Automated valuation models (AVMs) leverage algorithms and vast datasets to provide fast, data-driven property value estimates, enhancing efficiency in real estate transactions. The Income Approach, conversely, focuses on a property's potential to generate revenue, analyzing net operating income and capitalization rates to determine value. Explore these valuation methods further to understand their distinct advantages and applications in real estate.

Why it is important

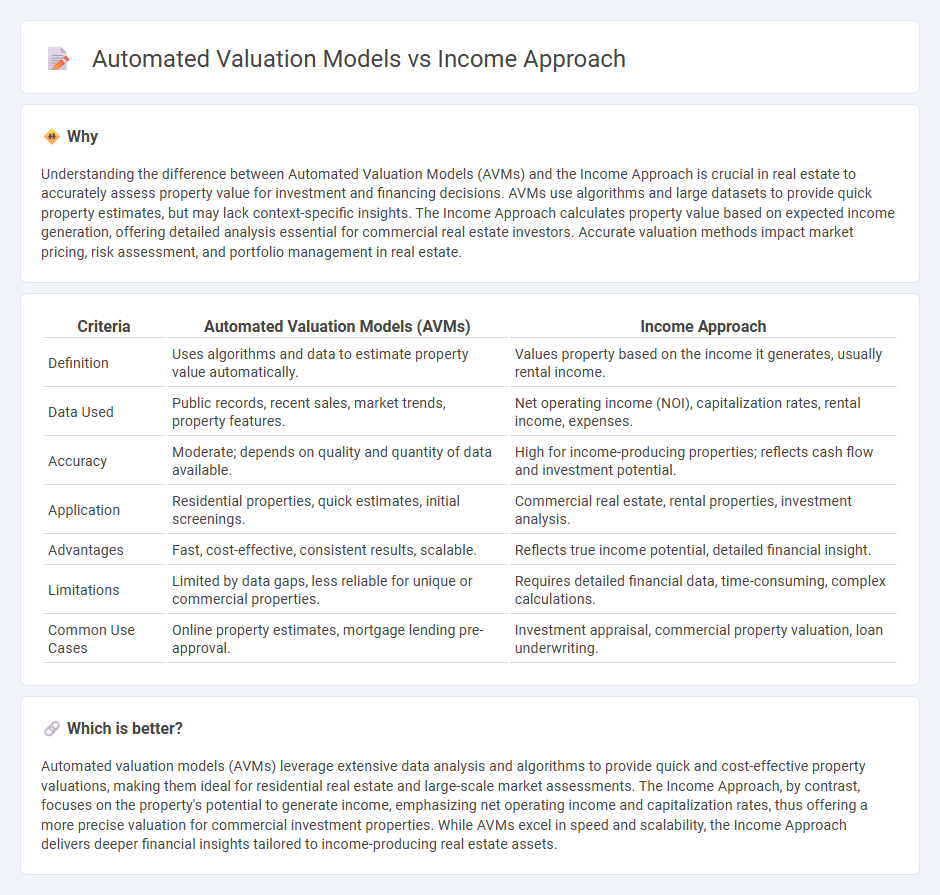

Understanding the difference between Automated Valuation Models (AVMs) and the Income Approach is crucial in real estate to accurately assess property value for investment and financing decisions. AVMs use algorithms and large datasets to provide quick property estimates, but may lack context-specific insights. The Income Approach calculates property value based on expected income generation, offering detailed analysis essential for commercial real estate investors. Accurate valuation methods impact market pricing, risk assessment, and portfolio management in real estate.

Comparison Table

| Criteria | Automated Valuation Models (AVMs) | Income Approach |

|---|---|---|

| Definition | Uses algorithms and data to estimate property value automatically. | Values property based on the income it generates, usually rental income. |

| Data Used | Public records, recent sales, market trends, property features. | Net operating income (NOI), capitalization rates, rental income, expenses. |

| Accuracy | Moderate; depends on quality and quantity of data available. | High for income-producing properties; reflects cash flow and investment potential. |

| Application | Residential properties, quick estimates, initial screenings. | Commercial real estate, rental properties, investment analysis. |

| Advantages | Fast, cost-effective, consistent results, scalable. | Reflects true income potential, detailed financial insight. |

| Limitations | Limited by data gaps, less reliable for unique or commercial properties. | Requires detailed financial data, time-consuming, complex calculations. |

| Common Use Cases | Online property estimates, mortgage lending pre-approval. | Investment appraisal, commercial property valuation, loan underwriting. |

Which is better?

Automated valuation models (AVMs) leverage extensive data analysis and algorithms to provide quick and cost-effective property valuations, making them ideal for residential real estate and large-scale market assessments. The Income Approach, by contrast, focuses on the property's potential to generate income, emphasizing net operating income and capitalization rates, thus offering a more precise valuation for commercial investment properties. While AVMs excel in speed and scalability, the Income Approach delivers deeper financial insights tailored to income-producing real estate assets.

Connection

Automated valuation models (AVMs) utilize the Income Approach by analyzing rental income, operating expenses, and capitalization rates to estimate property value efficiently. The Income Approach focuses on the present value of future cash flows generated by an investment property, making it integral to AVM algorithms for accuracy. Incorporating market rental data and expense ratios enables AVMs to deliver precise valuations aligned with investor expectations.

Key Terms

Net Operating Income (NOI)

The Income Approach values properties based on Net Operating Income (NOI), emphasizing cash flow generated from rental income minus operating expenses, providing a precise valuation aligned with actual property performance. Automated Valuation Models (AVMs) utilize algorithms and large datasets, including NOI when available, but often rely more on comparable sales and market trends, which can lead to less accuracy in income-focused property assessments. Explore deeper into NOI's critical role in these valuation methods to enhance your investment strategies.

Comparable Sales

The Income Approach values properties based on their future income potential, making it ideal for income-generating real estate like rental units. Automated Valuation Models (AVMs) primarily depend on Comparable Sales data, analyzing recent transactions of similar properties to estimate market value quickly. Explore deeper insights into how Comparable Sales influence AVMs versus the Income Approach for more accurate property valuations.

Algorithmic Analysis

The Income Approach evaluates property value based on projected cash flows, applying capitalization rates to net operating income to estimate market worth. Automated Valuation Models (AVMs) leverage algorithmic analysis by processing vast datasets with machine learning techniques, enhancing accuracy and speed in property valuation. Explore deeper insights into how advanced algorithms revolutionize real estate valuation by visiting our detailed guide.

Source and External Links

Income Approach | Formula + Calculator - Wall Street Prep - The income approach is a real estate valuation method estimating the fair market value of a property based on the income it can generate, calculated by dividing net operating income (NOI) by the capitalization rate (cap rate), reflecting the property's income-producing potential.

Income Approach to Value - IN.gov - This approach calculates value by dividing income by a rate and evaluates investment decisions by considering cost, return, risk, and comparing yields, while factoring in objectives like return on investment, risk, liquidity, and potential appreciation.

Income Approach | Pinal County, AZ - Used mainly for commercial or industrial properties, the income approach values properties by converting future income streams into present value, emphasizing investment components such as income generation and economic life of the property over physical characteristics.

dowidth.com

dowidth.com