Lease-to-own models offer tenants a path to homeownership by applying rent payments toward purchase equity over time, reducing upfront costs and fostering long-term investment. Shared equity arrangements involve investors co-owning property with buyers, sharing appreciation and risks, which lowers the initial financial burden for homeowners. Discover how these innovative real estate options can make homeownership more accessible and tailored to diverse financial needs.

Why it is important

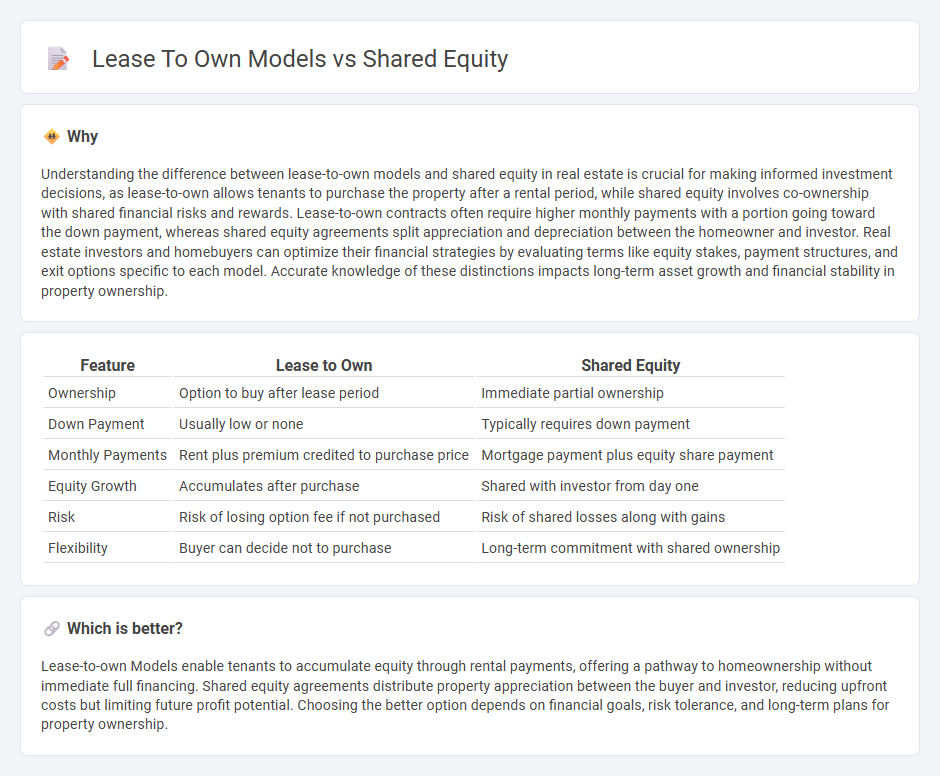

Understanding the difference between lease-to-own models and shared equity in real estate is crucial for making informed investment decisions, as lease-to-own allows tenants to purchase the property after a rental period, while shared equity involves co-ownership with shared financial risks and rewards. Lease-to-own contracts often require higher monthly payments with a portion going toward the down payment, whereas shared equity agreements split appreciation and depreciation between the homeowner and investor. Real estate investors and homebuyers can optimize their financial strategies by evaluating terms like equity stakes, payment structures, and exit options specific to each model. Accurate knowledge of these distinctions impacts long-term asset growth and financial stability in property ownership.

Comparison Table

| Feature | Lease to Own | Shared Equity |

|---|---|---|

| Ownership | Option to buy after lease period | Immediate partial ownership |

| Down Payment | Usually low or none | Typically requires down payment |

| Monthly Payments | Rent plus premium credited to purchase price | Mortgage payment plus equity share payment |

| Equity Growth | Accumulates after purchase | Shared with investor from day one |

| Risk | Risk of losing option fee if not purchased | Risk of shared losses along with gains |

| Flexibility | Buyer can decide not to purchase | Long-term commitment with shared ownership |

Which is better?

Lease-to-own Models enable tenants to accumulate equity through rental payments, offering a pathway to homeownership without immediate full financing. Shared equity agreements distribute property appreciation between the buyer and investor, reducing upfront costs but limiting future profit potential. Choosing the better option depends on financial goals, risk tolerance, and long-term plans for property ownership.

Connection

Lease-to-own models and shared equity arrangements are connected through their focus on providing alternative homeownership pathways by combining rental and investment components. Both approaches enable tenants to gradually build equity or ownership stakes while residing in the property, balancing risk between occupants and property owners. These models appeal to buyers with limited upfront capital, offering structured routes to full ownership and financial participation in real estate appreciation.

Key Terms

Ownership Structure

Shared equity models involve a co-ownership arrangement where the buyer and another party, often an investor or government entity, jointly own the property, sharing both equity gains and losses. Lease to own models grant the tenant the option to purchase the property after a rental period, with rent payments partially credited towards the eventual down payment, but ownership transfers only upon full purchase completion. Explore further to understand the financial and legal nuances impacting ownership rights and responsibilities under each model.

Equity Participation

Shared equity models enable homeowners to build equity while sharing property appreciation with investors, aligning financial interests and reducing upfront costs. Lease-to-own agreements allow tenants to accumulate rental credits toward future ownership but often lack direct equity participation during the lease term. Explore the detailed benefits and distinctions of equity participation in each model to determine the best fit for your homeownership goals.

Purchase Option

Shared equity models involve co-owning property with an investor who shares in the property's appreciation or depreciation, while lease to own models allow tenants to rent with an option to purchase the home after a set period. The purchase option in lease to own agreements typically requires predetermined terms, including option fees and set purchase prices, offering more control over eventual ownership. Explore detailed comparisons and benefits of each model to determine the best fit for your homeownership goals.

Source and External Links

Shared-Equity Homeownership: The Basics - Shared equity models, such as deed-restricted units, limited-equity co-ops, and community land trusts, help lower-income households buy homes at reduced prices while preserving long-term or permanent affordability for future buyers, often through resale restrictions that limit home price appreciation.

Shared equity or Partnership Mortgages - MoneyHelper - Shared equity mortgages enable buyers to combine a small deposit with an equity loan (often from the government or a developer) that covers part of the property's value, with the loan repaid when the home is sold, usually based on its current market value.

Shared Equity Housing | NeighborWorks America - Shared equity housing strategies create permanently affordable homes by limiting sale prices, sharing appreciation gains, and involving residents in governance, which helps prevent displacement and builds wealth for lower-income families.

dowidth.com

dowidth.com