Single family rental portfolios typically consist of individual homes offering privacy and appeal to tenants seeking a suburban lifestyle, with the advantage of easier property management and higher tenant retention rates. Multifamily rental portfolios include apartment complexes or multi-unit buildings, providing diversified income streams and economies of scale that often result in lower per-unit maintenance costs and higher cash flow potential. Explore the benefits and challenges of each investment strategy to make informed real estate decisions.

Why it is important

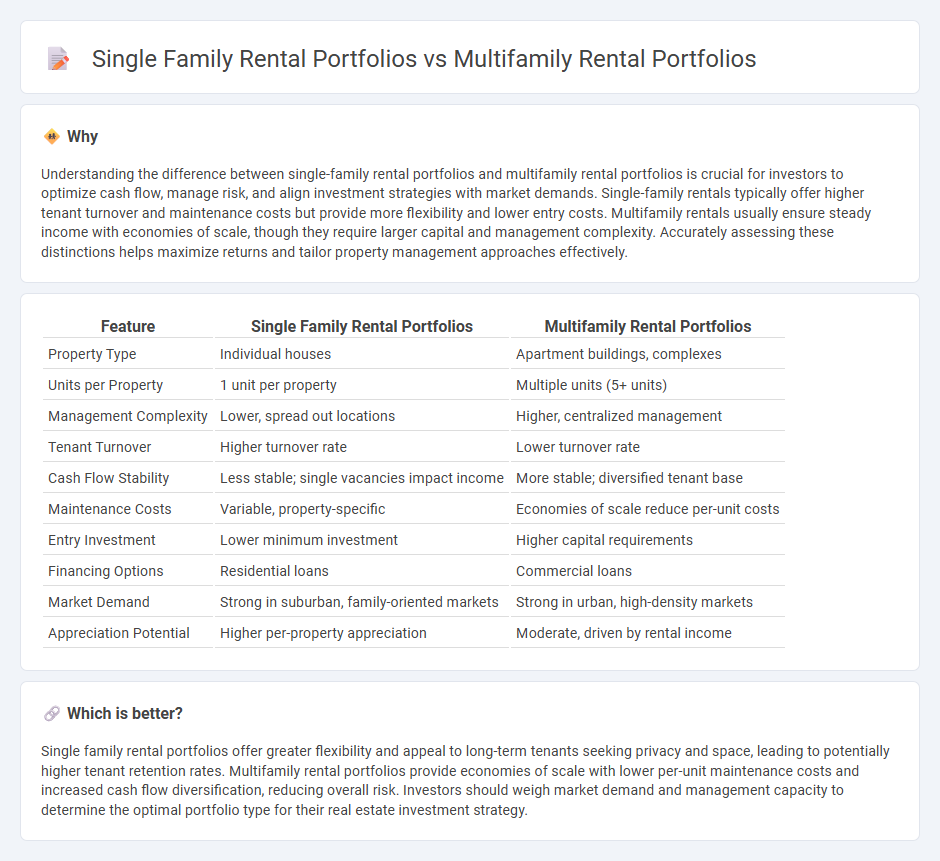

Understanding the difference between single-family rental portfolios and multifamily rental portfolios is crucial for investors to optimize cash flow, manage risk, and align investment strategies with market demands. Single-family rentals typically offer higher tenant turnover and maintenance costs but provide more flexibility and lower entry costs. Multifamily rentals usually ensure steady income with economies of scale, though they require larger capital and management complexity. Accurately assessing these distinctions helps maximize returns and tailor property management approaches effectively.

Comparison Table

| Feature | Single Family Rental Portfolios | Multifamily Rental Portfolios |

|---|---|---|

| Property Type | Individual houses | Apartment buildings, complexes |

| Units per Property | 1 unit per property | Multiple units (5+ units) |

| Management Complexity | Lower, spread out locations | Higher, centralized management |

| Tenant Turnover | Higher turnover rate | Lower turnover rate |

| Cash Flow Stability | Less stable; single vacancies impact income | More stable; diversified tenant base |

| Maintenance Costs | Variable, property-specific | Economies of scale reduce per-unit costs |

| Entry Investment | Lower minimum investment | Higher capital requirements |

| Financing Options | Residential loans | Commercial loans |

| Market Demand | Strong in suburban, family-oriented markets | Strong in urban, high-density markets |

| Appreciation Potential | Higher per-property appreciation | Moderate, driven by rental income |

Which is better?

Single family rental portfolios offer greater flexibility and appeal to long-term tenants seeking privacy and space, leading to potentially higher tenant retention rates. Multifamily rental portfolios provide economies of scale with lower per-unit maintenance costs and increased cash flow diversification, reducing overall risk. Investors should weigh market demand and management capacity to determine the optimal portfolio type for their real estate investment strategy.

Connection

Single family rental portfolios and multifamily rental portfolios are connected through their shared goal of generating steady cash flow from residential real estate investments. Both portfolio types benefit from location analysis, property management efficiencies, and tenant demand trends to maximize occupancy and rental income. Strategic diversification between single family homes and multifamily units helps investors balance risk and achieve scalable growth in rental property holdings.

Key Terms

Economies of Scale

Multifamily rental portfolios leverage economies of scale by reducing per-unit management and maintenance costs compared to single family rental portfolios, which typically have higher variable expenses. Concentrating multiple units within a single location allows for streamlined property management, bulk purchasing, and consistent income streams, enhancing overall investment efficiency. Explore more insights on optimizing rental portfolio strategies for maximum returns.

Tenant Turnover

Multifamily rental portfolios typically experience lower tenant turnover rates compared to single-family rental portfolios due to shared amenities and community living, which promote tenant retention. Single-family rentals often face higher vacancy periods and turnover costs because tenants tend to view these properties as long-term homes, leading to less frequent but more impactful tenant changes. Explore detailed metrics and strategies on managing tenant turnover in multifamily versus single-family rental portfolios to optimize investment returns.

Property Management Complexity

Multifamily rental portfolios typically involve managing multiple units within one or several buildings, requiring coordinated maintenance, tenant communication, and centralized operations, which can streamline property management but increase operational complexity. Single-family rental portfolios often demand individualized attention to each separate property, leading to higher travel times, varying tenant needs, and dispersed maintenance efforts. Explore more insights on effective property management strategies for diverse rental portfolios.

Source and External Links

It's Time to Rebalance Investment Portfolios - This article discusses the benefits of rebalancing investment portfolios with multifamily real estate, highlighting its potential for long-term returns and diversification.

Building A Rental Portfolio with Multi-Family Properties - This guide provides strategies for building a rental portfolio with multifamily properties, focusing on investment strategy and property evaluation.

7 Reasons Multifamily Should Be in Your CRE Portfolio - This article outlines seven benefits of including multifamily properties in a commercial real estate portfolio, including stable cash flow and lower vacancy rates.

dowidth.com

dowidth.com