Tokenized real estate offers fractional ownership of specific properties through blockchain technology, providing direct asset exposure and increased liquidity compared to traditional investments. Real estate ETFs pool diverse property assets, allowing investors to gain broad market exposure with lower entry costs and simplified management. Explore the advantages and differences between tokenized real estate and real estate ETFs to make informed investment choices.

Why it is important

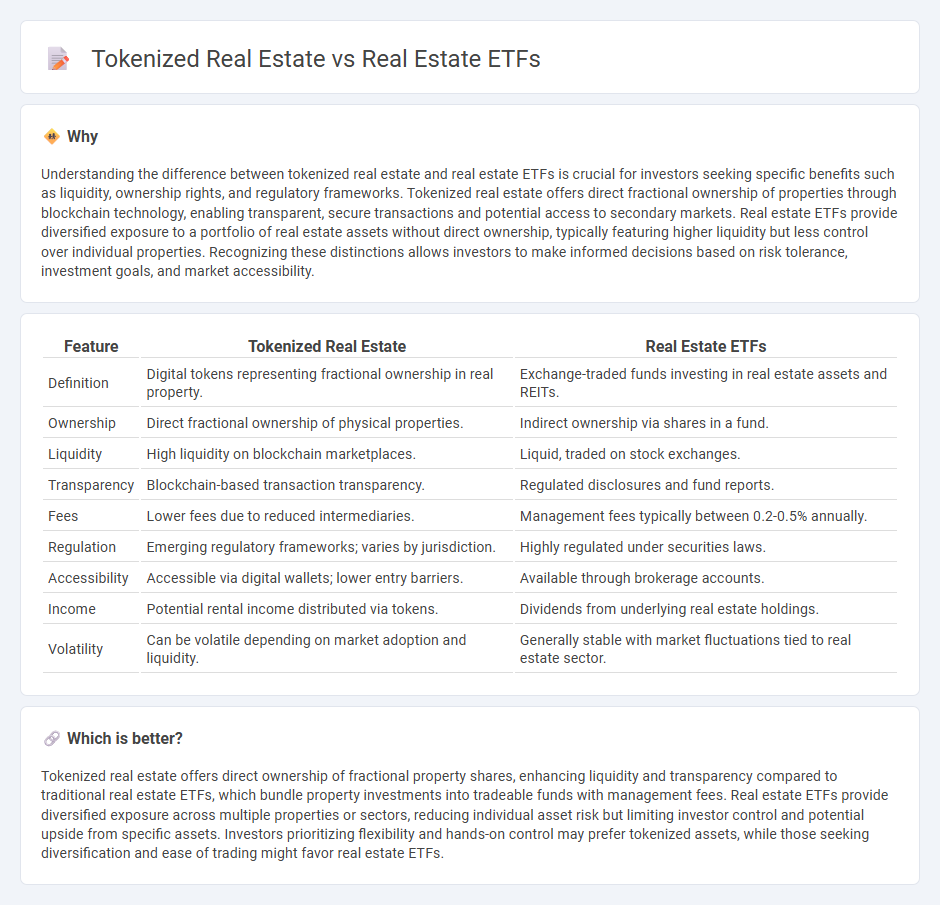

Understanding the difference between tokenized real estate and real estate ETFs is crucial for investors seeking specific benefits such as liquidity, ownership rights, and regulatory frameworks. Tokenized real estate offers direct fractional ownership of properties through blockchain technology, enabling transparent, secure transactions and potential access to secondary markets. Real estate ETFs provide diversified exposure to a portfolio of real estate assets without direct ownership, typically featuring higher liquidity but less control over individual properties. Recognizing these distinctions allows investors to make informed decisions based on risk tolerance, investment goals, and market accessibility.

Comparison Table

| Feature | Tokenized Real Estate | Real Estate ETFs |

|---|---|---|

| Definition | Digital tokens representing fractional ownership in real property. | Exchange-traded funds investing in real estate assets and REITs. |

| Ownership | Direct fractional ownership of physical properties. | Indirect ownership via shares in a fund. |

| Liquidity | High liquidity on blockchain marketplaces. | Liquid, traded on stock exchanges. |

| Transparency | Blockchain-based transaction transparency. | Regulated disclosures and fund reports. |

| Fees | Lower fees due to reduced intermediaries. | Management fees typically between 0.2-0.5% annually. |

| Regulation | Emerging regulatory frameworks; varies by jurisdiction. | Highly regulated under securities laws. |

| Accessibility | Accessible via digital wallets; lower entry barriers. | Available through brokerage accounts. |

| Income | Potential rental income distributed via tokens. | Dividends from underlying real estate holdings. |

| Volatility | Can be volatile depending on market adoption and liquidity. | Generally stable with market fluctuations tied to real estate sector. |

Which is better?

Tokenized real estate offers direct ownership of fractional property shares, enhancing liquidity and transparency compared to traditional real estate ETFs, which bundle property investments into tradeable funds with management fees. Real estate ETFs provide diversified exposure across multiple properties or sectors, reducing individual asset risk but limiting investor control and potential upside from specific assets. Investors prioritizing flexibility and hands-on control may prefer tokenized assets, while those seeking diversification and ease of trading might favor real estate ETFs.

Connection

Tokenized real estate and real estate ETFs both provide innovative ways to invest in property markets by increasing liquidity and accessibility. Tokenized real estate leverages blockchain technology to fractionalize ownership into digital tokens, enabling smaller investments and faster transactions. Real estate ETFs diversify investment across multiple properties or real estate companies, offering lower risk and easier portfolio management while both methods democratize real estate investing.

Key Terms

Liquidity

Real estate ETFs offer high liquidity through public exchanges, enabling investors to buy and sell shares quickly with minimal transaction costs. Tokenized real estate provides liquidity by fractionalizing ownership on blockchain platforms, allowing 24/7 trading but often faces regulatory challenges and limited market depth. Explore in-depth comparisons of liquidity features between these two investment vehicles to enhance your portfolio strategy.

Fractional Ownership

Real estate ETFs offer investors diversified exposure to property markets through shares traded on stock exchanges, allowing fractional ownership in a broad portfolio of assets with high liquidity and lower entry costs. Tokenized real estate leverages blockchain technology to provide direct fractional ownership of individual properties, enhancing transparency, reducing transaction times, and enabling 24/7 global access to real estate investments. Explore deeper insights into how fractional ownership transforms real estate investment strategies with cutting-edge technology.

Regulation

Real estate ETFs operate under stringent SEC regulations, offering investors transparency, liquidity, and protection through registered securities frameworks. Tokenized real estate leverages blockchain technology to enable fractional ownership and faster transactions but faces evolving regulatory scrutiny regarding compliance, investor protections, and anti-money laundering laws. Explore how these regulatory differences impact investment security and market access.

Source and External Links

5 Best-Performing Real Estate ETFs for July 2025 - NerdWallet - Highlights the top-performing real estate ETFs, including JRE, SRVR, and BYRE, offering diversification and liquidity.

The Best REIT ETFs to Buy | Morningstar - Lists top REIT ETFs, such as Vanguard Real Estate ETF, known for low fees and market-cap weighting.

Real Estate ETFs - ETF Database - Provides an overview of real estate ETFs, including various structures and focuses within the US real estate market.

dowidth.com

dowidth.com