Tokenized real estate enables fractional ownership through blockchain technology, offering increased liquidity and transparency compared to traditional private equity real estate funds, which typically require larger capital commitments and involve longer lock-up periods. While private equity funds focus on pooled investments managed by professionals, tokenization democratizes access by allowing individual investors to buy and sell property tokens on digital platforms. Discover how these innovative approaches are transforming real estate investing opportunities today.

Why it is important

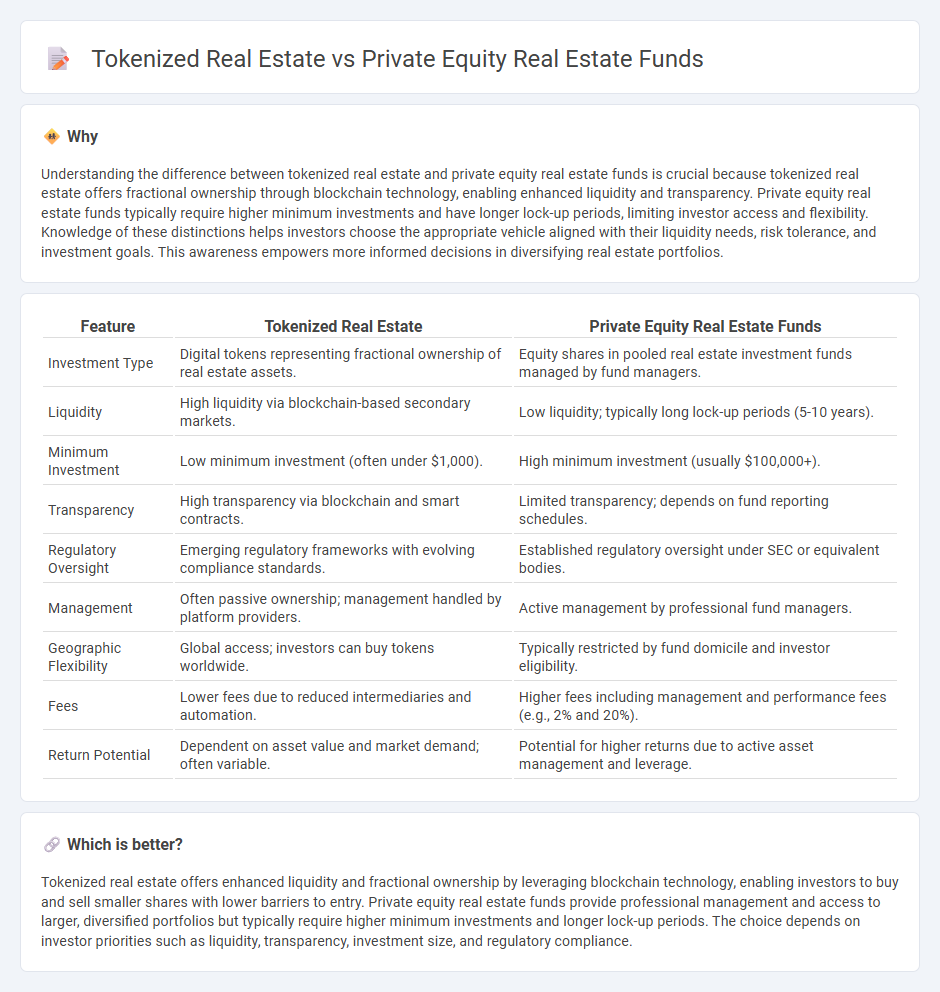

Understanding the difference between tokenized real estate and private equity real estate funds is crucial because tokenized real estate offers fractional ownership through blockchain technology, enabling enhanced liquidity and transparency. Private equity real estate funds typically require higher minimum investments and have longer lock-up periods, limiting investor access and flexibility. Knowledge of these distinctions helps investors choose the appropriate vehicle aligned with their liquidity needs, risk tolerance, and investment goals. This awareness empowers more informed decisions in diversifying real estate portfolios.

Comparison Table

| Feature | Tokenized Real Estate | Private Equity Real Estate Funds |

|---|---|---|

| Investment Type | Digital tokens representing fractional ownership of real estate assets. | Equity shares in pooled real estate investment funds managed by fund managers. |

| Liquidity | High liquidity via blockchain-based secondary markets. | Low liquidity; typically long lock-up periods (5-10 years). |

| Minimum Investment | Low minimum investment (often under $1,000). | High minimum investment (usually $100,000+). |

| Transparency | High transparency via blockchain and smart contracts. | Limited transparency; depends on fund reporting schedules. |

| Regulatory Oversight | Emerging regulatory frameworks with evolving compliance standards. | Established regulatory oversight under SEC or equivalent bodies. |

| Management | Often passive ownership; management handled by platform providers. | Active management by professional fund managers. |

| Geographic Flexibility | Global access; investors can buy tokens worldwide. | Typically restricted by fund domicile and investor eligibility. |

| Fees | Lower fees due to reduced intermediaries and automation. | Higher fees including management and performance fees (e.g., 2% and 20%). |

| Return Potential | Dependent on asset value and market demand; often variable. | Potential for higher returns due to active asset management and leverage. |

Which is better?

Tokenized real estate offers enhanced liquidity and fractional ownership by leveraging blockchain technology, enabling investors to buy and sell smaller shares with lower barriers to entry. Private equity real estate funds provide professional management and access to larger, diversified portfolios but typically require higher minimum investments and longer lock-up periods. The choice depends on investor priorities such as liquidity, transparency, investment size, and regulatory compliance.

Connection

Tokenized real estate leverages blockchain technology to create digital shares that represent ownership in physical properties, enabling fractional investment and enhanced liquidity. Private equity real estate funds pool capital from investors to acquire, manage, and sell real estate assets, often providing the underlying portfolio that can be tokenized for broader market access. This connection allows private equity funds to democratize real estate investment, attract a wider investor base, and improve transparency through tokenization platforms.

Key Terms

Liquidity

Private equity real estate funds typically have longer lock-up periods, restricting liquidity and requiring investors to commit capital for several years. Tokenized real estate offers enhanced liquidity by enabling fractional ownership on blockchain platforms, allowing investors to buy or sell shares more easily and frequently. Explore the benefits and challenges of each to make informed investment decisions.

Ownership structure

Private equity real estate funds typically involve pooled capital from accredited investors managed by a general partner, offering indirect ownership with limited liquidity and longer investment horizons. Tokenized real estate provides fractional ownership through blockchain-based digital tokens, enabling direct asset ownership with increased transparency and faster transaction settlements. Explore the evolving ownership structures reshaping real estate investment for deeper insights.

Regulatory compliance

Private equity real estate funds operate under well-established regulatory frameworks such as the Investment Company Act of 1940 in the U.S., ensuring investor protections through registration and reporting requirements. Tokenized real estate leverages blockchain technology, presenting novel regulatory challenges involving securities laws, anti-money laundering (AML) compliance, and cross-border jurisdictional issues that are still evolving globally. To explore the latest regulatory developments and compliance strategies in both investment models, discover more insights here.

Source and External Links

The Ultimate Guide to Private Equity Real Estate Investing - This guide provides an overview of private equity real estate investing, including how funds are structured and the roles of sponsors and investors.

How to Set Up a Private Equity Real Estate Fund - This article outlines steps for creating and managing a private equity real estate fund, including diversifying funding sources and structuring investments.

Real Estate Private Equity Fund Structures & Taxes Guide - This guide discusses various structures for private equity real estate funds, including REITs and special purpose entities, and tax implications.

dowidth.com

dowidth.com