Micro flipping involves quickly buying and selling properties for small profits, capitalizing on minimal renovations and fast transactions. Pre-foreclosure investing targets properties in default before auction, offering opportunities to negotiate directly with distressed owners for below-market deals. Explore the distinct strategies and benefits of micro flipping and pre-foreclosure investing to optimize your real estate portfolio.

Why it is important

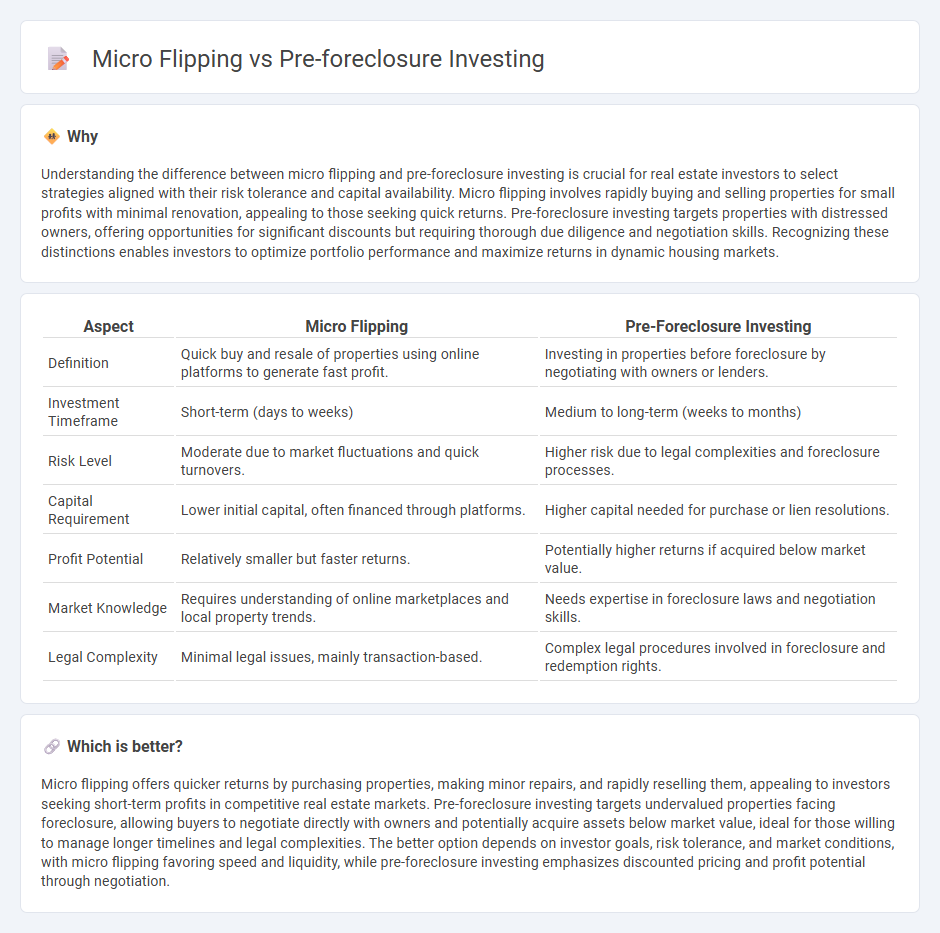

Understanding the difference between micro flipping and pre-foreclosure investing is crucial for real estate investors to select strategies aligned with their risk tolerance and capital availability. Micro flipping involves rapidly buying and selling properties for small profits with minimal renovation, appealing to those seeking quick returns. Pre-foreclosure investing targets properties with distressed owners, offering opportunities for significant discounts but requiring thorough due diligence and negotiation skills. Recognizing these distinctions enables investors to optimize portfolio performance and maximize returns in dynamic housing markets.

Comparison Table

| Aspect | Micro Flipping | Pre-Foreclosure Investing |

|---|---|---|

| Definition | Quick buy and resale of properties using online platforms to generate fast profit. | Investing in properties before foreclosure by negotiating with owners or lenders. |

| Investment Timeframe | Short-term (days to weeks) | Medium to long-term (weeks to months) |

| Risk Level | Moderate due to market fluctuations and quick turnovers. | Higher risk due to legal complexities and foreclosure processes. |

| Capital Requirement | Lower initial capital, often financed through platforms. | Higher capital needed for purchase or lien resolutions. |

| Profit Potential | Relatively smaller but faster returns. | Potentially higher returns if acquired below market value. |

| Market Knowledge | Requires understanding of online marketplaces and local property trends. | Needs expertise in foreclosure laws and negotiation skills. |

| Legal Complexity | Minimal legal issues, mainly transaction-based. | Complex legal procedures involved in foreclosure and redemption rights. |

Which is better?

Micro flipping offers quicker returns by purchasing properties, making minor repairs, and rapidly reselling them, appealing to investors seeking short-term profits in competitive real estate markets. Pre-foreclosure investing targets undervalued properties facing foreclosure, allowing buyers to negotiate directly with owners and potentially acquire assets below market value, ideal for those willing to manage longer timelines and legal complexities. The better option depends on investor goals, risk tolerance, and market conditions, with micro flipping favoring speed and liquidity, while pre-foreclosure investing emphasizes discounted pricing and profit potential through negotiation.

Connection

Micro flipping and pre-foreclosure investing are connected through their focus on acquiring undervalued properties quickly to generate profit. Both strategies rely on identifying distressed or motivated sellers, often involving short-term transactions that maximize return on investment. Utilizing market data and predictive analytics enhances the ability to spot these opportunities before traditional buyers.

Key Terms

Distressed Properties

Investing in pre-foreclosure properties targets homeowners facing financial difficulties, offering opportunities to acquire assets below market value before foreclosure is finalized. Micro flipping involves quickly reselling properties, often distressed, with minimal renovation to capture short-term profit from market fluctuations. Explore these strategies further to understand how focusing on distressed properties can maximize your real estate investment returns.

Assignment Contracts

Pre-foreclosure investing involves acquiring distressed properties before foreclosure through Assignment Contracts, enabling investors to secure rights to purchase below market value. Micro flipping uses Assignment Contracts to quickly assign property rights for fast profits without traditional renovations. Explore our detailed guide to understand how Assignment Contracts function in both investing strategies.

Equity Spread

Pre-foreclosure investing targets properties with significant equity spread, allowing investors to purchase below market value and maximize profit upon sale or refinancing. Micro flipping involves quick transactions on properties with small equity differences, aiming for rapid turnover rather than long-term value appreciation. Explore the nuances of equity spread in both strategies to optimize your real estate investments.

Source and External Links

How to Identify and Invest in Pre-Foreclosure Properties - This webpage provides insights into identifying and investing in pre-foreclosure properties, highlighting benefits such as lower competition and potential for higher profits.

Capitalize on Pre-Foreclosure: Understanding and Investing - This blog discusses the advantages of pre-foreclosure investing, including purchasing properties at a discount and negotiating directly with homeowners.

Understanding Pre-Foreclosure Properties: Risks and Opportunities - This post explains the risks and opportunities associated with pre-foreclosure property investing, including lucrative deals but also potential challenges like property condition and homeowner trust.

dowidth.com

dowidth.com