predictable cash flow, though with less frequent tenant turnover. Explore the nuances of lease structures to optimize your investment strategy in both housing markets.

Property Management

Student housing portfolios demand specialized property management strategies due to high turnover rates and the need for community engagement, contrasting with single family rental portfolios that emphasize long-term tenant retention and individualized maintenance. Efficient property managers in student housing utilize streamlined leasing processes and leverage technology for tenant communications, while single family rental managers prioritize personalized services and property upkeep to maximize investment ROI. Explore detailed comparisons to optimize your property management approach.

Source and External Links

Diversified US Student Housing Portfolio II - This portfolio involves a $260 million acquisition of student housing assets across Texas, Michigan, and Missouri, offering over 2,000 beds near top-rated universities.

GSA Lands $500M for Student Portfolio - Global Student Accommodation secured $500 million for the refinancing of a 23-asset student housing portfolio across the U.S., reinforcing its growth strategy.

Investcorp Expands U.S. Student Housing Portfolio - Investcorp completed four acquisitions totaling nearly 3,000 beds for over $300 million, enhancing its presence at key U.S. universities.

dowidth.com

dowidth.com