Value-add real estate investments focus on properties requiring renovations, repositioning, or operational improvements to increase cash flow and asset value. Stabilized investments involve fully leased, well-maintained properties generating steady income with lower risk. Discover the advantages and strategies behind each approach to make informed real estate investment decisions.

Why it is important

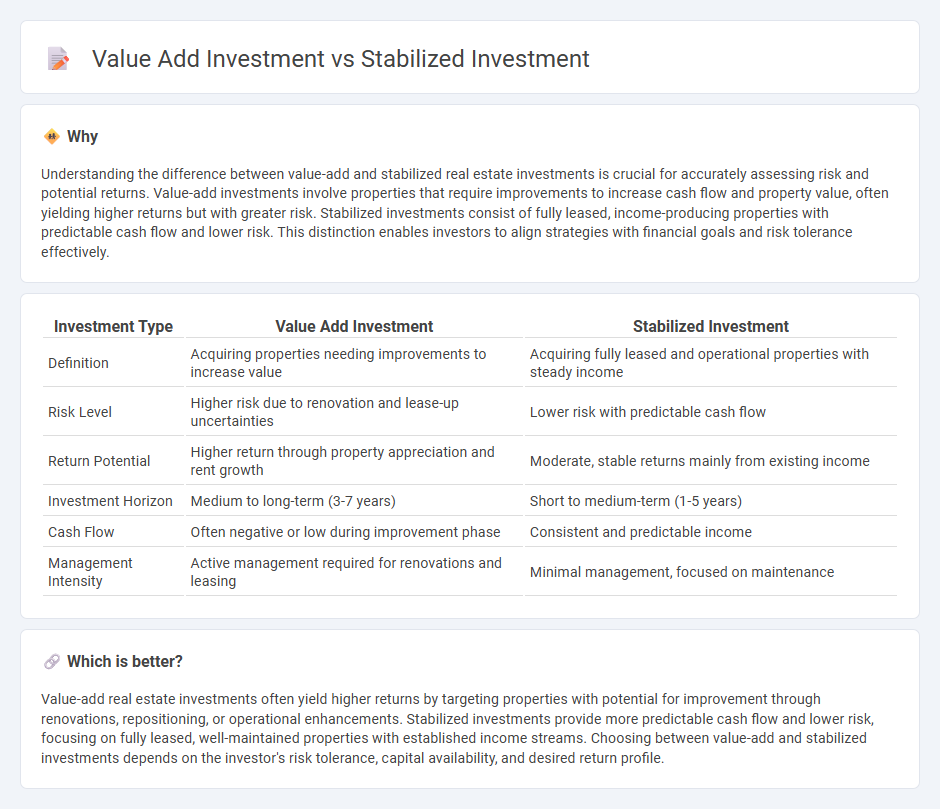

Understanding the difference between value-add and stabilized real estate investments is crucial for accurately assessing risk and potential returns. Value-add investments involve properties that require improvements to increase cash flow and property value, often yielding higher returns but with greater risk. Stabilized investments consist of fully leased, income-producing properties with predictable cash flow and lower risk. This distinction enables investors to align strategies with financial goals and risk tolerance effectively.

Comparison Table

| Investment Type | Value Add Investment | Stabilized Investment |

|---|---|---|

| Definition | Acquiring properties needing improvements to increase value | Acquiring fully leased and operational properties with steady income |

| Risk Level | Higher risk due to renovation and lease-up uncertainties | Lower risk with predictable cash flow |

| Return Potential | Higher return through property appreciation and rent growth | Moderate, stable returns mainly from existing income |

| Investment Horizon | Medium to long-term (3-7 years) | Short to medium-term (1-5 years) |

| Cash Flow | Often negative or low during improvement phase | Consistent and predictable income |

| Management Intensity | Active management required for renovations and leasing | Minimal management, focused on maintenance |

Which is better?

Value-add real estate investments often yield higher returns by targeting properties with potential for improvement through renovations, repositioning, or operational enhancements. Stabilized investments provide more predictable cash flow and lower risk, focusing on fully leased, well-maintained properties with established income streams. Choosing between value-add and stabilized investments depends on the investor's risk tolerance, capital availability, and desired return profile.

Connection

Value-add investments and stabilized investments are connected through their roles in the real estate investment lifecycle, where value-add properties undergo improvements to increase cash flow and property value before reaching a stabilized state. Stabilized investments provide steady income streams with lower risk, often representing the end goal after successful value-add strategies enhance a property's performance and market competitiveness. This progression from value-add to stabilized status maximizes returns by balancing risk with predictable cash flow over time.

Key Terms

Cash Flow

Stabilized investments generate consistent cash flow through fully leased, low-risk properties with steady income streams, while value-add investments improve cash flow by renovating or repositioning underperforming assets to increase rents and occupancy rates. Stabilized assets appeal to investors seeking predictable dividends, whereas value-add investments attract those willing to accept higher risk for potentially greater returns and cash flow growth. Explore detailed strategies and risk profiles to better understand which approach suits your financial goals.

Renovation/Capital Improvements

Stabilized investments typically involve properties with steady income and minimal need for capital improvements, maintaining consistent occupancy rates and cash flow. Value-add investments focus on properties requiring significant renovations or capital improvements to increase property value and generate higher returns. Explore detailed strategies to determine which investment aligns with your portfolio goals.

Occupancy Rate

Stabilized investments typically exhibit high occupancy rates, often above 90%, reflecting steady cash flow and reduced risk for investors seeking predictable returns. Value-add investments, however, usually have lower occupancy rates, ranging from 60% to 80%, presenting an opportunity to increase property value through active management and renovations. Explore detailed strategies for optimizing occupancy rates in both investment types to maximize returns.

Source and External Links

Stabilized or Value-Add Investments: Which Strategy Is Right For You? - Stabilized investments are real estate properties with occupancy typically around 85% or higher and lease terms that generate substantial net cash flow without requiring significant property improvements, offering consistent, predictable returns with a low-risk profile similar to fixed-income investments.

How to Identify a Stabilized Property in Real Estate - A stabilized property is defined by a predictable and sustainable level of occupancy and income that provides investors with consistent rental income and steady cash flow, making it an attractive, lower-risk investment option.

Can a Stabilized Real Estate Asset Yield Strong Returns? - Stabilized real estate assets have completed construction or renovation, reached occupancy above about 90%, and generate strong net operating income, offering less risk but typically lower potential returns compared to development or value-add properties.

dowidth.com

dowidth.com