Institutional landlords manage large-scale real estate portfolios, often owning multiple commercial or residential properties with professional management teams ensuring efficiency and consistent returns. Individual investors typically own fewer properties, focusing on personal or regional investments with more hands-on management and localized market knowledge. Explore the distinct advantages and strategies of institutional landlords versus individual investors to optimize your real estate approach.

Why it is important

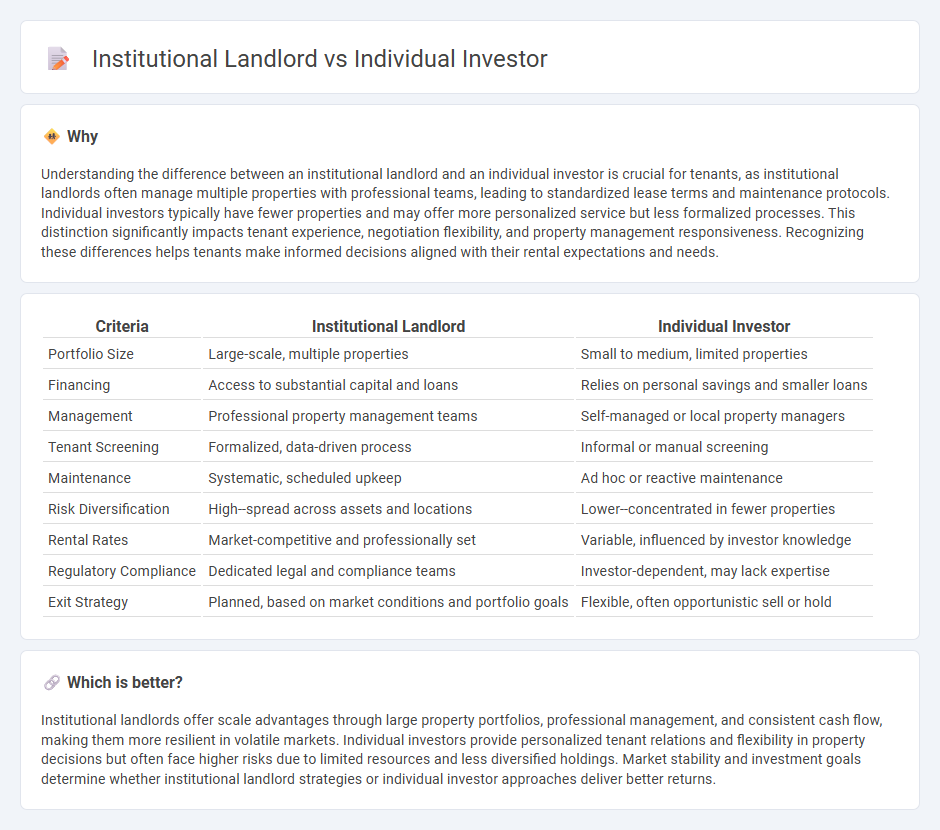

Understanding the difference between an institutional landlord and an individual investor is crucial for tenants, as institutional landlords often manage multiple properties with professional teams, leading to standardized lease terms and maintenance protocols. Individual investors typically have fewer properties and may offer more personalized service but less formalized processes. This distinction significantly impacts tenant experience, negotiation flexibility, and property management responsiveness. Recognizing these differences helps tenants make informed decisions aligned with their rental expectations and needs.

Comparison Table

| Criteria | Institutional Landlord | Individual Investor |

|---|---|---|

| Portfolio Size | Large-scale, multiple properties | Small to medium, limited properties |

| Financing | Access to substantial capital and loans | Relies on personal savings and smaller loans |

| Management | Professional property management teams | Self-managed or local property managers |

| Tenant Screening | Formalized, data-driven process | Informal or manual screening |

| Maintenance | Systematic, scheduled upkeep | Ad hoc or reactive maintenance |

| Risk Diversification | High--spread across assets and locations | Lower--concentrated in fewer properties |

| Rental Rates | Market-competitive and professionally set | Variable, influenced by investor knowledge |

| Regulatory Compliance | Dedicated legal and compliance teams | Investor-dependent, may lack expertise |

| Exit Strategy | Planned, based on market conditions and portfolio goals | Flexible, often opportunistic sell or hold |

Which is better?

Institutional landlords offer scale advantages through large property portfolios, professional management, and consistent cash flow, making them more resilient in volatile markets. Individual investors provide personalized tenant relations and flexibility in property decisions but often face higher risks due to limited resources and less diversified holdings. Market stability and investment goals determine whether institutional landlord strategies or individual investor approaches deliver better returns.

Connection

Institutional landlords and individual investors are connected through shared participation in real estate markets, where institutional landlords often manage large portfolios of commercial or residential properties that individual investors can indirectly access via real estate investment trusts (REITs) or real estate crowdfunding platforms. Institutional landlords provide market stability and professional management, attracting individual investors seeking diversified exposure without direct property ownership. This symbiotic relationship enhances liquidity, risk distribution, and capital flow within the real estate sector.

Key Terms

Ownership Structure

Individual investors typically hold direct ownership of single or multiple residential or commercial properties, allowing for personalized management and decision-making. Institutional landlords, such as real estate investment trusts (REITs) and pension funds, manage large portfolios of properties through complex ownership structures designed for scalability, risk mitigation, and diversified income streams. Explore the differences in ownership structures to understand their impact on market dynamics and investment strategies.

Scale of Investment

Individual investors typically manage smaller portfolios with limited capital, focusing on one or a few properties, while institutional landlords operate large-scale investments encompassing hundreds or thousands of units across multiple markets. Institutional landlords benefit from economies of scale, professional management teams, and access to diversified financing options, enabling more efficient property acquisition and operations. Discover how scale impacts investment strategies and returns by exploring the differences in depth.

Portfolio Diversification

Individual investors often prioritize portfolio diversification by spreading assets across various property types and geographic locations to mitigate risk and enhance returns. Institutional landlords leverage extensive capital and data analytics to diversify holdings on a larger scale, frequently investing in commercial real estate, multifamily units, and emerging markets for optimized risk management. Explore detailed strategies and comparative advantages to refine your investment approach.

Source and External Links

Individual Investors Vs. Institutional Investors: How They Differ - Individual investors typically invest smaller amounts frequently, often through mutual funds or ETFs, and can buy smaller stocks, while institutional investors trade large sums with greater access to research but less flexibility in small stocks.

Definition, Investing, Individual vs. Institutional Investors - An individual investor buys securities in smaller quantities for their own portfolio, often influenced by emotions, unlike institutional investors who manage large investments on behalf of organizations or others.

Individual investor | Invesco US - Individual investors can access a variety of customized investment products like ETFs and mutual funds designed to help meet their specific financial goals with options for income and volatility management.

dowidth.com

dowidth.com