Proptech solutions revolutionize real estate by integrating digital technologies such as AI-driven property management, virtual tours, and blockchain-based transactions to enhance investment efficiency and tenant experience. Insurtech solutions focus on transforming insurance processes within real estate, offering data-driven risk assessment, automated claims processing, and personalized coverage options for property owners. Explore the distinct advantages of Proptech and Insurtech solutions for smarter real estate management and protection.

Why it is important

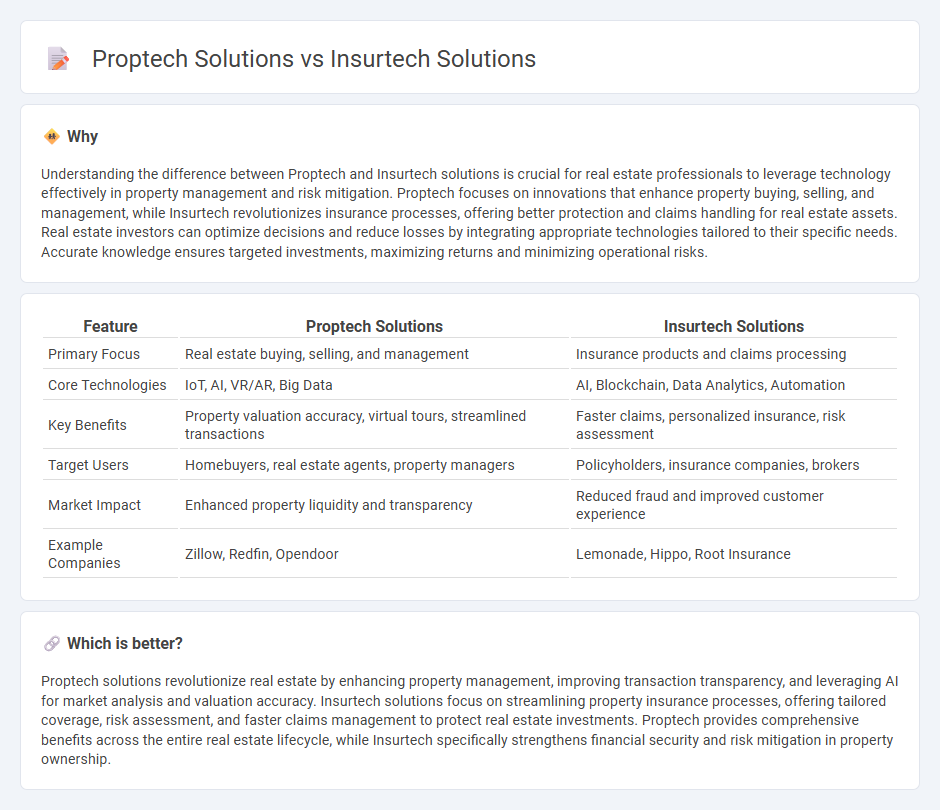

Understanding the difference between Proptech and Insurtech solutions is crucial for real estate professionals to leverage technology effectively in property management and risk mitigation. Proptech focuses on innovations that enhance property buying, selling, and management, while Insurtech revolutionizes insurance processes, offering better protection and claims handling for real estate assets. Real estate investors can optimize decisions and reduce losses by integrating appropriate technologies tailored to their specific needs. Accurate knowledge ensures targeted investments, maximizing returns and minimizing operational risks.

Comparison Table

| Feature | Proptech Solutions | Insurtech Solutions |

|---|---|---|

| Primary Focus | Real estate buying, selling, and management | Insurance products and claims processing |

| Core Technologies | IoT, AI, VR/AR, Big Data | AI, Blockchain, Data Analytics, Automation |

| Key Benefits | Property valuation accuracy, virtual tours, streamlined transactions | Faster claims, personalized insurance, risk assessment |

| Target Users | Homebuyers, real estate agents, property managers | Policyholders, insurance companies, brokers |

| Market Impact | Enhanced property liquidity and transparency | Reduced fraud and improved customer experience |

| Example Companies | Zillow, Redfin, Opendoor | Lemonade, Hippo, Root Insurance |

Which is better?

Proptech solutions revolutionize real estate by enhancing property management, improving transaction transparency, and leveraging AI for market analysis and valuation accuracy. Insurtech solutions focus on streamlining property insurance processes, offering tailored coverage, risk assessment, and faster claims management to protect real estate investments. Proptech provides comprehensive benefits across the entire real estate lifecycle, while Insurtech specifically strengthens financial security and risk mitigation in property ownership.

Connection

Proptech solutions integrate digital technologies to enhance real estate transactions, property management, and market analysis, while Insurtech focuses on innovating insurance processes related to real estate risks and property coverage. Both sectors leverage data analytics, AI, and IoT to streamline underwriting, claims processing, and risk assessment, creating a seamless interface between property ownership and insurance services. This convergence improves transparency, reduces operational costs, and accelerates decision-making for homeowners, investors, and insurers.

Key Terms

Risk Management (Insurtech)

Insurtech solutions leverage advanced data analytics, AI-driven risk assessments, and real-time monitoring to enhance underwriting accuracy and reduce claim fraud, significantly improving risk management outcomes for insurers. Proptech solutions primarily focus on optimizing property management and tenant experiences through IoT, smart building technologies, and automated maintenance systems, indirectly contributing to risk mitigation but with less emphasis on direct risk assessment. Explore our in-depth analysis to understand how these technologies uniquely manage risk in their respective industries.

Smart Property Management (Proptech)

Smart Property Management in Proptech enhances real estate operations through AI-driven maintenance scheduling, tenant communication platforms, and automated rental payments, improving efficiency and tenant satisfaction. Insurtech solutions complement this by offering real-time property insurance updates, risk assessment, and automated claims processing, reducing financial uncertainties. Explore how integrating Insurtech with Proptech can revolutionize property management and insurance processes.

Automated Underwriting (Insurtech)

Insurtech solutions leverage AI-powered automated underwriting to streamline risk assessment, enabling faster policy issuance and reducing operational costs through data-driven decision-making. In contrast, Proptech solutions prioritize property management and real estate transactions, utilizing automation primarily for tenant screening and lease management rather than underwriting risk. Explore the latest advancements in automated underwriting technology to understand its transformative impact on insurance innovation.

Source and External Links

7+ InsurTech Solutions to Explore in 2025: Industry Guide - Aloa - InsurTech solutions streamline insurance processes through API integrations, customer self-service portals, and AI-powered underwriting to improve efficiency and personalize customer experience.

Guide to Insurtech: Technology in the Insurance Industry - Insurtech innovations disrupt traditional insurance by leveraging AI, machine learning, IoT, and big data to enhance underwriting, claims management, cost optimization, and customer service.

39 Insurtech Companies Making Coverage Simpler 2025 | Built In - Various insurtech companies utilize digital platforms, AI, and APIs to simplify insurance distribution, prevent fraud, and improve access to customized policies and claims management.

dowidth.com

dowidth.com