Opportunity zones provide tax incentives aimed at spurring investment in designated low-income areas, promoting economic development and job creation. Urban renewal projects focus on revitalizing deteriorated urban neighborhoods through public and private sector collaboration to improve infrastructure and housing. Discover the key differences and benefits of each approach to make informed real estate decisions.

Why it is important

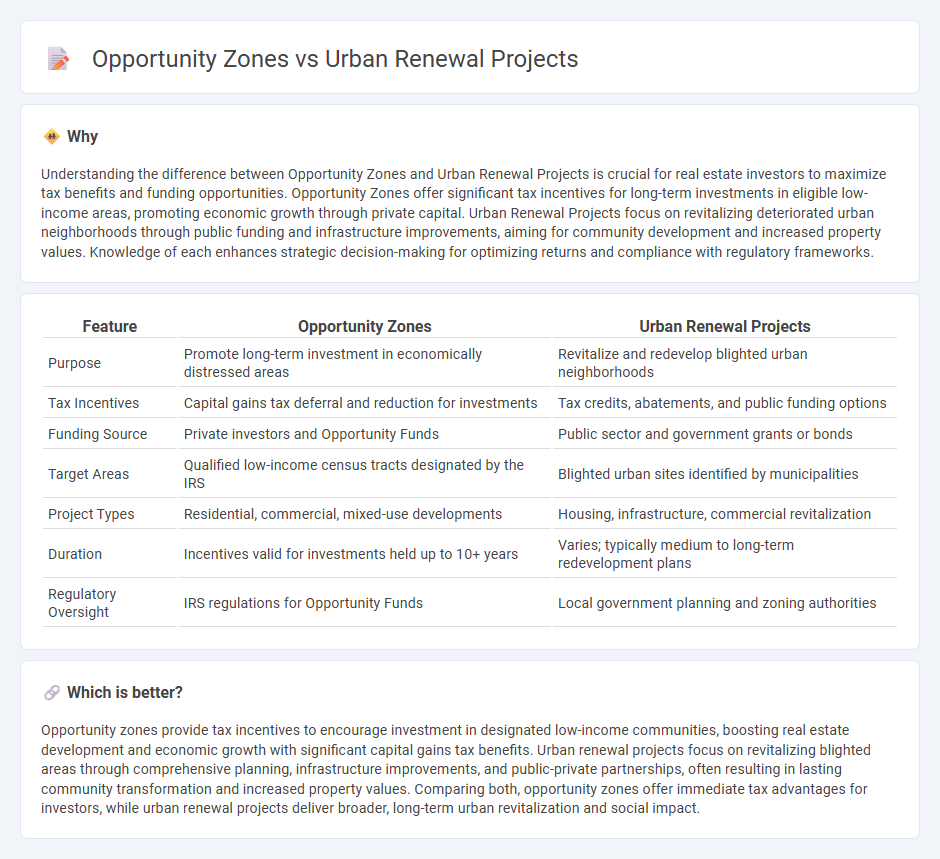

Understanding the difference between Opportunity Zones and Urban Renewal Projects is crucial for real estate investors to maximize tax benefits and funding opportunities. Opportunity Zones offer significant tax incentives for long-term investments in eligible low-income areas, promoting economic growth through private capital. Urban Renewal Projects focus on revitalizing deteriorated urban neighborhoods through public funding and infrastructure improvements, aiming for community development and increased property values. Knowledge of each enhances strategic decision-making for optimizing returns and compliance with regulatory frameworks.

Comparison Table

| Feature | Opportunity Zones | Urban Renewal Projects |

|---|---|---|

| Purpose | Promote long-term investment in economically distressed areas | Revitalize and redevelop blighted urban neighborhoods |

| Tax Incentives | Capital gains tax deferral and reduction for investments | Tax credits, abatements, and public funding options |

| Funding Source | Private investors and Opportunity Funds | Public sector and government grants or bonds |

| Target Areas | Qualified low-income census tracts designated by the IRS | Blighted urban sites identified by municipalities |

| Project Types | Residential, commercial, mixed-use developments | Housing, infrastructure, commercial revitalization |

| Duration | Incentives valid for investments held up to 10+ years | Varies; typically medium to long-term redevelopment plans |

| Regulatory Oversight | IRS regulations for Opportunity Funds | Local government planning and zoning authorities |

Which is better?

Opportunity zones provide tax incentives to encourage investment in designated low-income communities, boosting real estate development and economic growth with significant capital gains tax benefits. Urban renewal projects focus on revitalizing blighted areas through comprehensive planning, infrastructure improvements, and public-private partnerships, often resulting in lasting community transformation and increased property values. Comparing both, opportunity zones offer immediate tax advantages for investors, while urban renewal projects deliver broader, long-term urban revitalization and social impact.

Connection

Opportunity zones drive investment in designated areas by offering tax incentives, which align closely with urban renewal projects focused on revitalizing underdeveloped communities. Urban renewal initiatives often target these opportunity zones to attract developers and funding, accelerating economic growth and infrastructure improvements. This synergy enhances property values, stimulates job creation, and fosters sustainable community development in real estate markets.

Key Terms

Tax Incentives

Urban renewal projects offer targeted tax incentives such as property tax abatements and credits to stimulate redevelopment in distressed areas, while Opportunity Zones provide capital gains tax deferrals and exclusions to encourage long-term investments in economically disadvantaged communities. Both programs aim to revitalize neighborhoods but differ in scope and tax benefits, with urban renewal focusing on local redevelopment and Opportunity Zones leveraging federal tax advantages for investors. Explore more about how these tax incentives can drive your investment strategy and community impact.

Zoning Regulations

Urban renewal projects often involve comprehensive rezoning to revitalize underdeveloped areas, enabling mixed-use developments and increased density to spur economic growth. Opportunity zones provide tax incentives encouraging investment in designated low-income neighborhoods but typically require adherence to existing zoning laws unless local amendments are made. Explore how zoning regulations shape these strategies to maximize urban development and investment benefits.

Public-Private Partnerships

Urban renewal projects leverage public-private partnerships (PPPs) to revitalize deteriorated urban areas through infrastructure upgrades, affordable housing, and commercial development, often funded by municipal bonds and federal grants. Opportunity Zones offer tax incentives to private investors who invest in designated low-income communities, encouraging capital flow to spur economic growth while fostering long-term community benefits. Discover how integrating PPPs with Opportunity Zones can maximize urban revitalization impact and drive sustainable economic development.

Source and External Links

Urban Renewal Projects: Successes and Failures - This webpage discusses the successes and failures of urban renewal projects in India, highlighting examples like the Sabarmati Riverfront Development and the Slum Networking Project in Indore.

Urban Renewal - This Wikipedia article provides an overview of urban renewal, including its goals, methods, and impacts globally, such as economic revitalization and cultural regeneration.

Urban Renewal - This resource from EBSCO describes urban renewal as a process aimed at revitalizing urban and rural areas by renovating existing structures or constructing new ones, highlighting its economic and aesthetic goals.

dowidth.com

dowidth.com