Fractional ownership platforms enable multiple investors to own specific shares of a single property, offering liquidity and individual control over real estate assets. Property syndication pools funds from numerous investors into a collective entity, which purchases and manages larger, often commercial, properties under professional oversight. Explore the differences to determine which investment strategy aligns with your real estate goals.

Why it is important

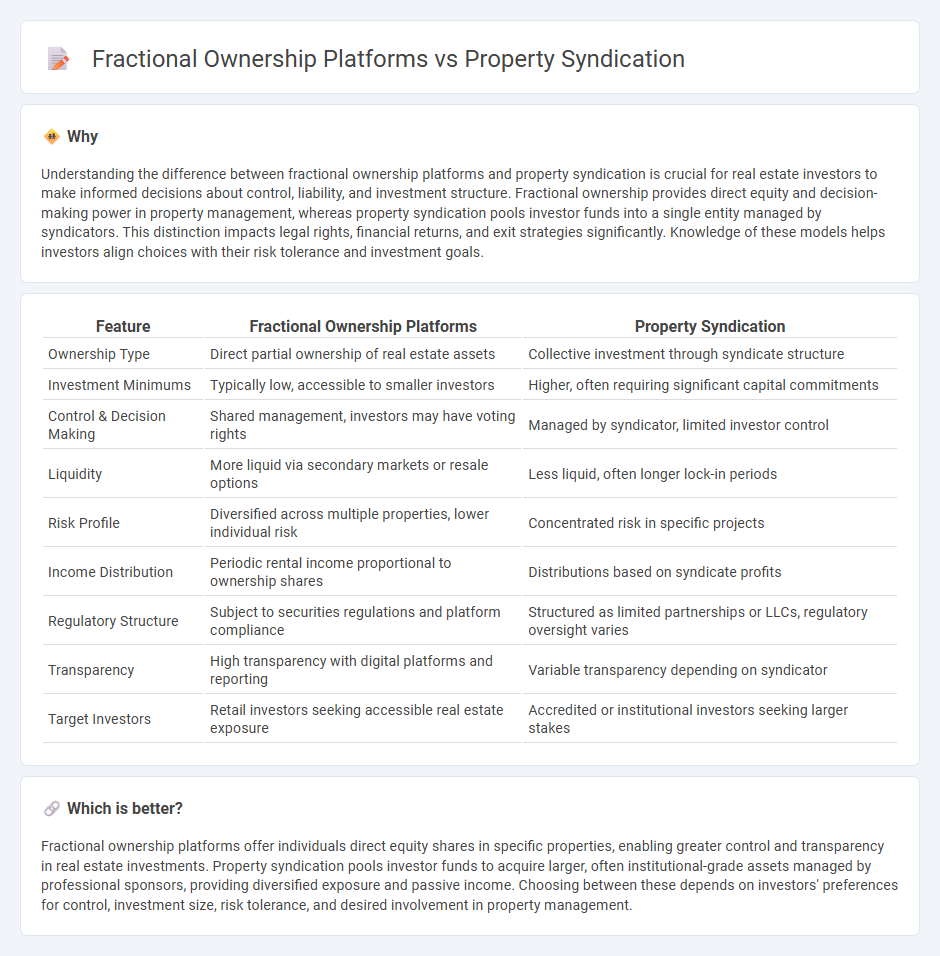

Understanding the difference between fractional ownership platforms and property syndication is crucial for real estate investors to make informed decisions about control, liability, and investment structure. Fractional ownership provides direct equity and decision-making power in property management, whereas property syndication pools investor funds into a single entity managed by syndicators. This distinction impacts legal rights, financial returns, and exit strategies significantly. Knowledge of these models helps investors align choices with their risk tolerance and investment goals.

Comparison Table

| Feature | Fractional Ownership Platforms | Property Syndication |

|---|---|---|

| Ownership Type | Direct partial ownership of real estate assets | Collective investment through syndicate structure |

| Investment Minimums | Typically low, accessible to smaller investors | Higher, often requiring significant capital commitments |

| Control & Decision Making | Shared management, investors may have voting rights | Managed by syndicator, limited investor control |

| Liquidity | More liquid via secondary markets or resale options | Less liquid, often longer lock-in periods |

| Risk Profile | Diversified across multiple properties, lower individual risk | Concentrated risk in specific projects |

| Income Distribution | Periodic rental income proportional to ownership shares | Distributions based on syndicate profits |

| Regulatory Structure | Subject to securities regulations and platform compliance | Structured as limited partnerships or LLCs, regulatory oversight varies |

| Transparency | High transparency with digital platforms and reporting | Variable transparency depending on syndicator |

| Target Investors | Retail investors seeking accessible real estate exposure | Accredited or institutional investors seeking larger stakes |

Which is better?

Fractional ownership platforms offer individuals direct equity shares in specific properties, enabling greater control and transparency in real estate investments. Property syndication pools investor funds to acquire larger, often institutional-grade assets managed by professional sponsors, providing diversified exposure and passive income. Choosing between these depends on investors' preferences for control, investment size, risk tolerance, and desired involvement in property management.

Connection

Fractional ownership platforms and property syndication both enable multiple investors to collectively purchase real estate assets, minimizing individual financial risk while maximizing access to high-value properties. These models share a core principle of dividing ownership shares among participants, allowing diversified real estate portfolios without full property acquisition. By leveraging technology and legal frameworks, fractional ownership platforms streamline syndication processes, enhancing liquidity and investor transparency.

Key Terms

Collective Investment Structure

Property syndication pools investor funds into a collective investment structure where a syndicator manages the acquisition and operation of real estate assets, providing passive income and potential capital appreciation. Fractional ownership platforms divide a property into shares, allowing investors to directly own a portion of the asset with shared usage rights and expenses. Explore the benefits and differences of these collective investment structures to find the optimal real estate investment strategy.

Ownership Shares/Equity

Property syndication pools investor funds to purchase large real estate assets, offering ownership shares proportional to investment, while fractional ownership platforms divide a specific property into equity shares sold to multiple owners. Syndication typically involves passive investment with professional management of the entire asset, whereas fractional ownership grants more control and use rights over a property segment. Explore how different platforms impact equity structure, investor rights, and return profiles to make an informed choice.

Management Control

Property syndication offers investors collective ownership with centralized management control typically held by the syndicator, streamlining decision-making and operational oversight. Fractional ownership platforms provide investors with direct stakes in individual properties, often allowing more personal input but requiring cooperative management among owners. Explore further differences in management control and investor roles in property syndication versus fractional ownership models.

Source and External Links

Real Estate Syndicates and Investment Trusts - This document describes real estate syndication as a method for pooling investor capital to finance properties, often involving a sponsor who manages the investment.

Real Estate Syndication Guide - This guide provides a comprehensive overview of real estate syndication, covering its process, benefits, and risks for passive investors.

What is a Property Syndicate? - A property syndicate involves multiple investors pooling capital to invest in real estate, offering distributions and capital returns at the end of the syndicate's term.

dowidth.com

dowidth.com